2024 European Winter Meeting, Palma de Majorca, Spain: December, 2024

Monetary Policy Normalization in the New Normal: The Role of Quantitative Tightening

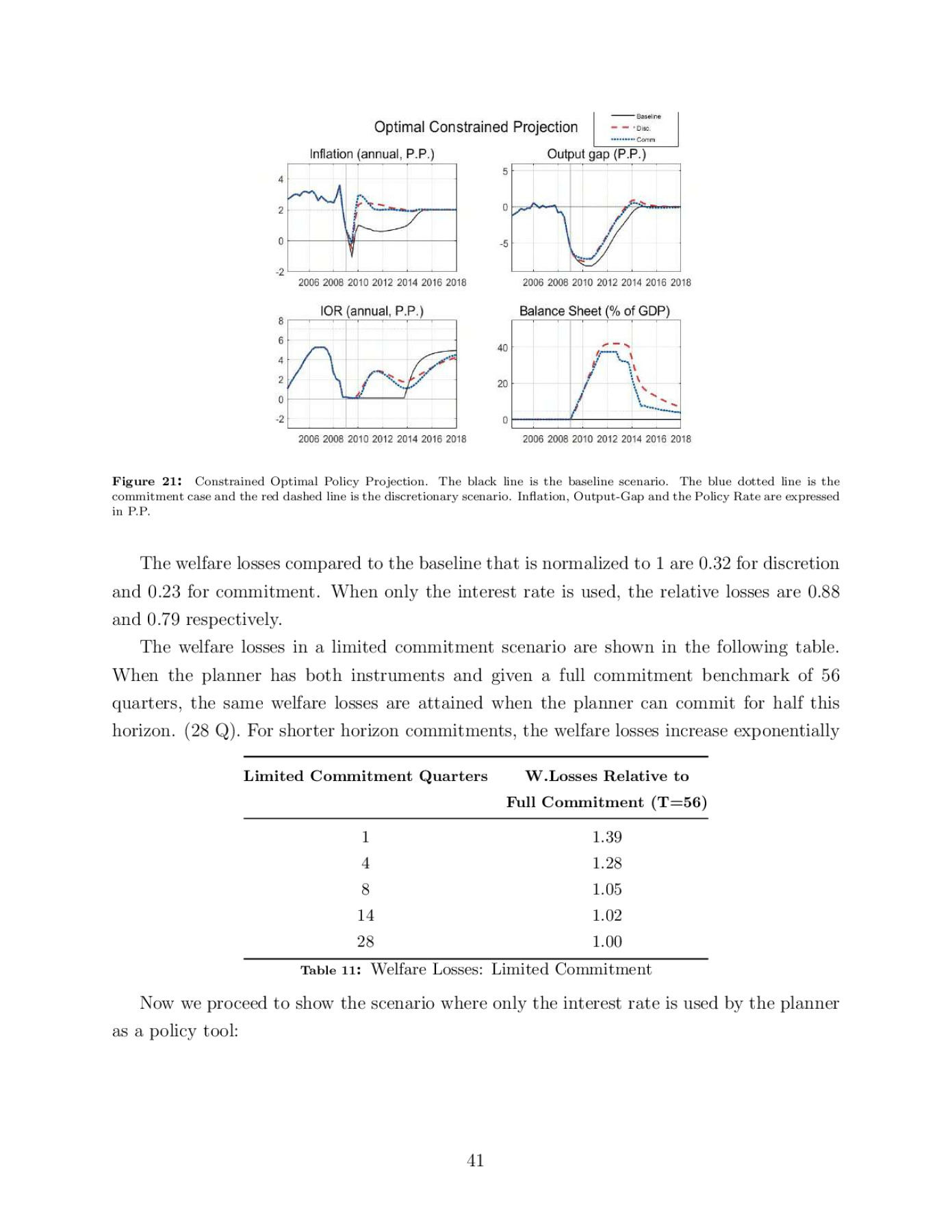

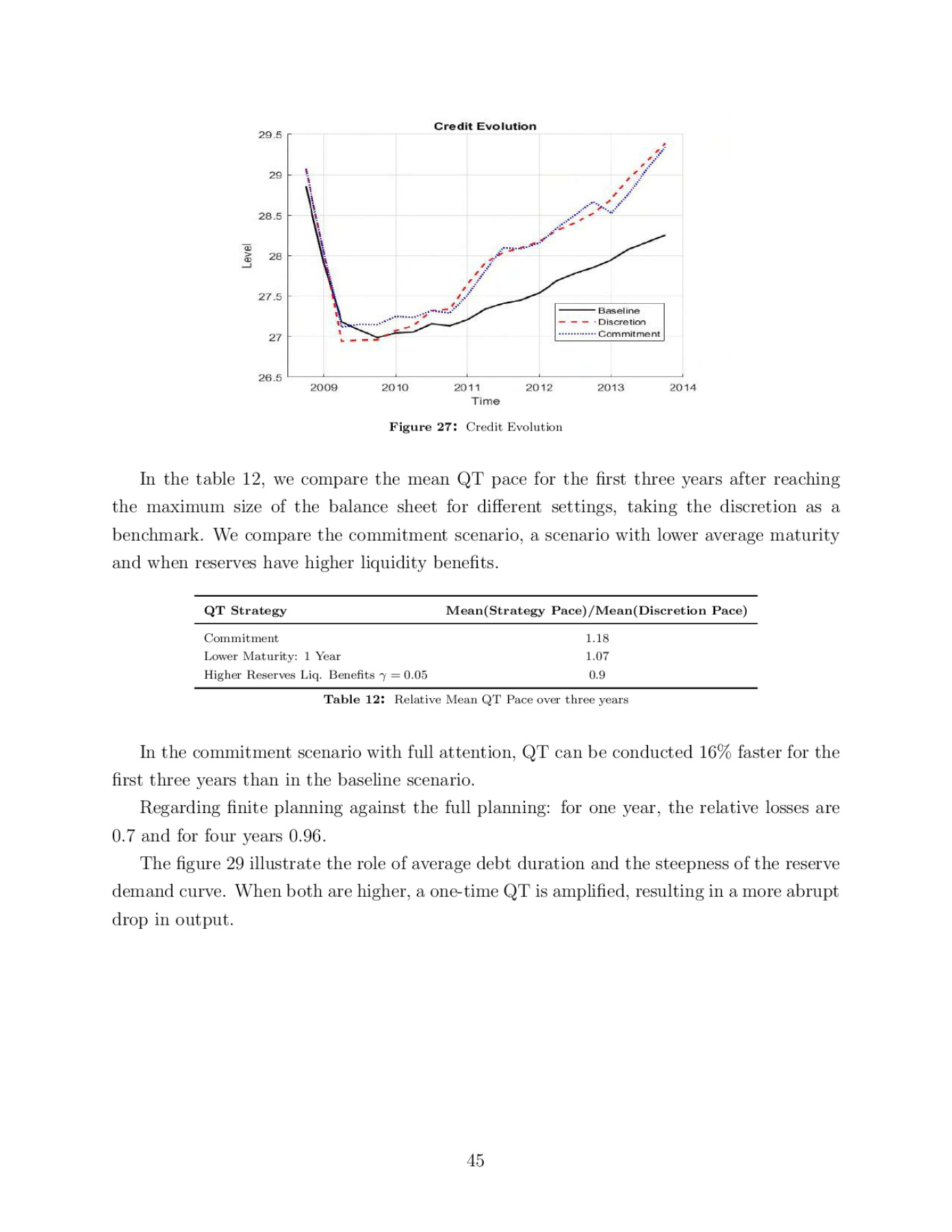

