2024 North American Summer Meeting: June, 2024

Financial Frictions, Capital Structure, and Aggregate Productivity

Alexandros Fakos

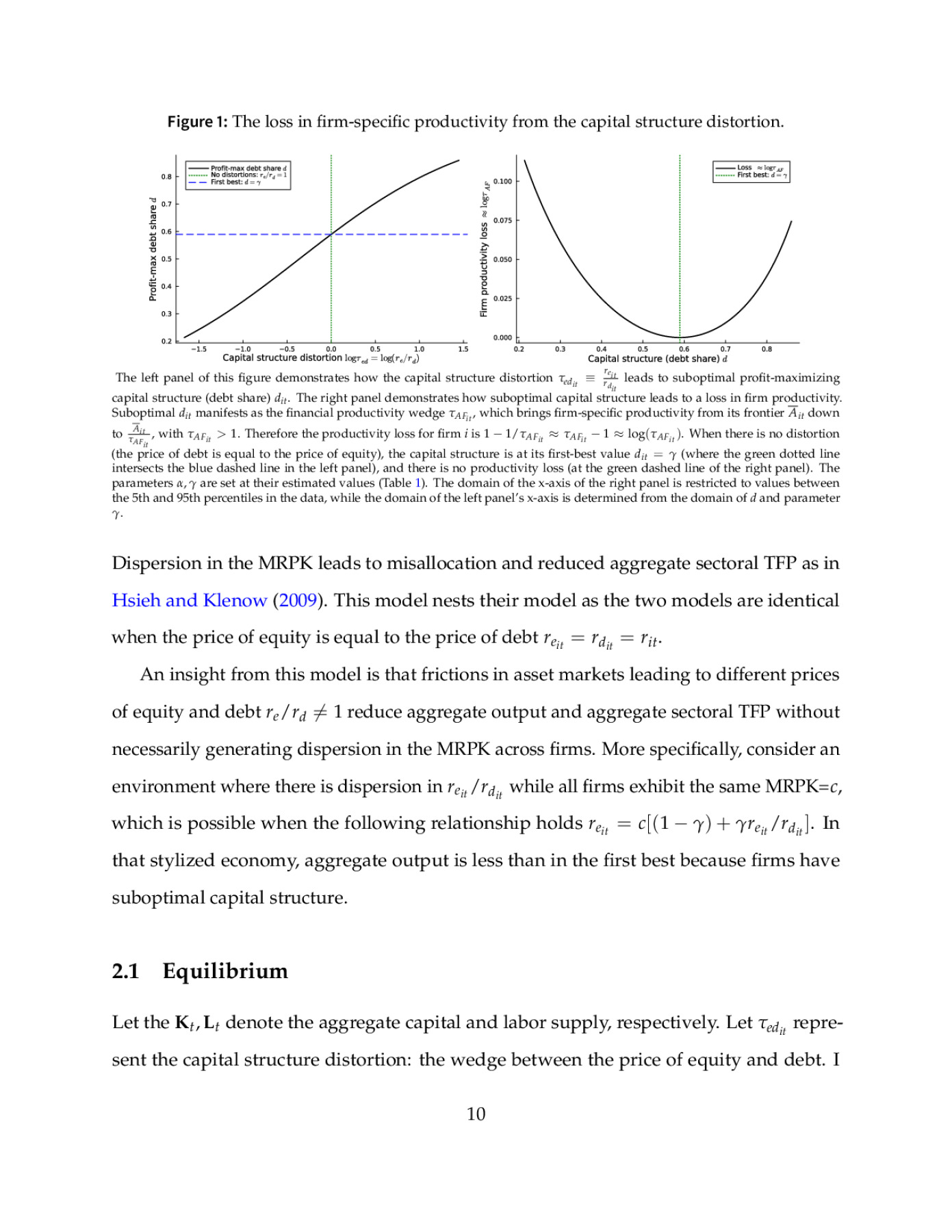

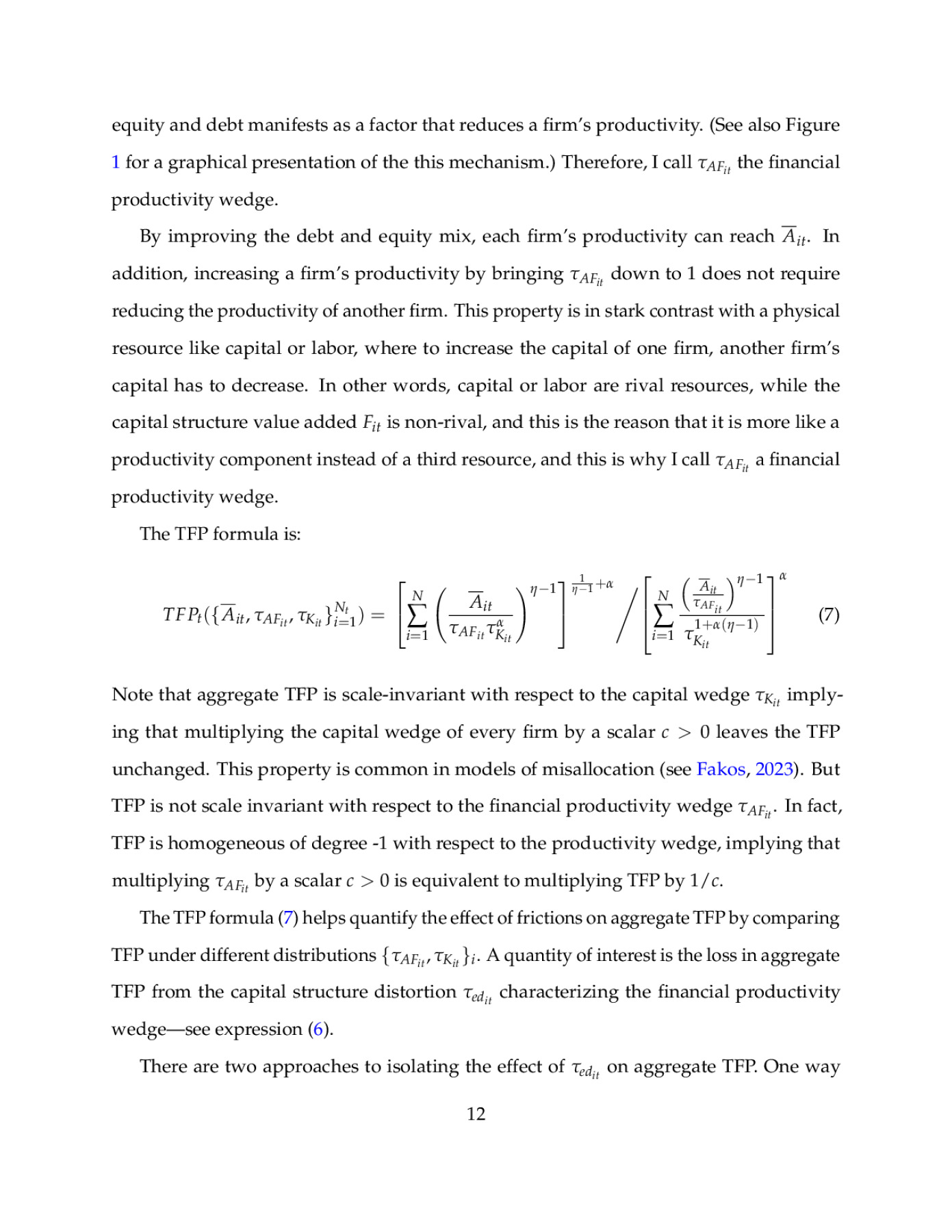

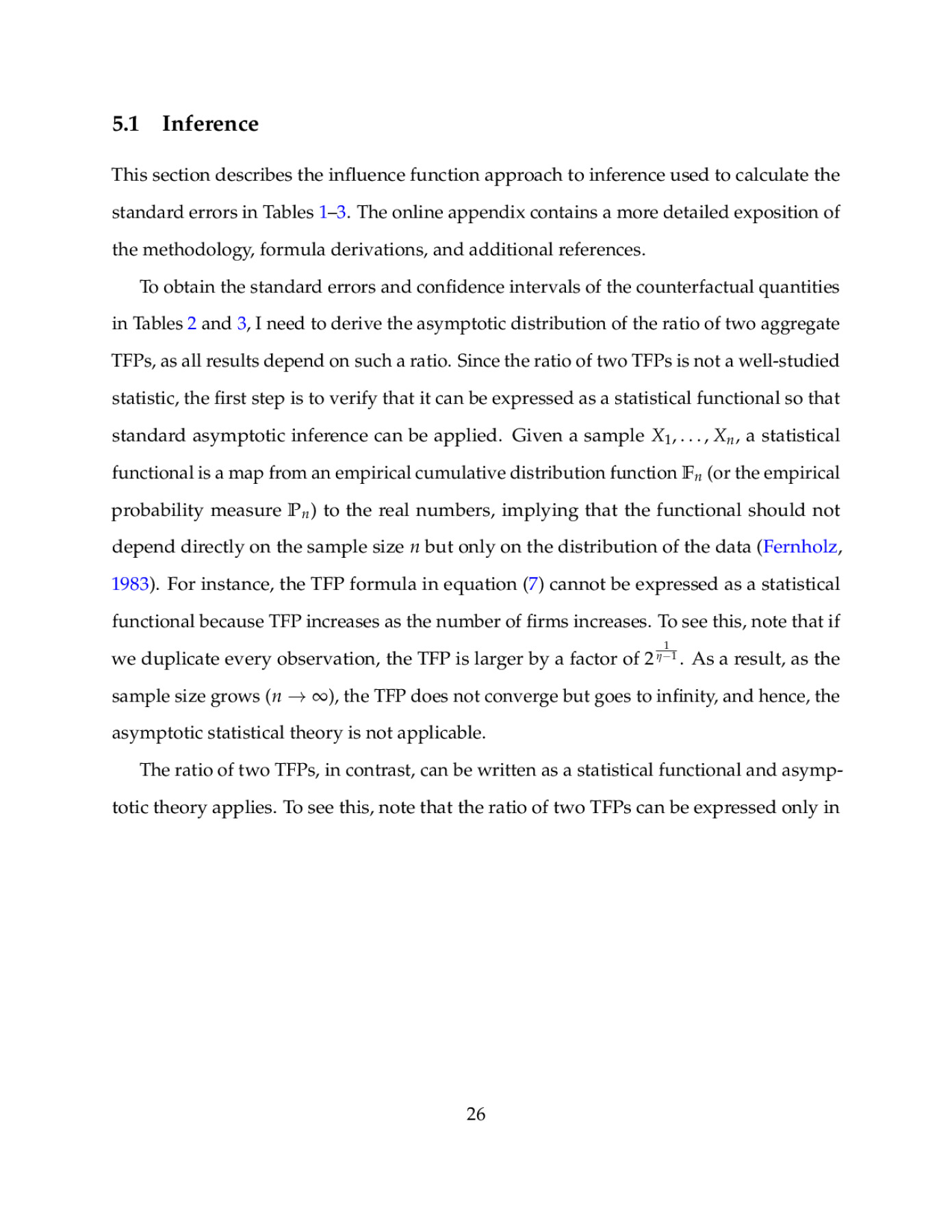

