2024 European Winter Meeting, Palma de Majorca, Spain: December, 2024

A Search and Matching Model of Housing and Rental Market Interactions

Nitish Kumar

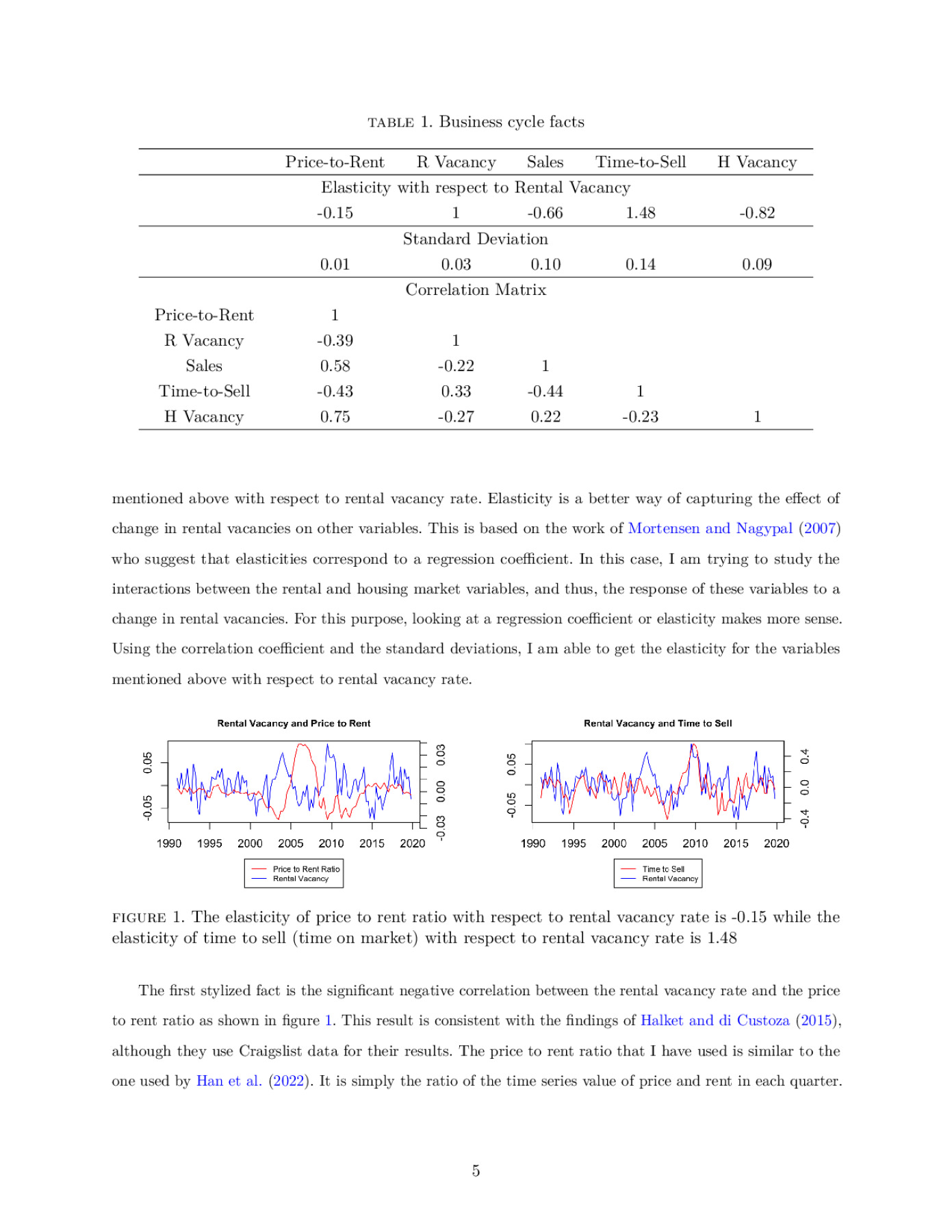