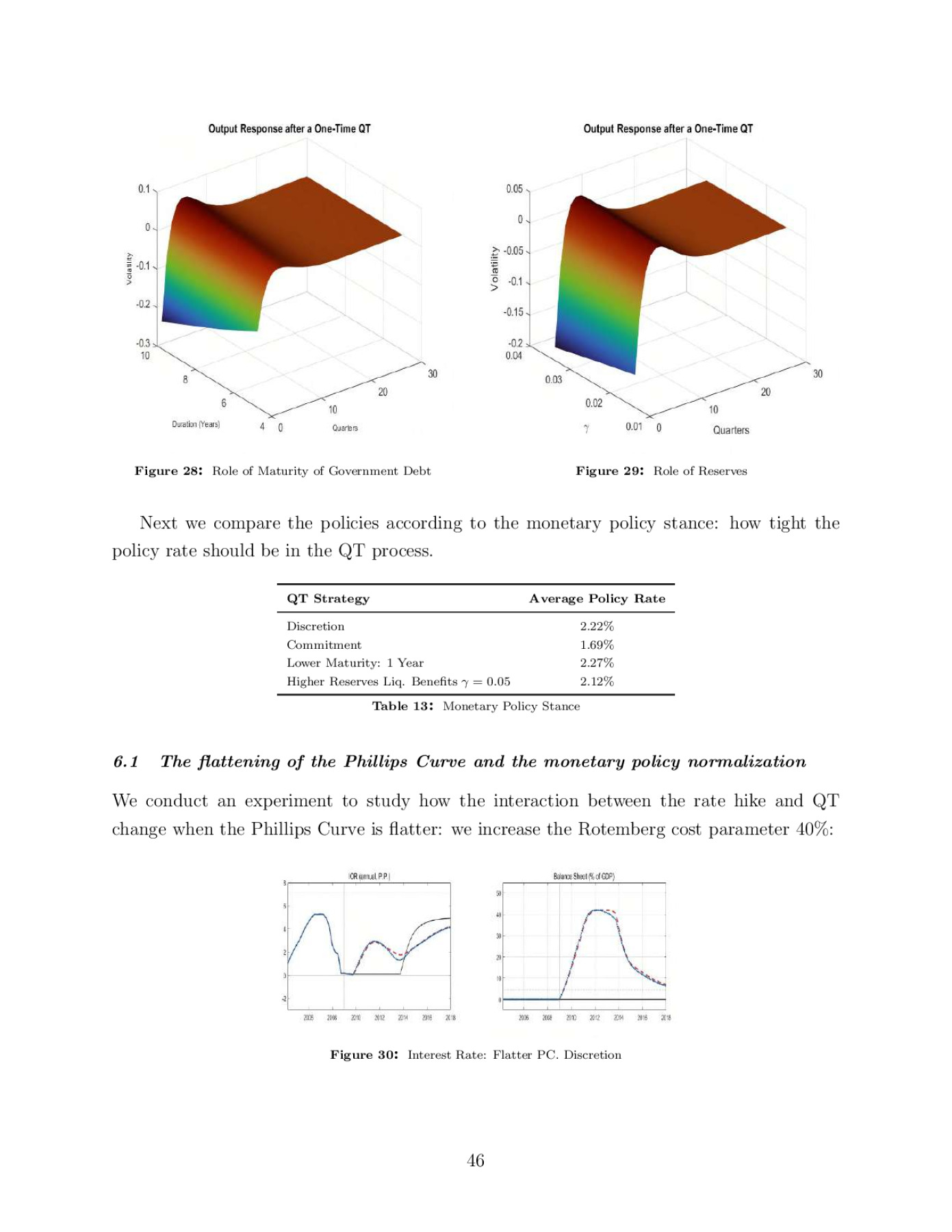

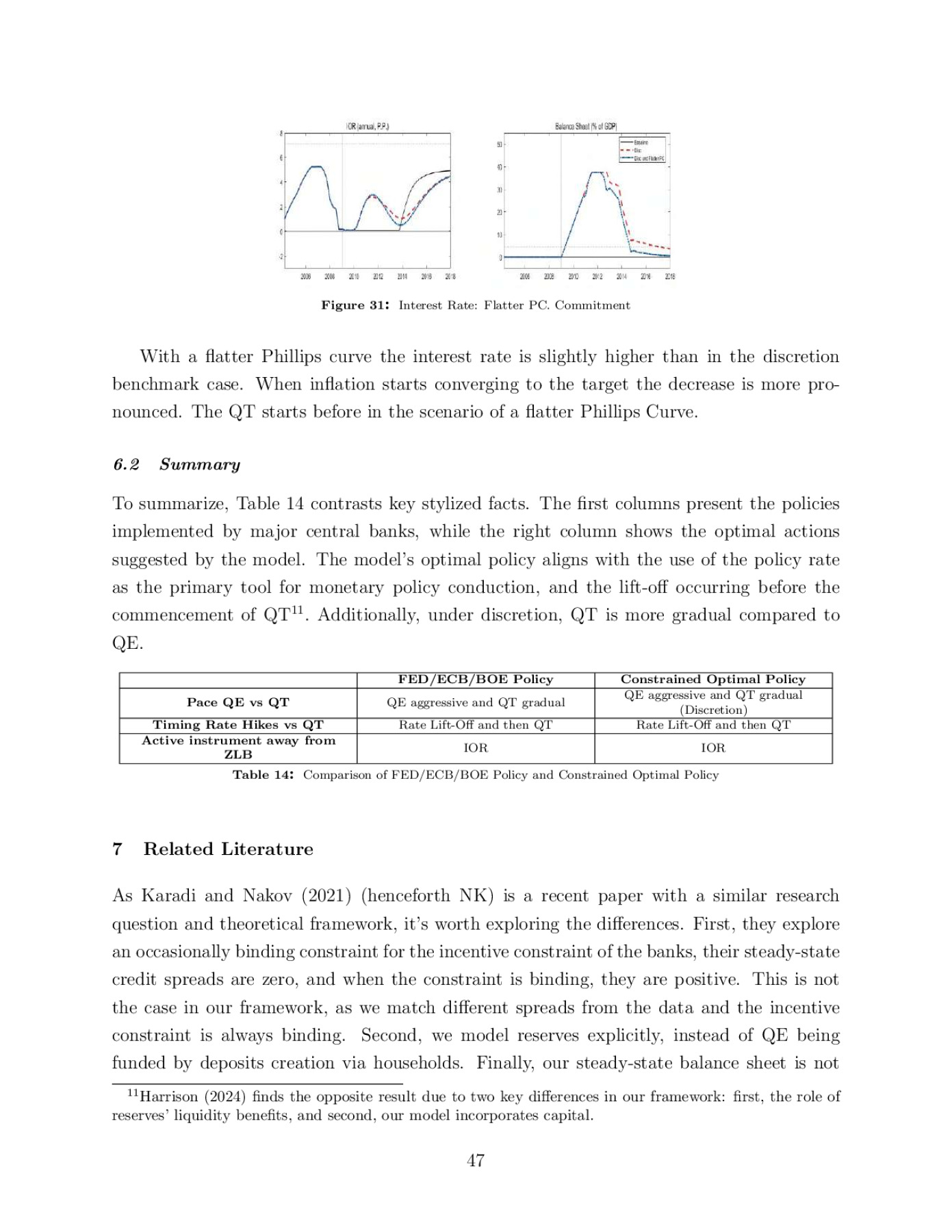