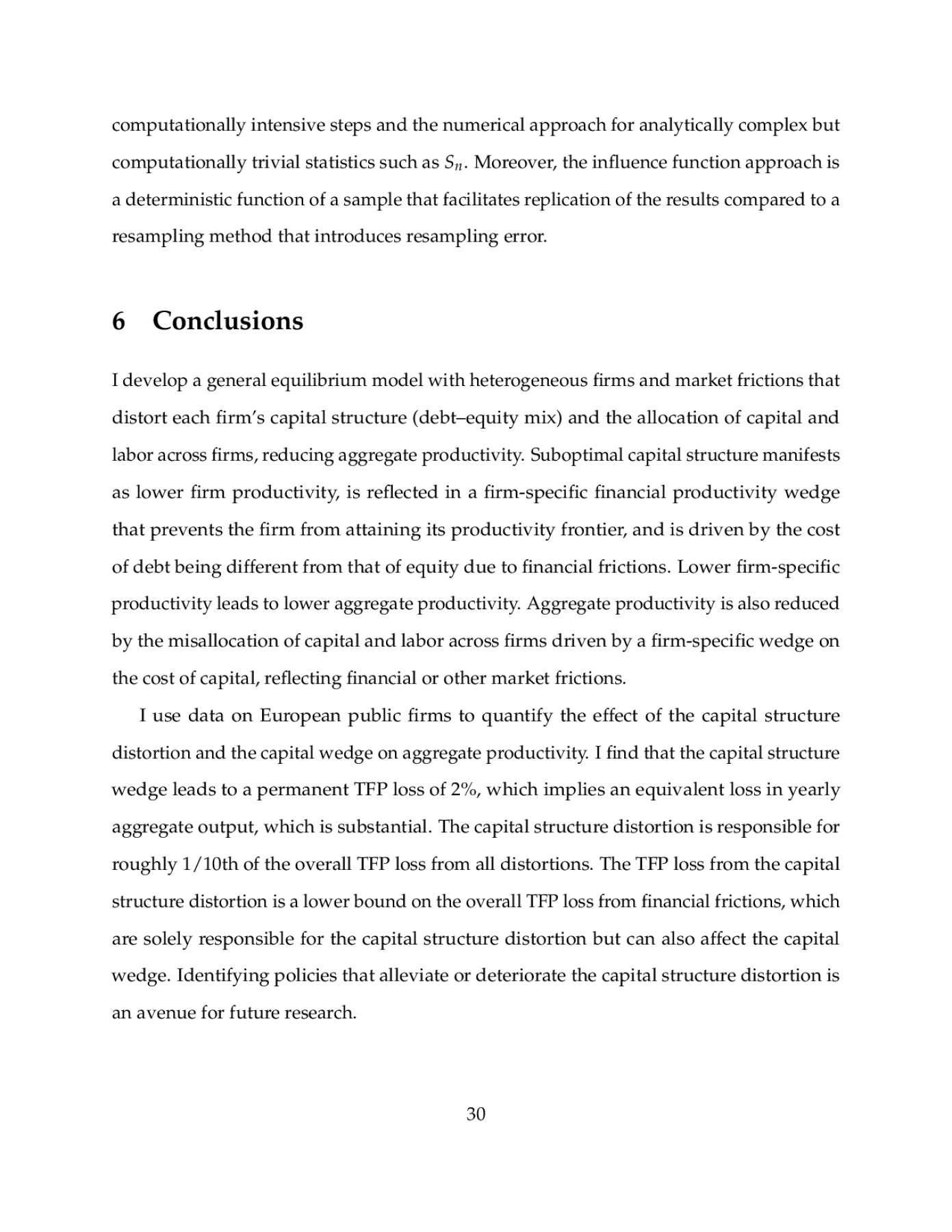

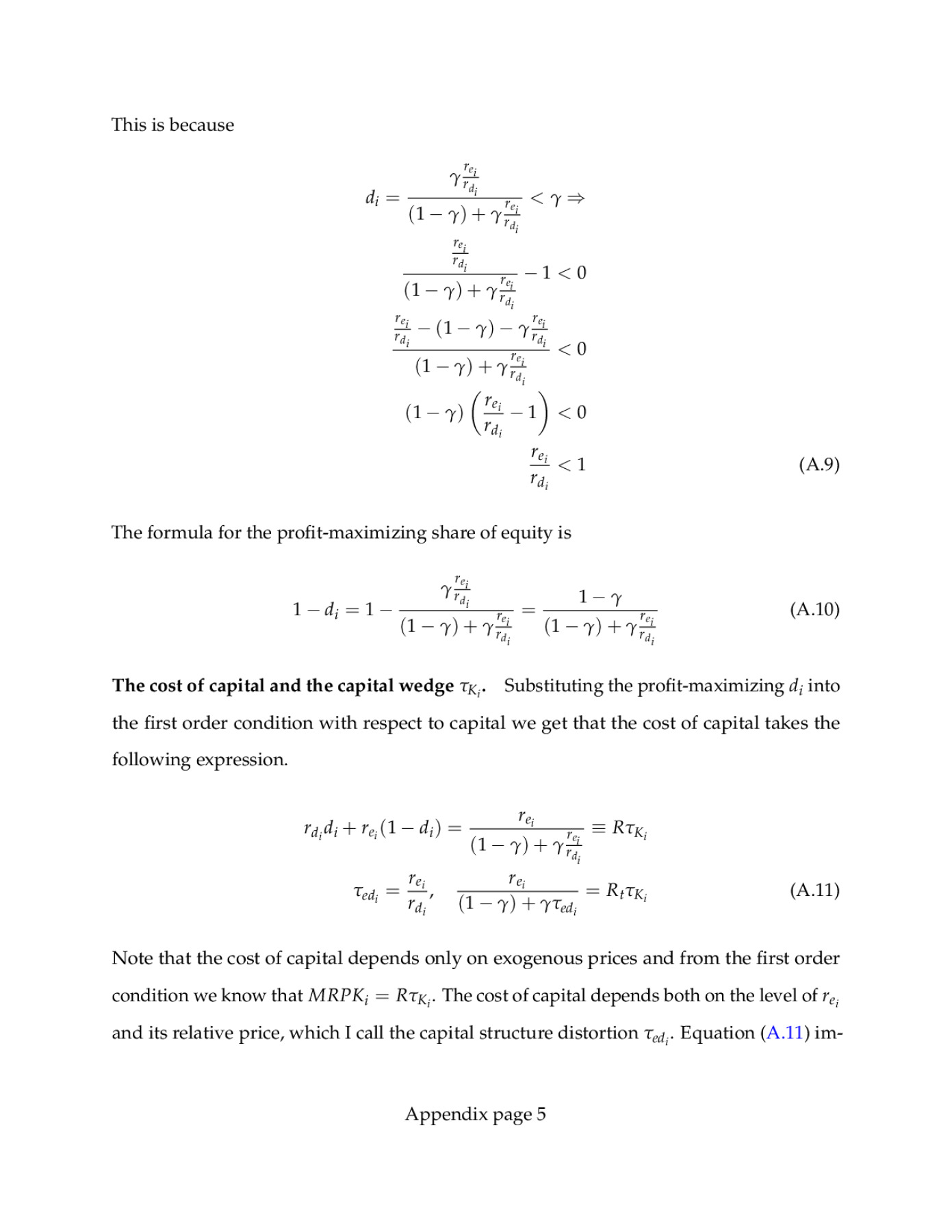

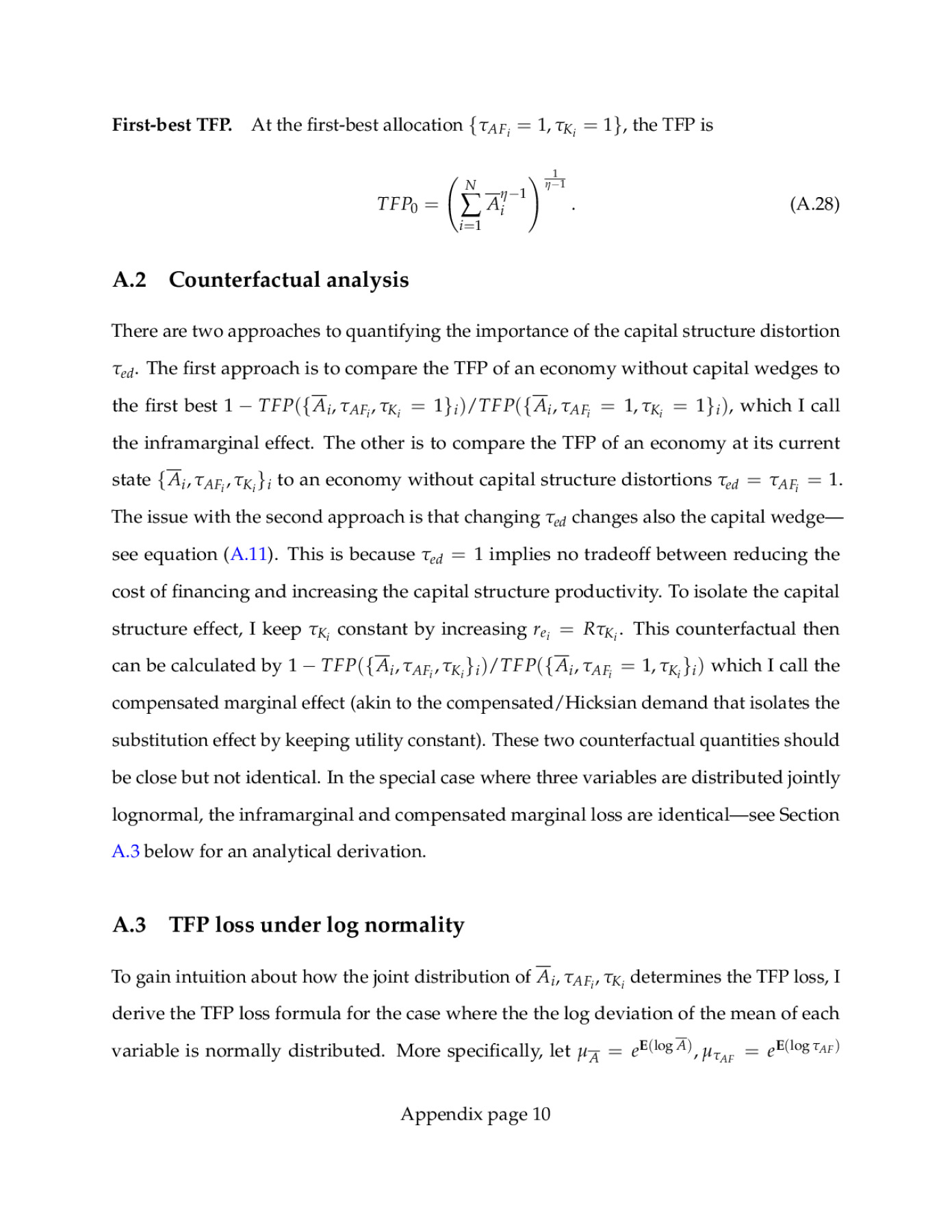

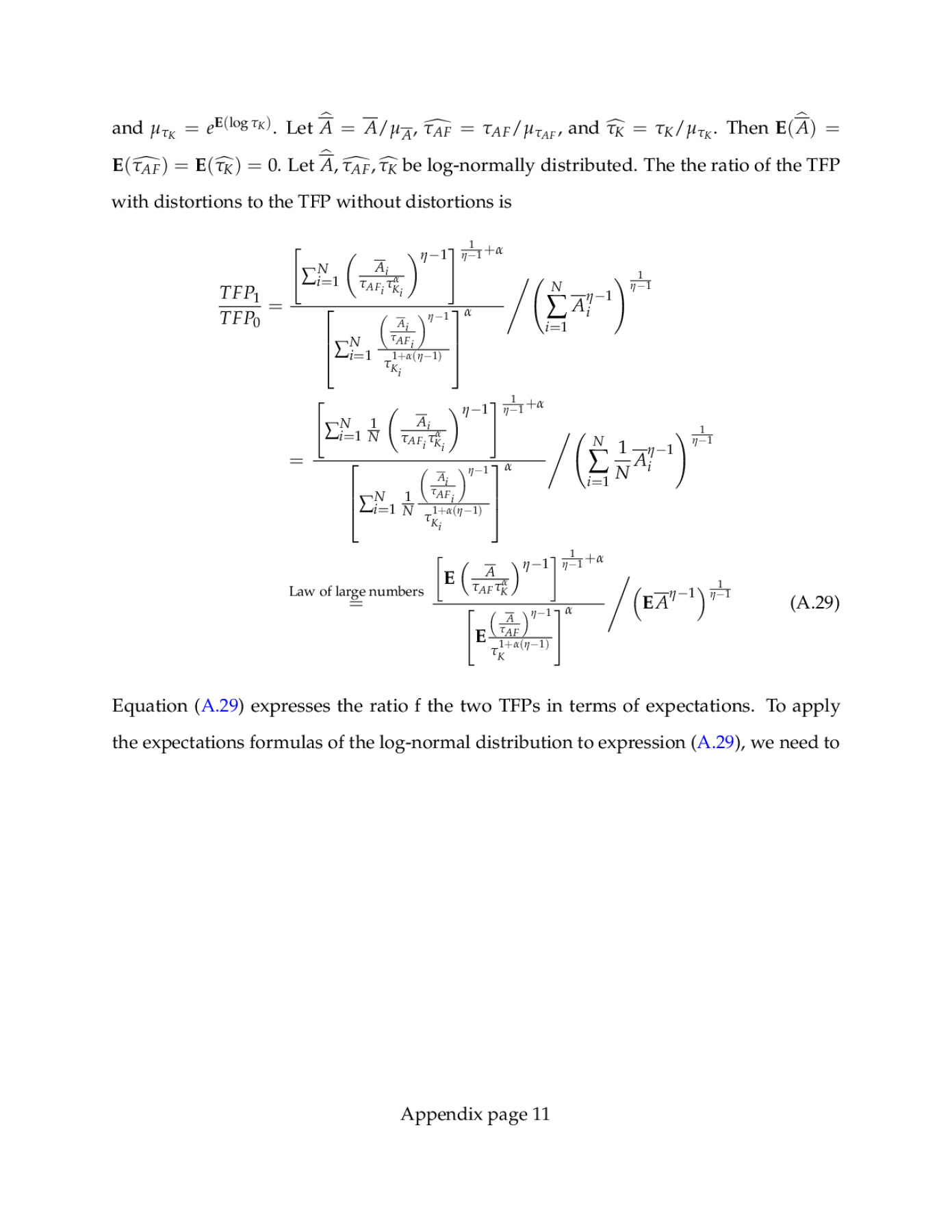

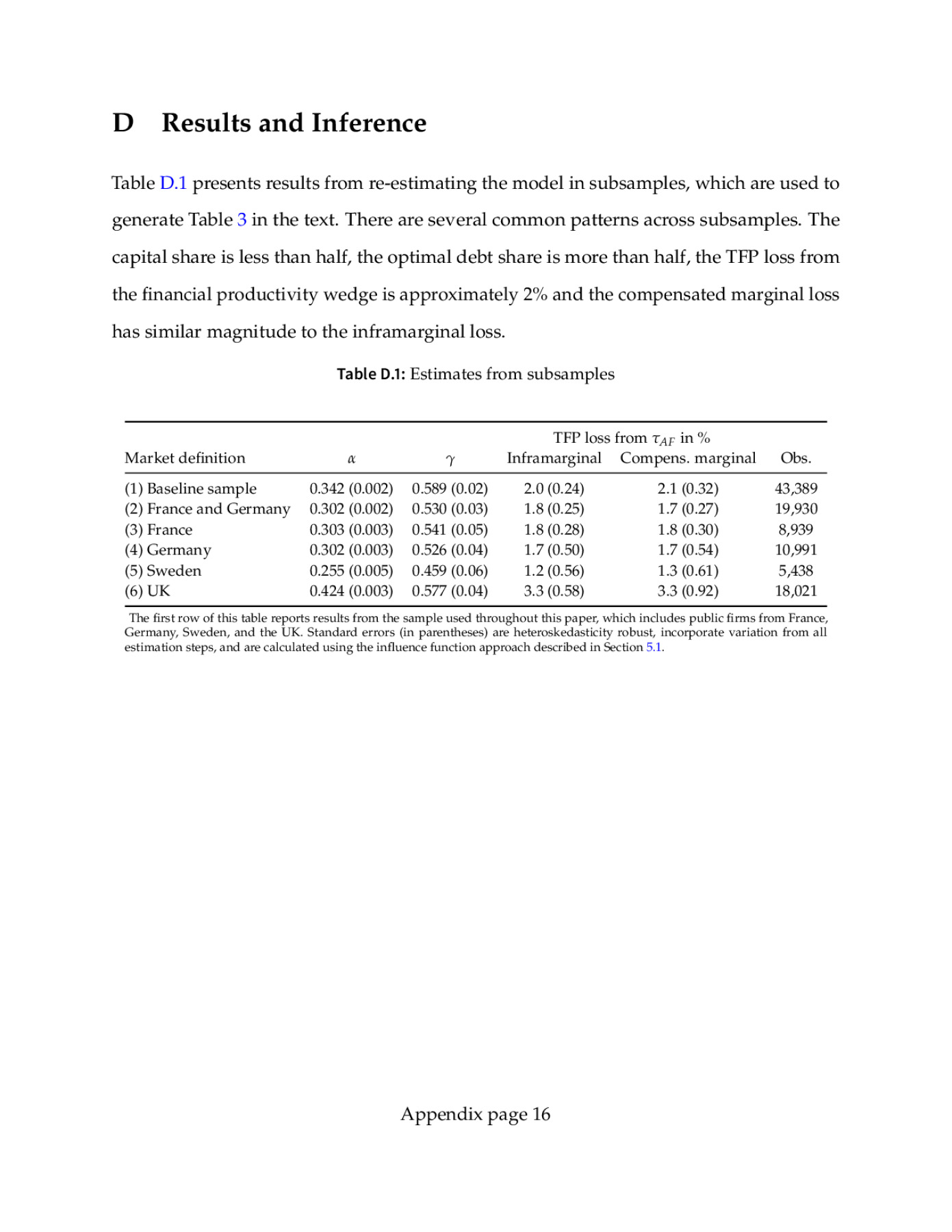