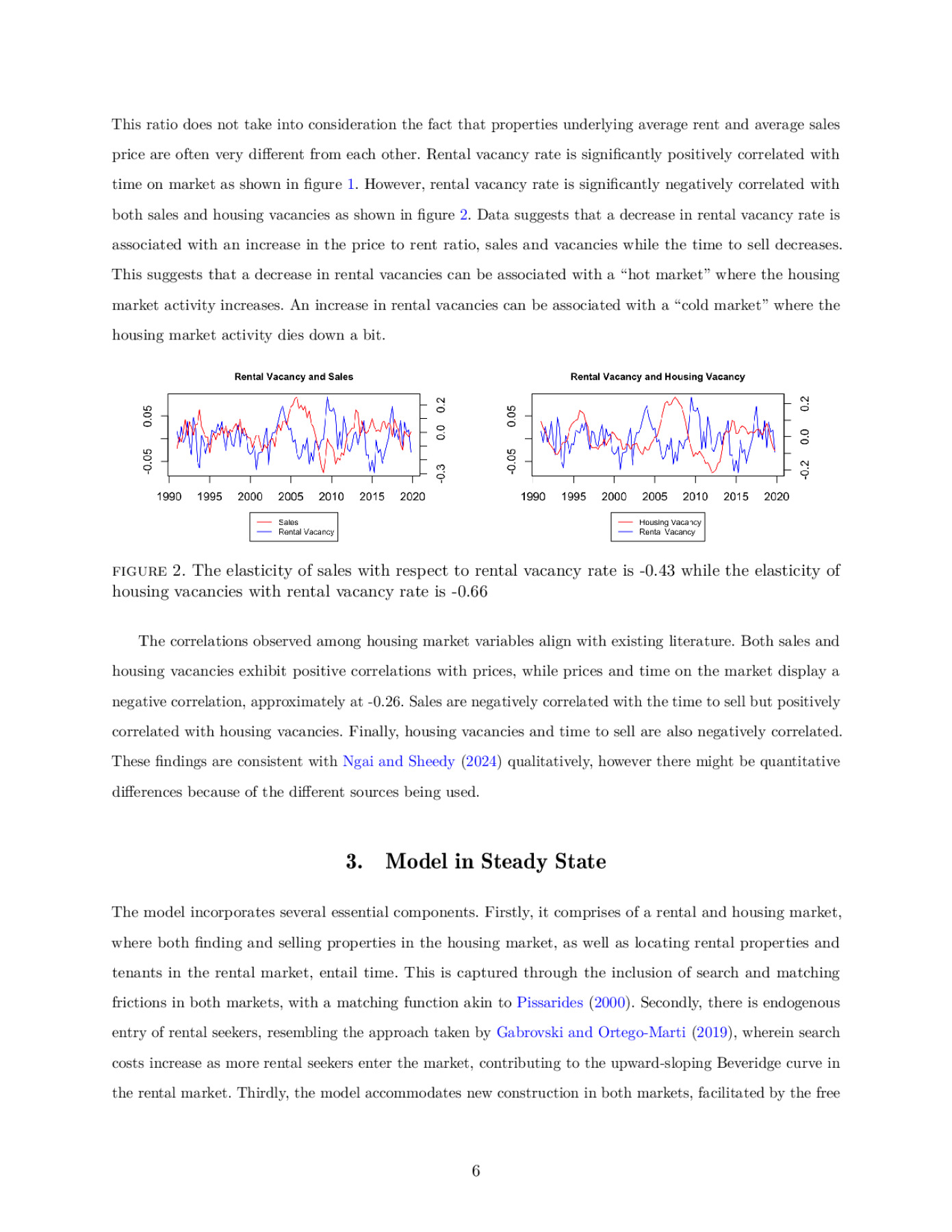

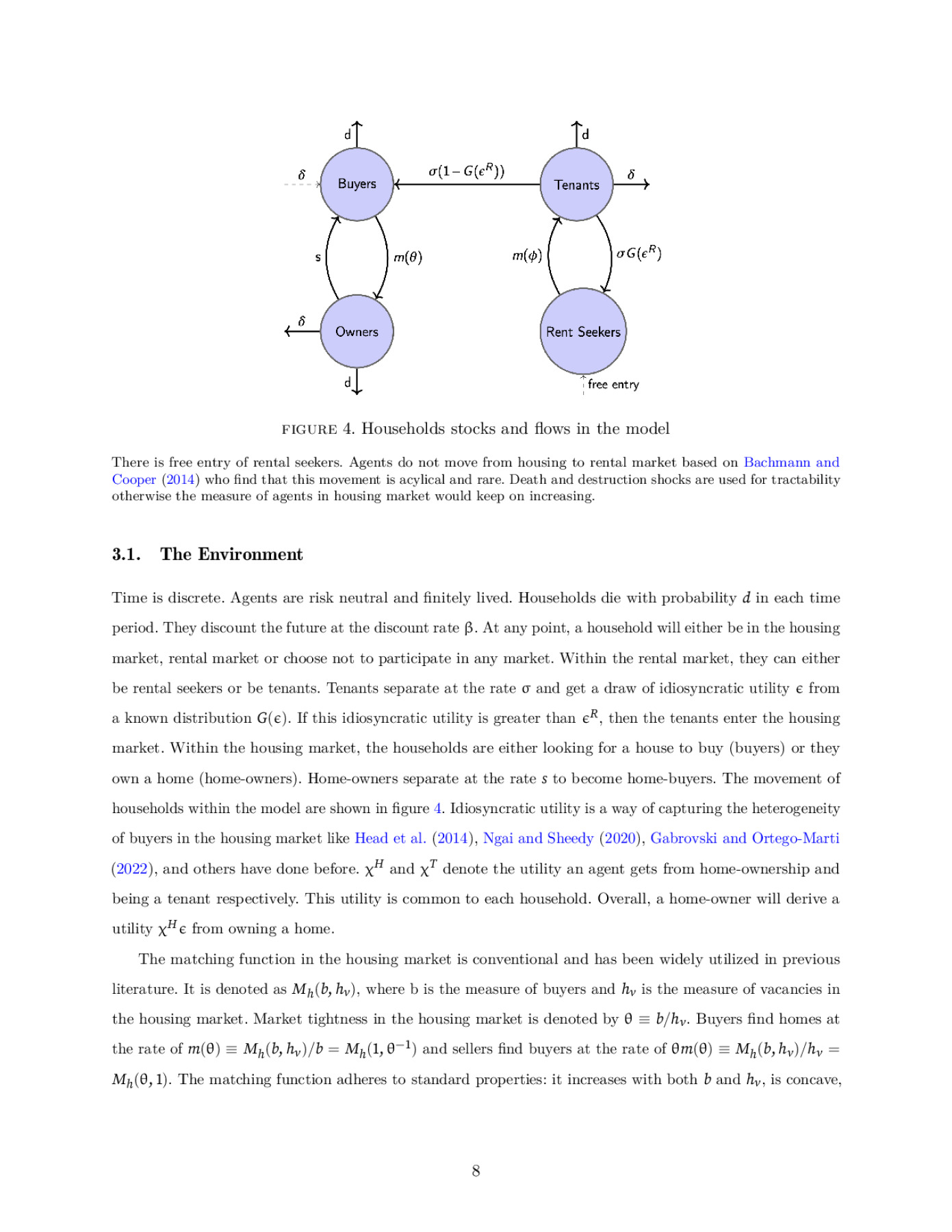

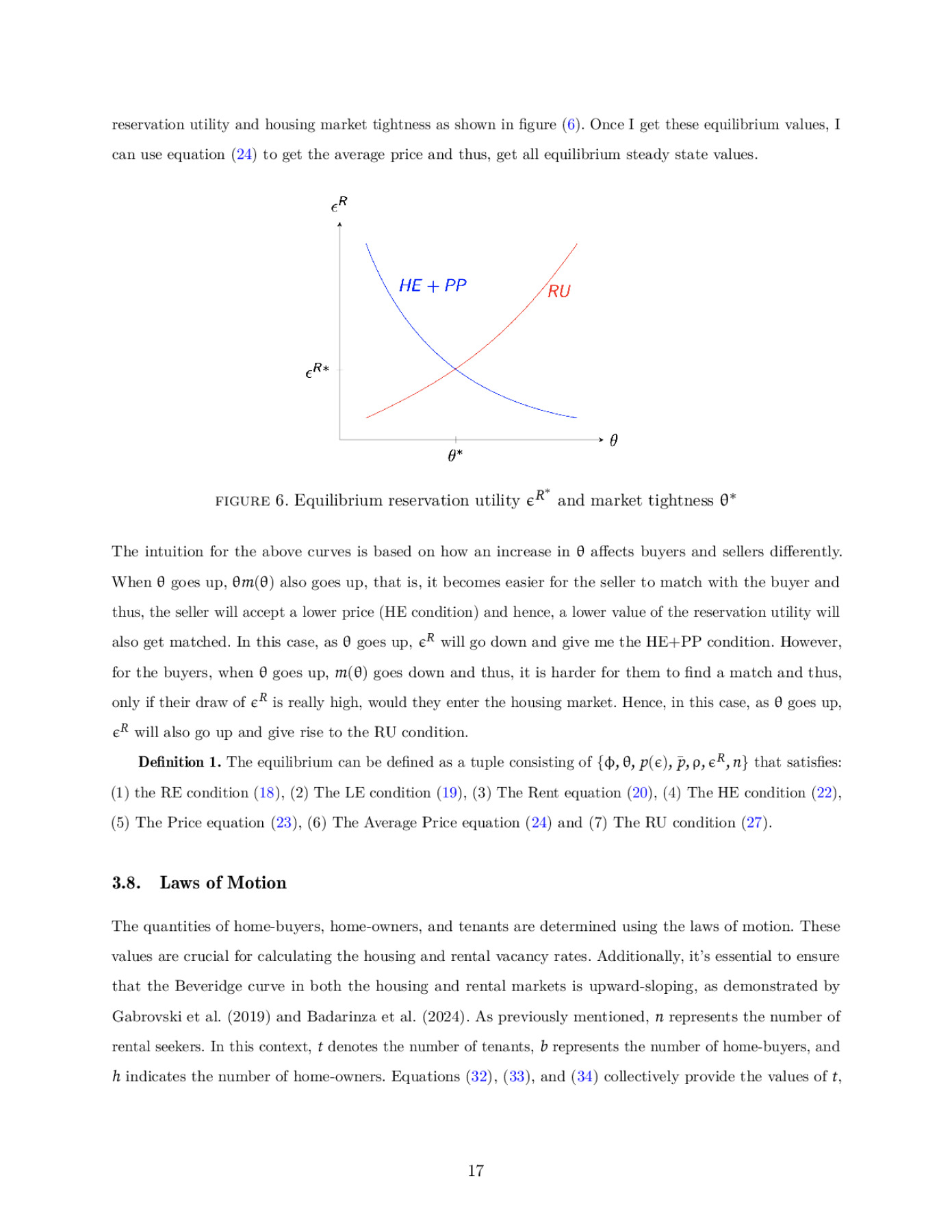

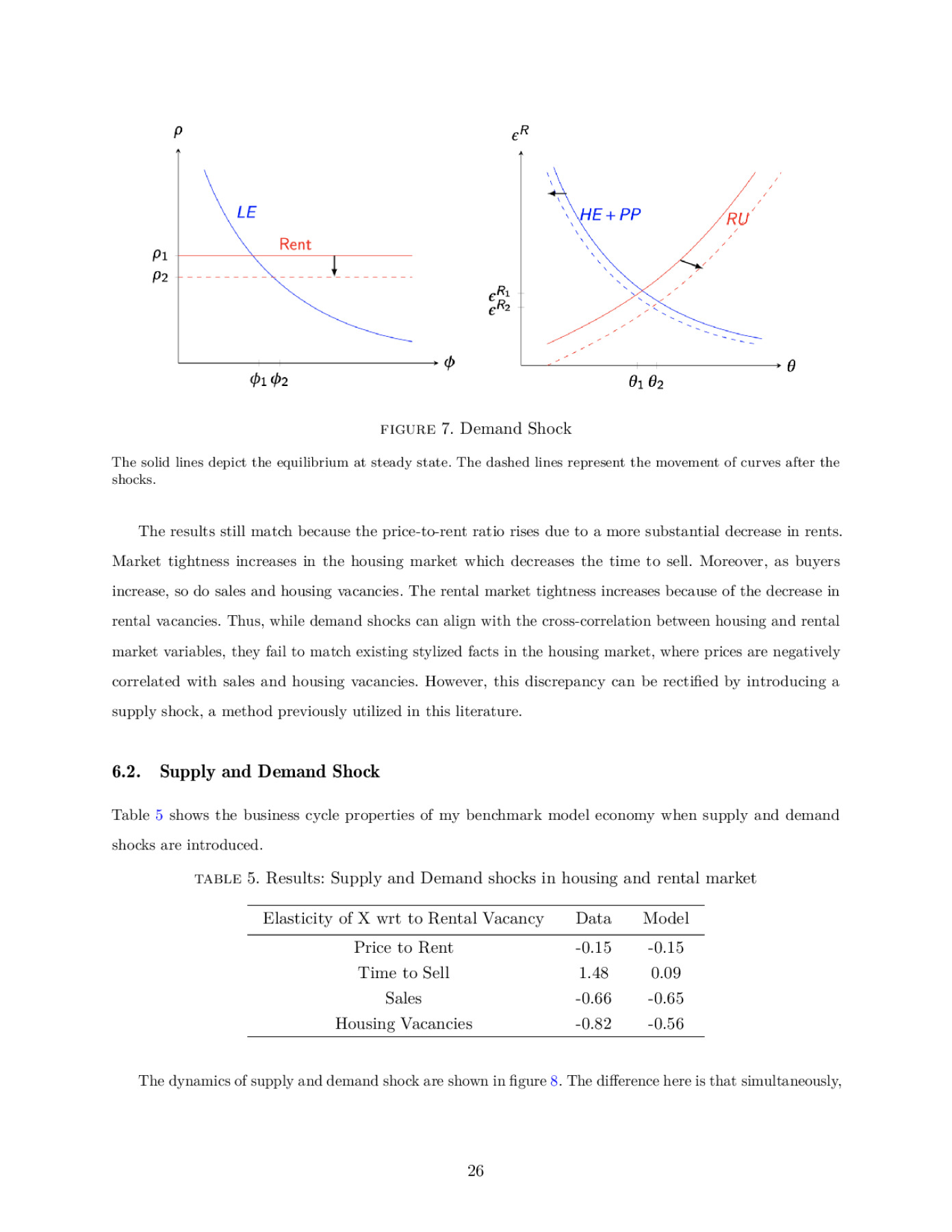