Martin Arazi

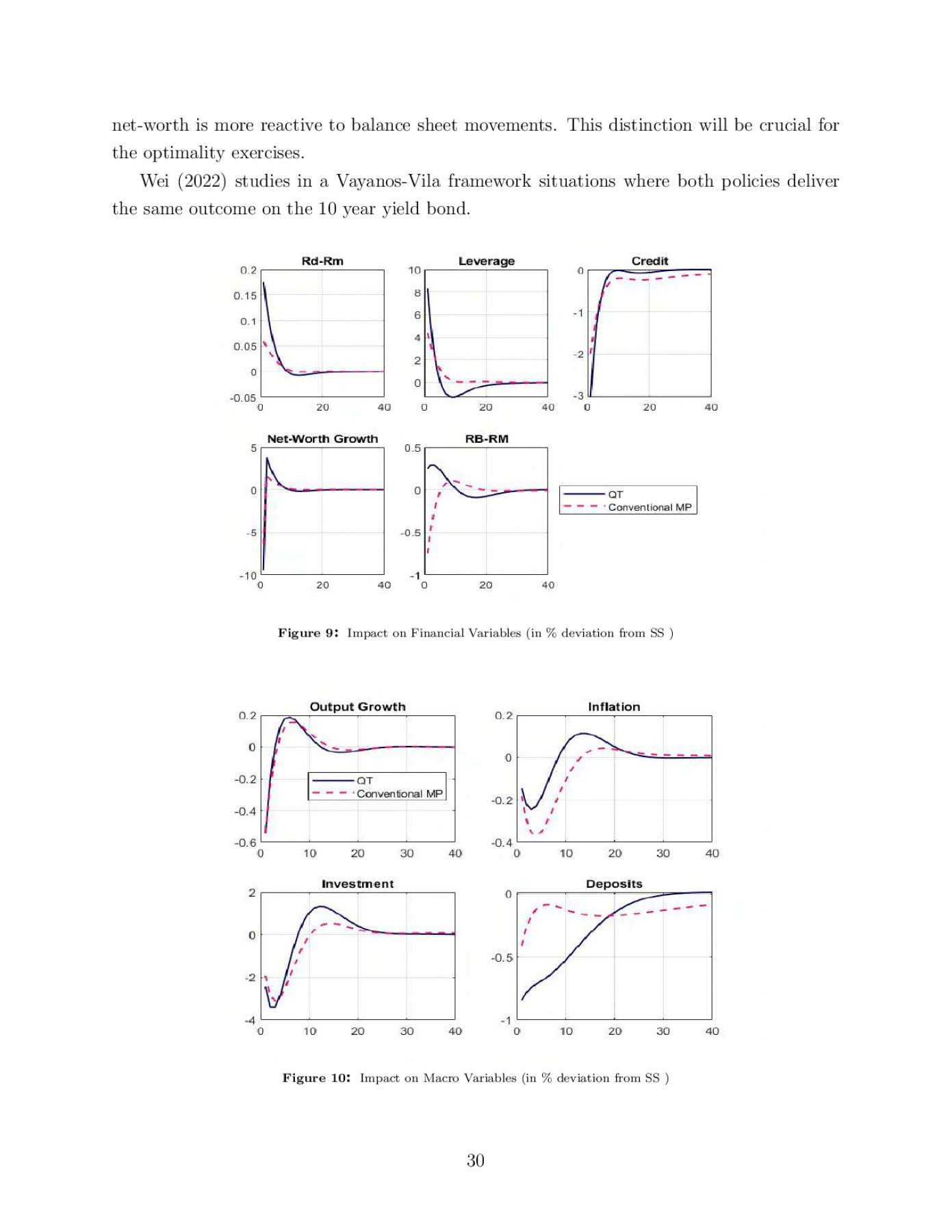