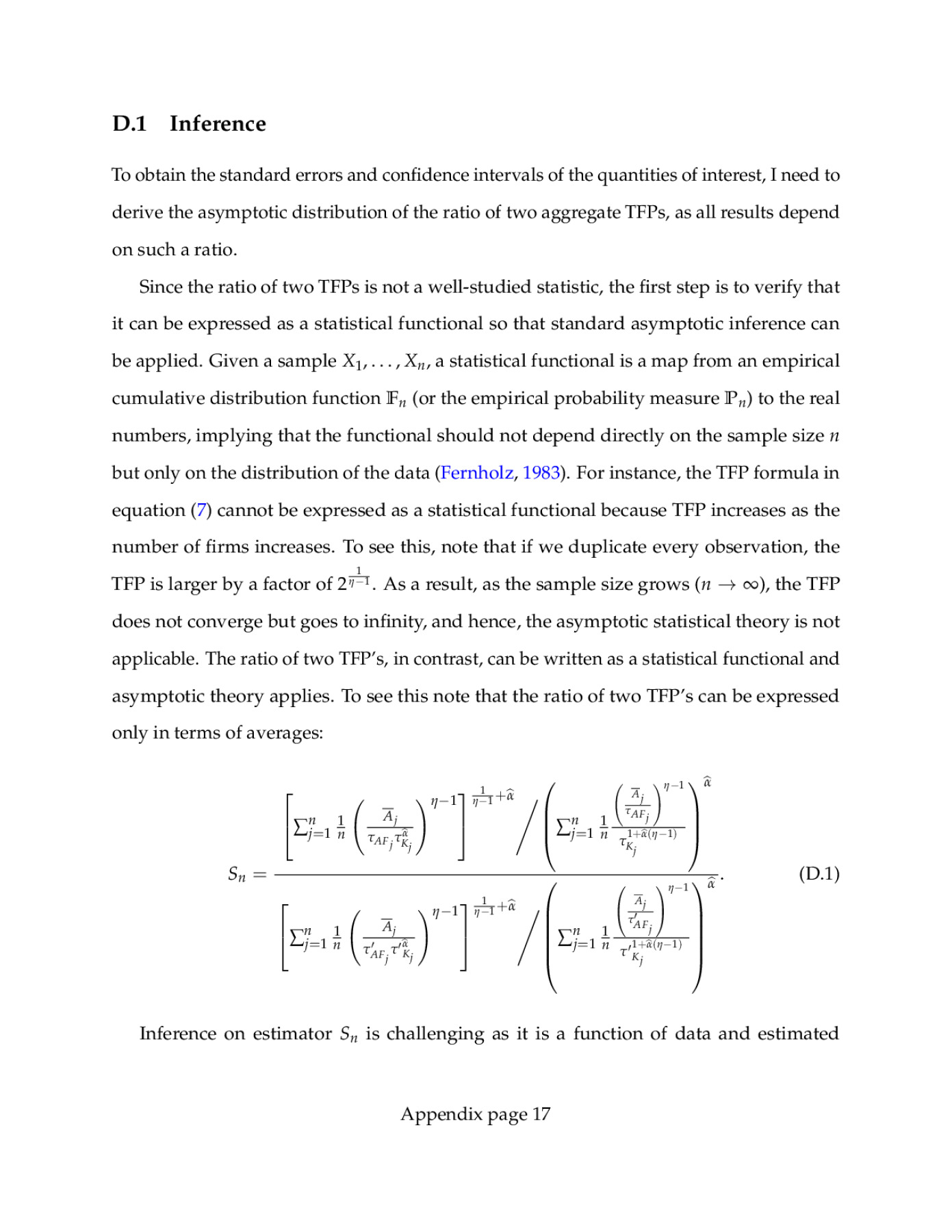

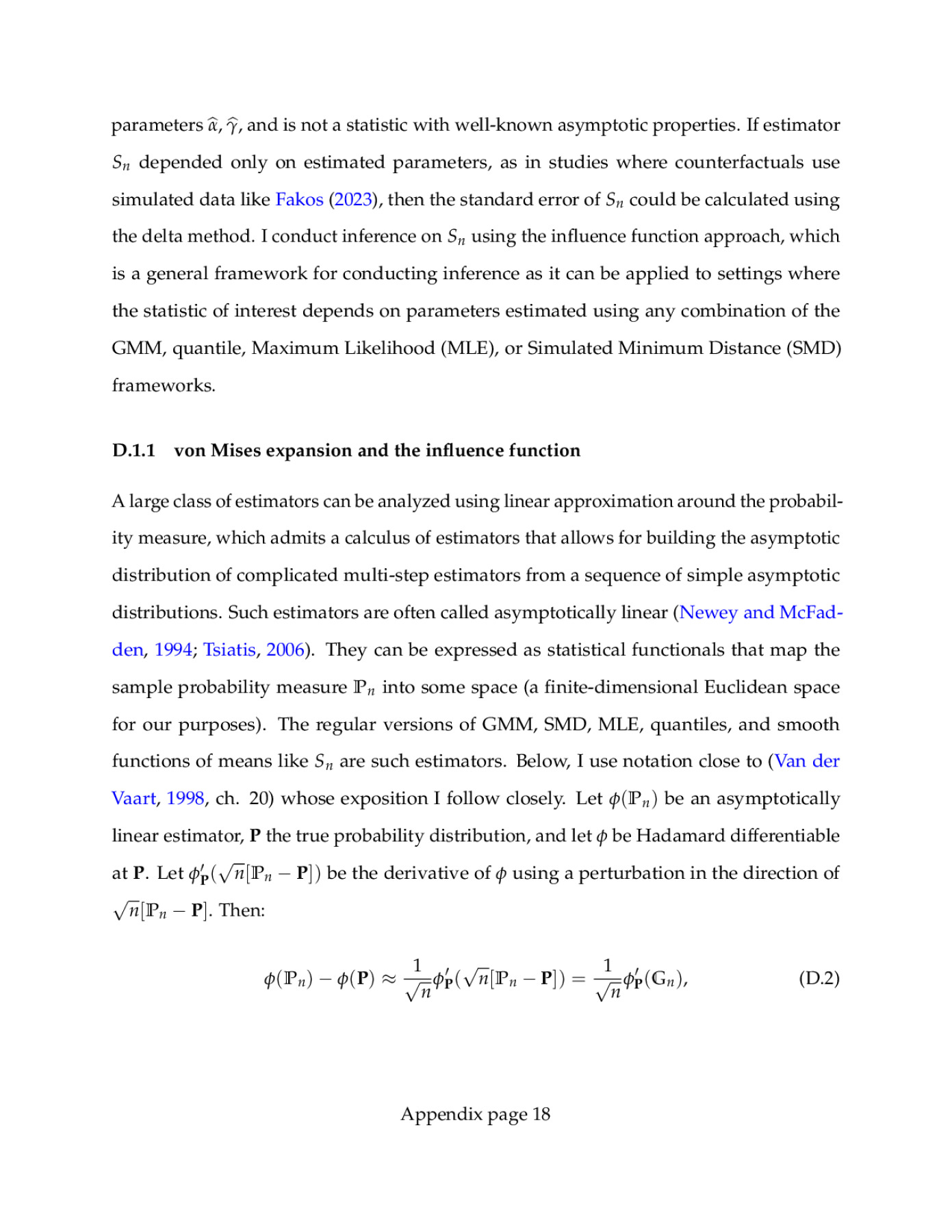

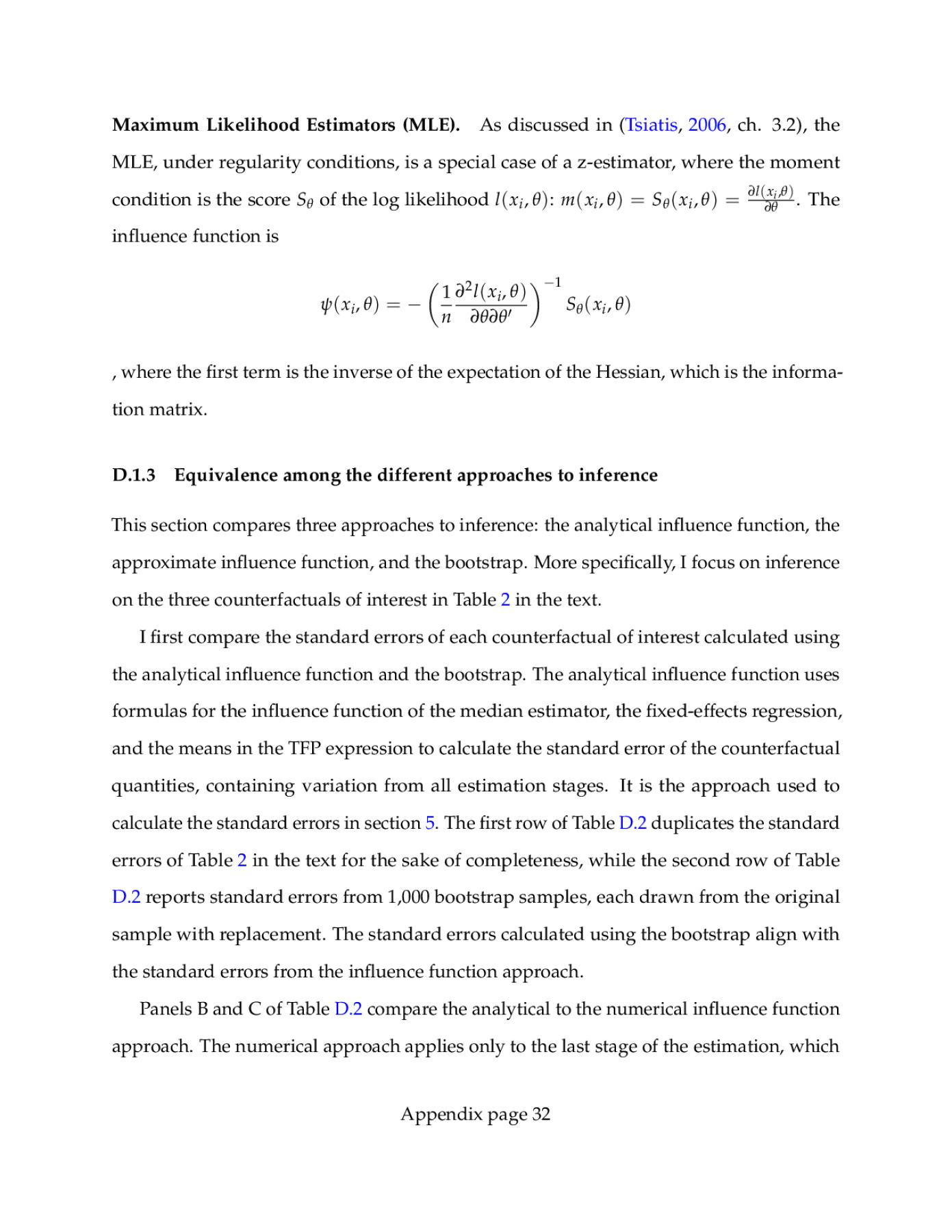

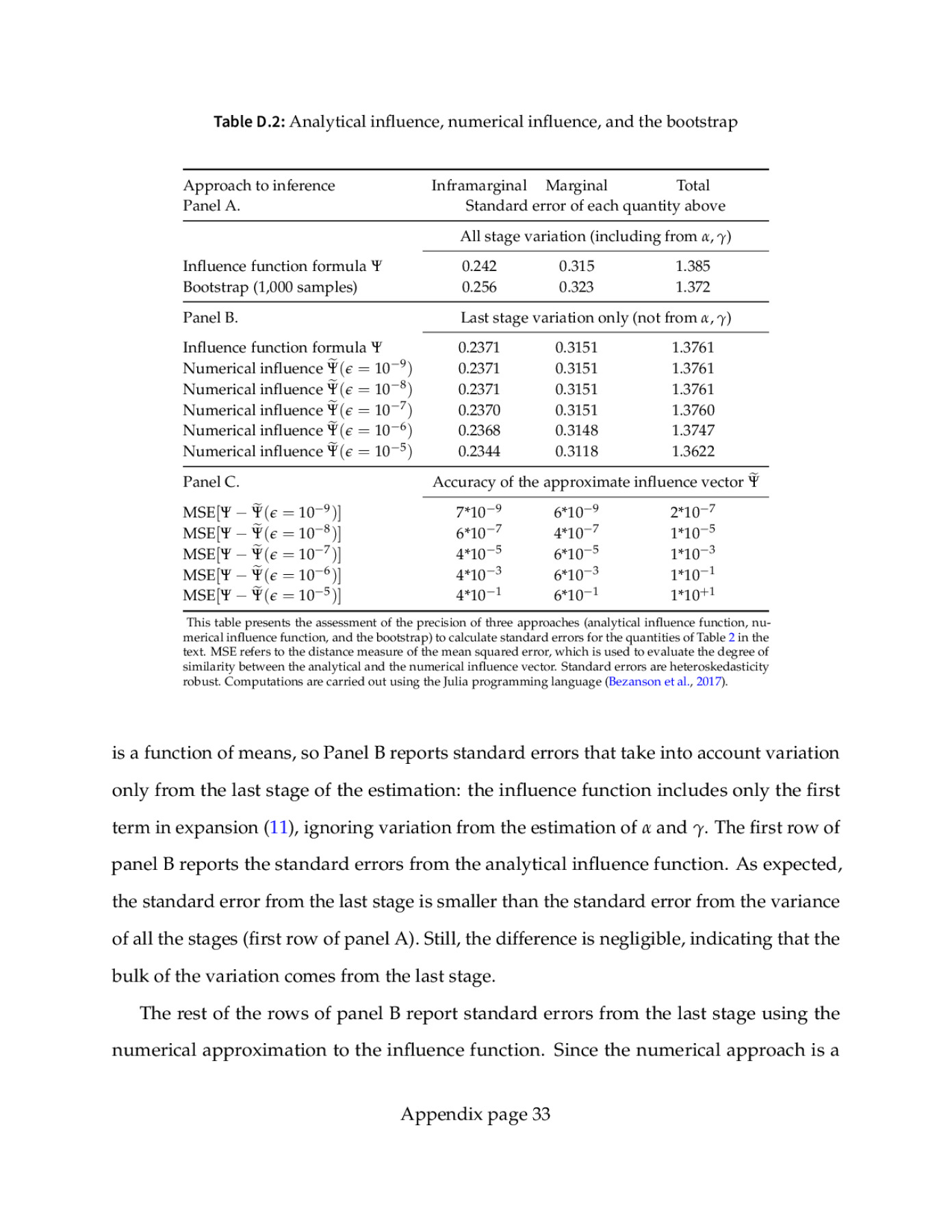

I develop a general equilibrium model of heterogeneous firms to study the importance of financial frictions on aggregate productivity. Frictions lead to lower aggregate productivity by inducing suboptimal firm capital structure and leading to misallocation of capital and labor across firms. Financial frictions are the only cause of suboptimal capital structure by driving a wedge between the price of debt and equity. Yet, they are one of the possible sources of the marginal revenue product of capital (MRPK) dispersion that leads to the misallocation of real resources. Model estimates from European public firms imply that suboptimal capital structure leads to a 2% loss in aggregate productivity, which is a lower bound on the importance of financial frictions and represents 1/10 of the total loss from all frictions. The quantities of interest are precisely estimated, and I obtain their standard errors using the influence function approach, which provides a general inferential framework for multi-step estimators of structural models in finance.