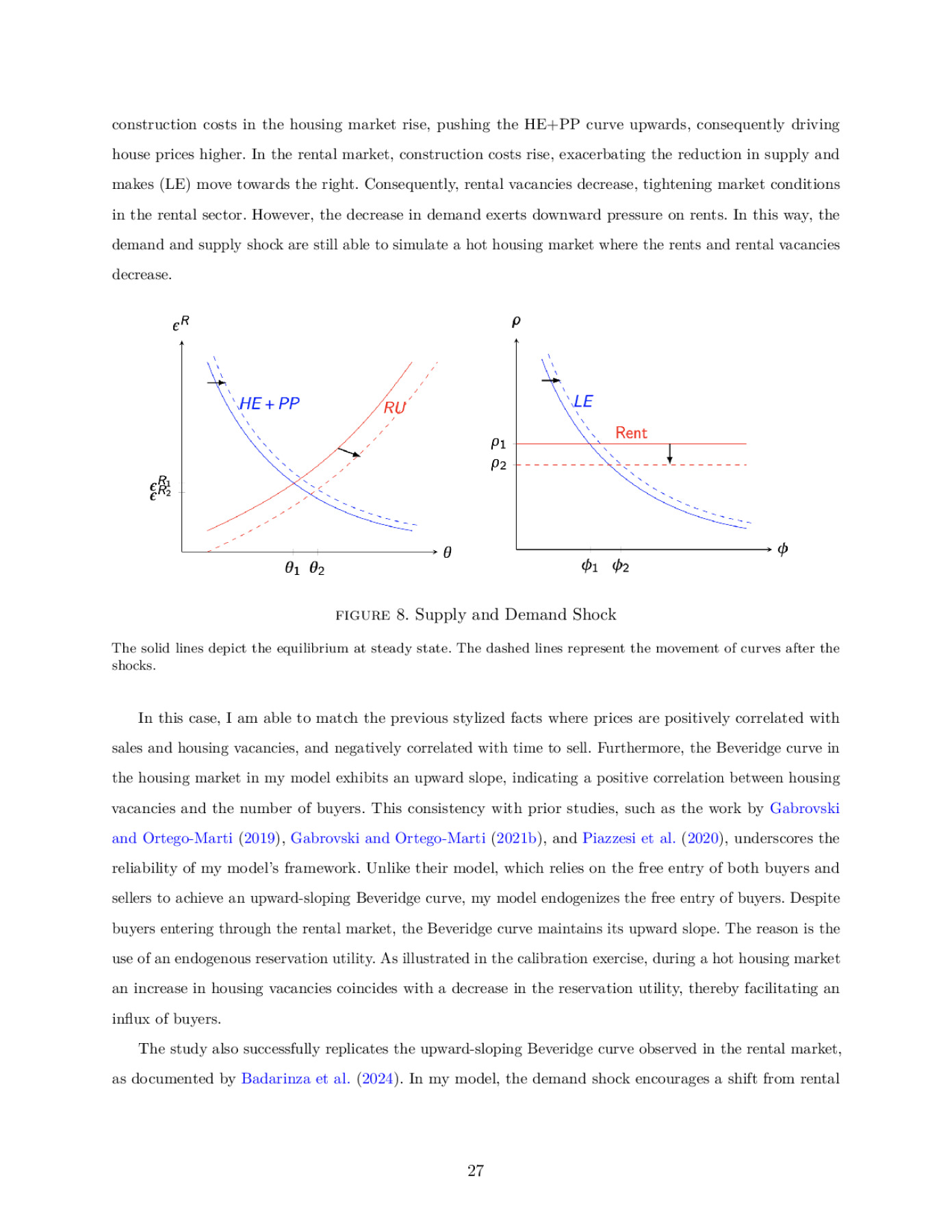

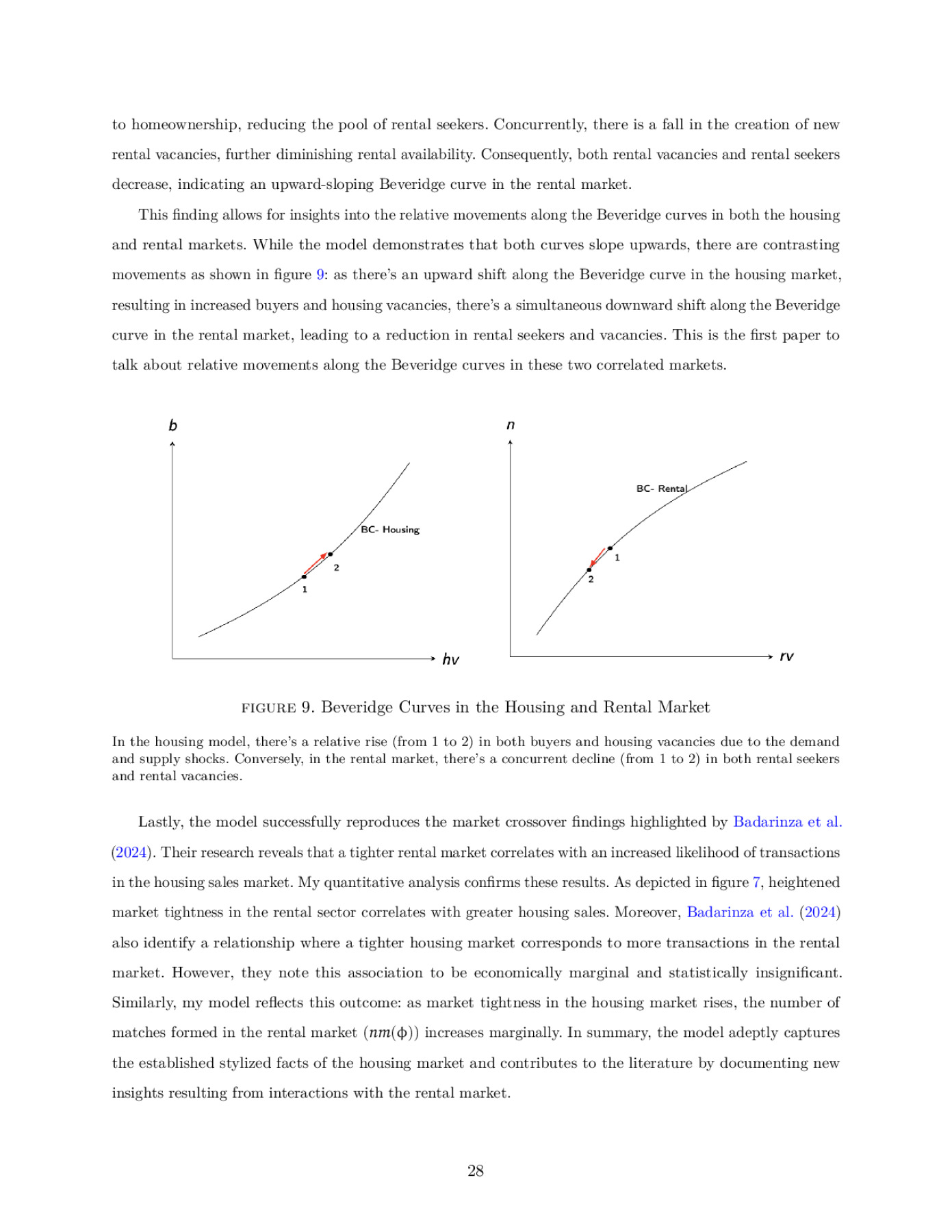

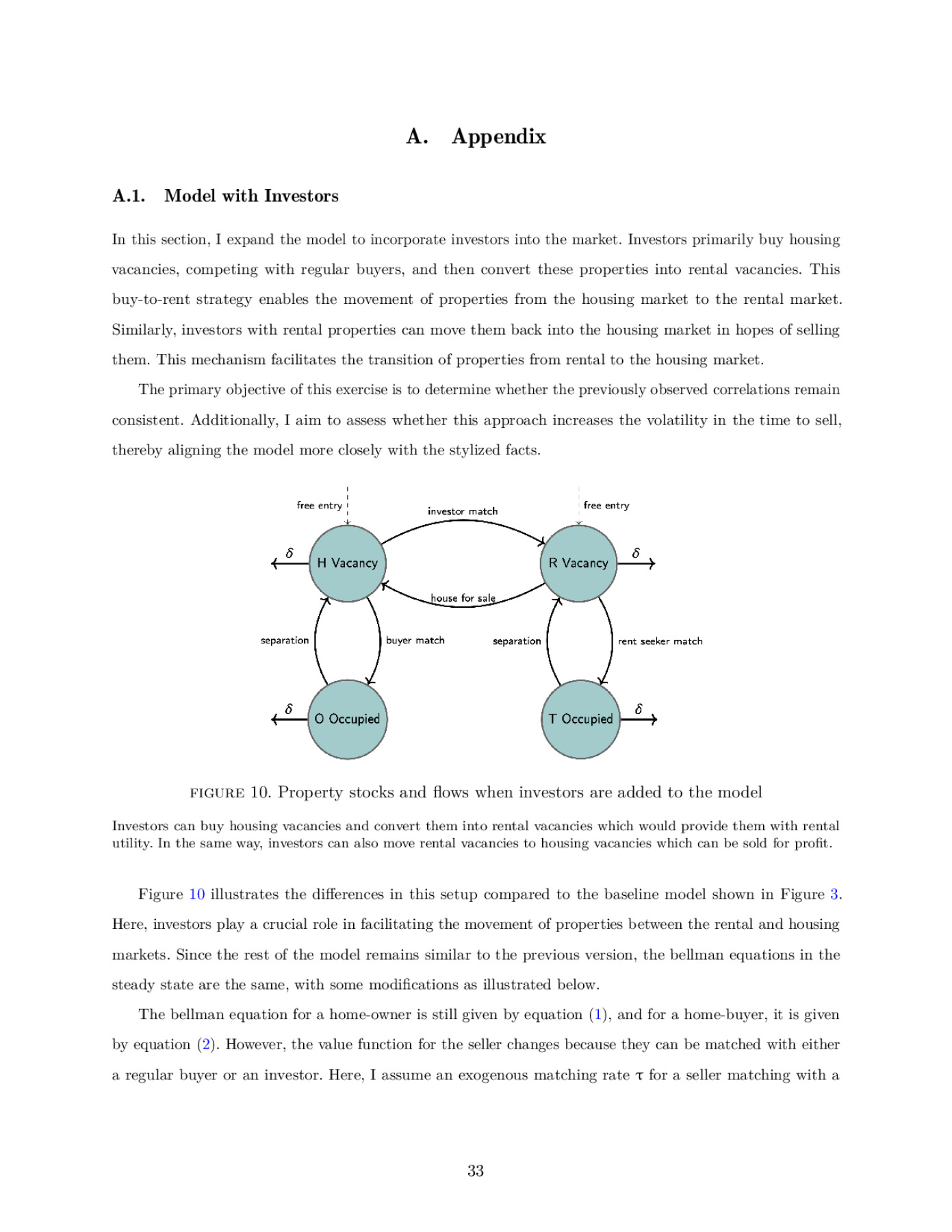

This study presents empirical evidence demonstrating a correlation between rental vacancy rates, frictions within the housing market, and housing prices. Decreased rental vacancies are correlated with higher price-to-rent ratios, increased sales, more housing vacancies, and shorter selling times. To examine these market interactions, I develop a search and matching model of the housing market that incorporates a rental market with search frictions, heterogeneous buyers, and free entry of sellers and landlords. I simulate the model using perfectly correlated demand and supply-side shocks to match the stylized facts. It illustrates that fluctuations in rental vacancies influence agents’ decisions to enter the housing market, consequently altering market tightness in both markets. Additionally, the model replicates empirically observed elasticities and provides new insights into the opposing movements along the Beveridge curve in both markets.

Preview