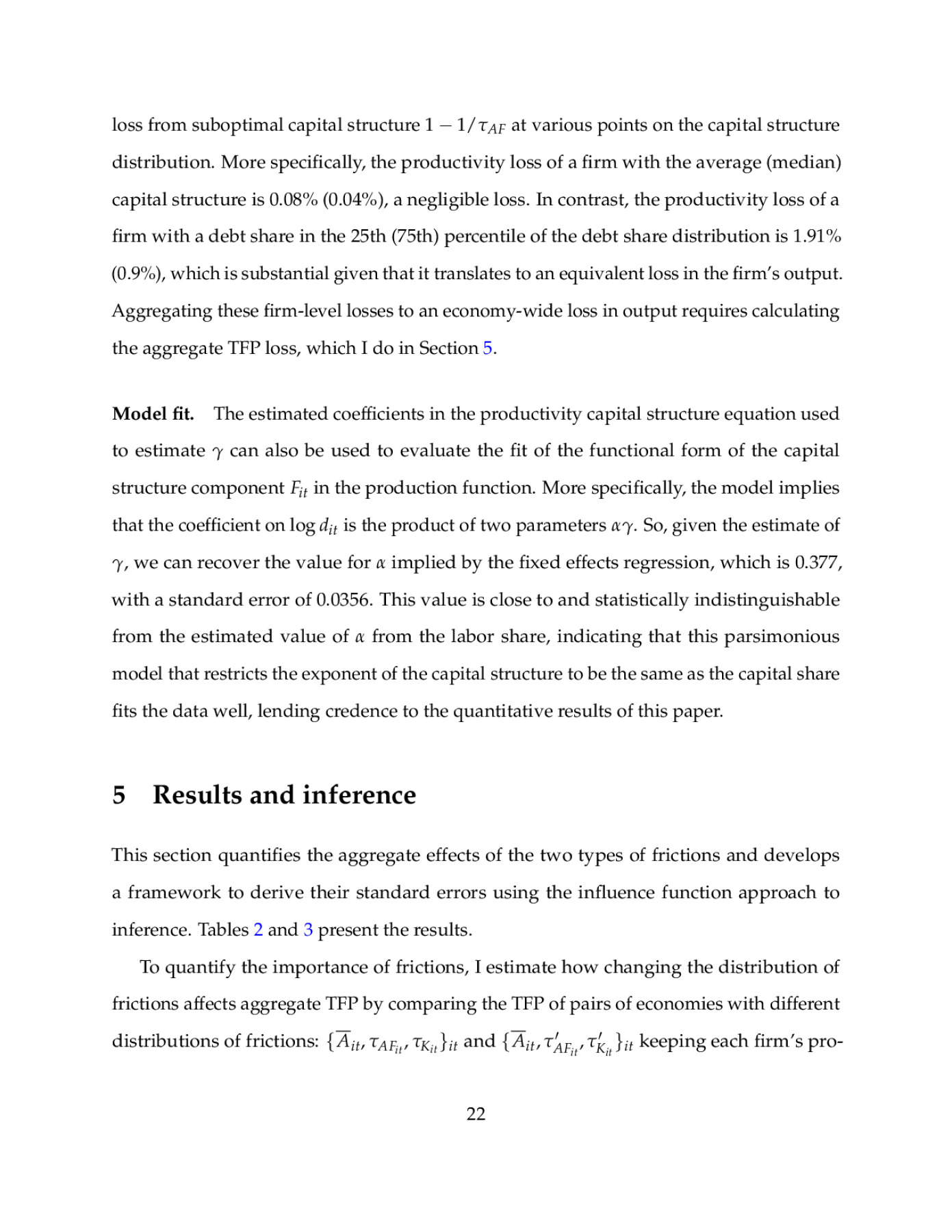

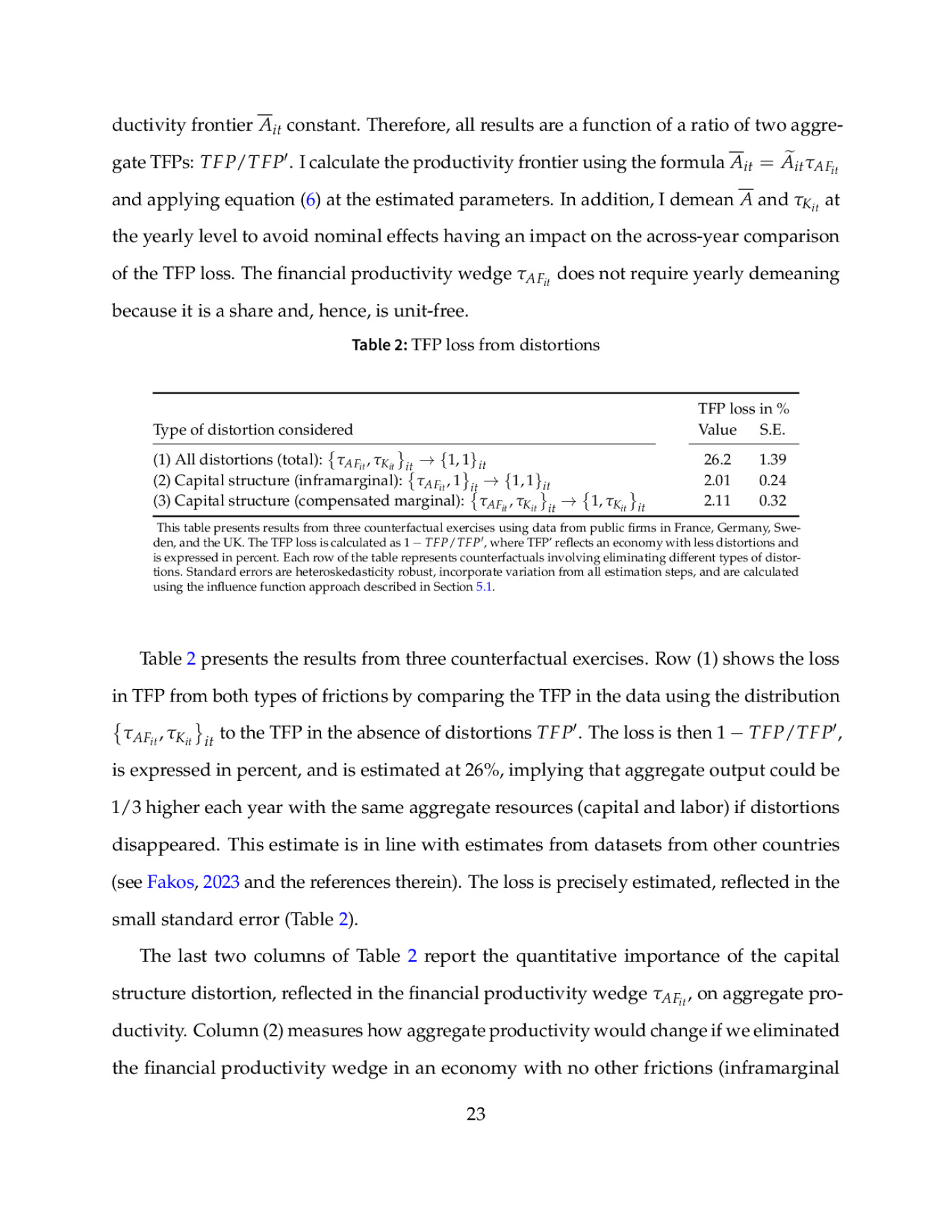

Preview