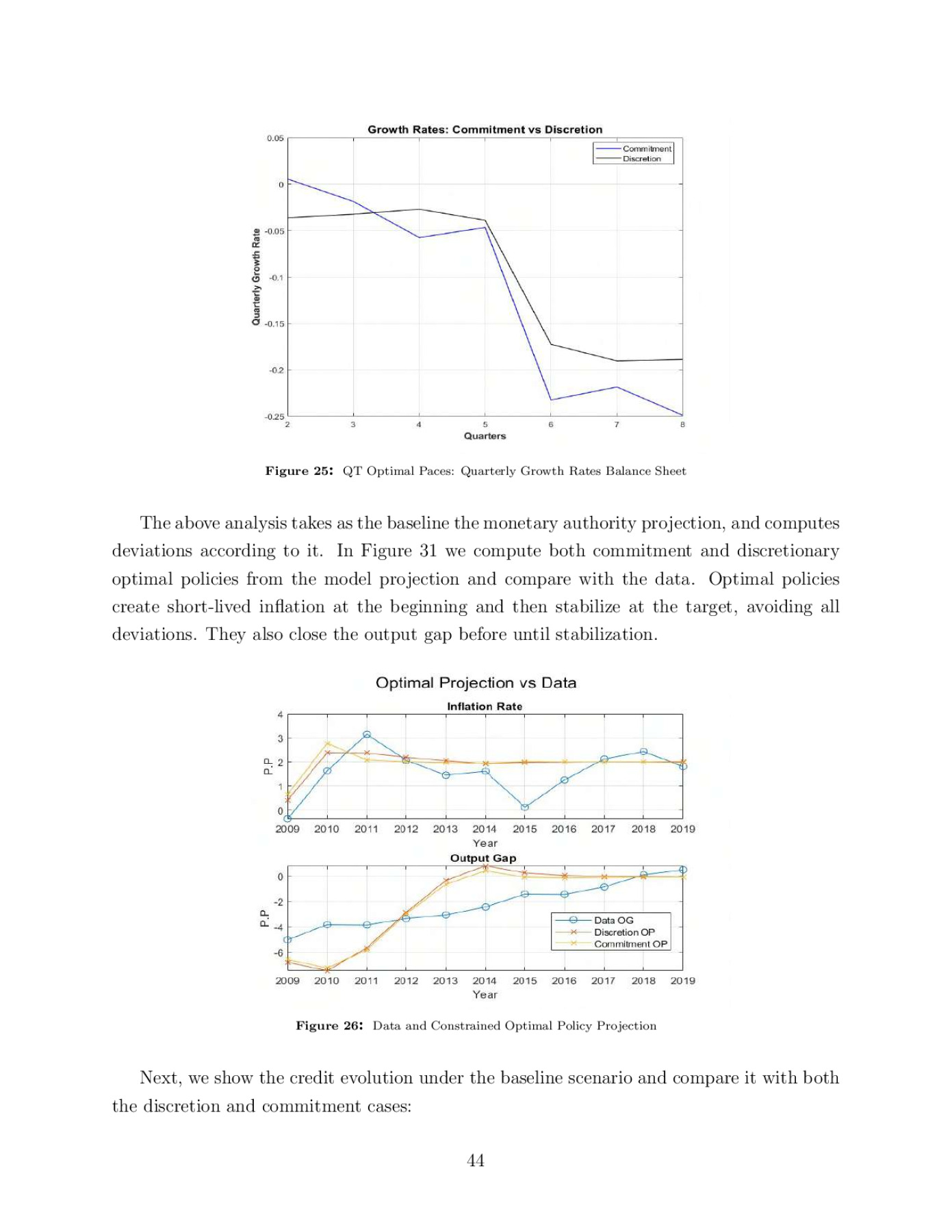

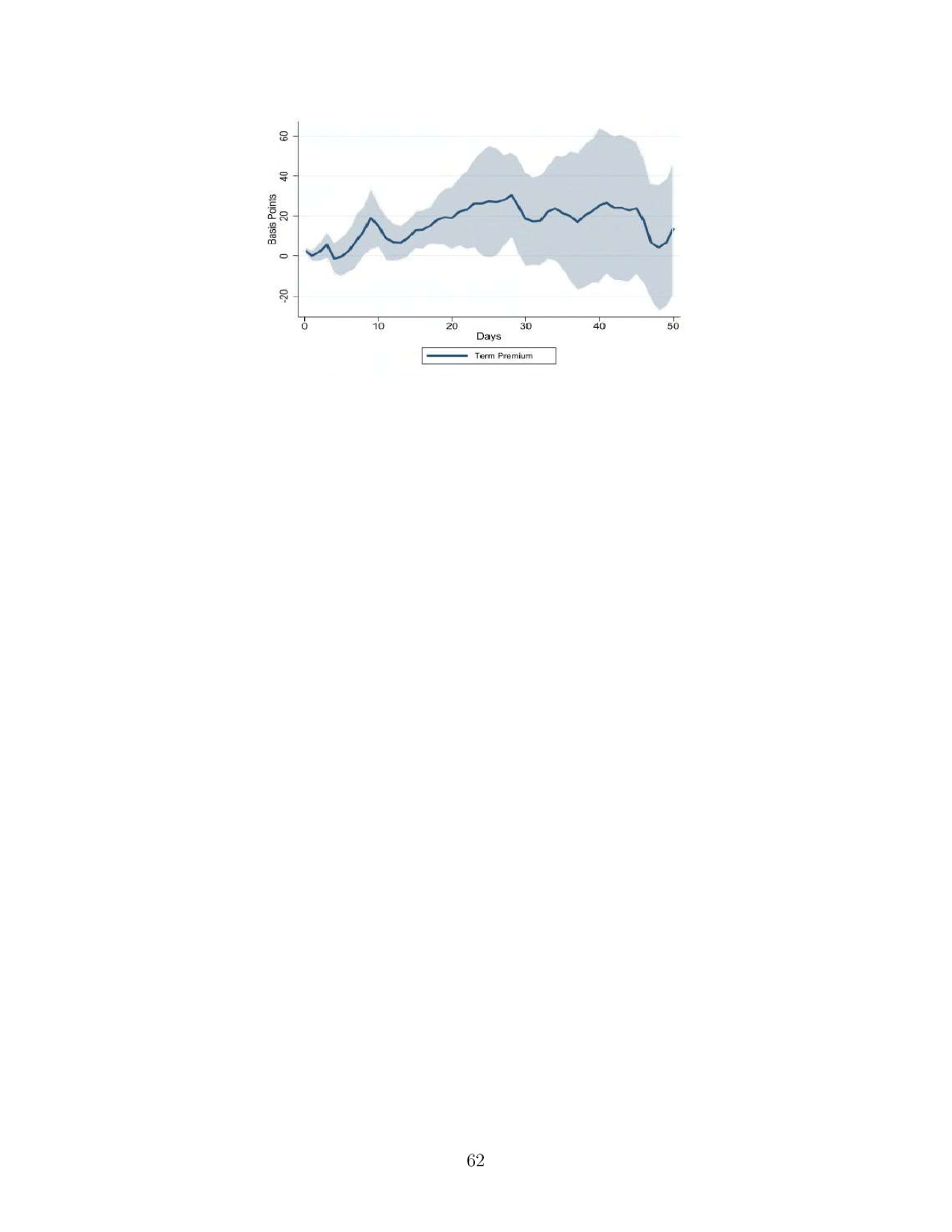

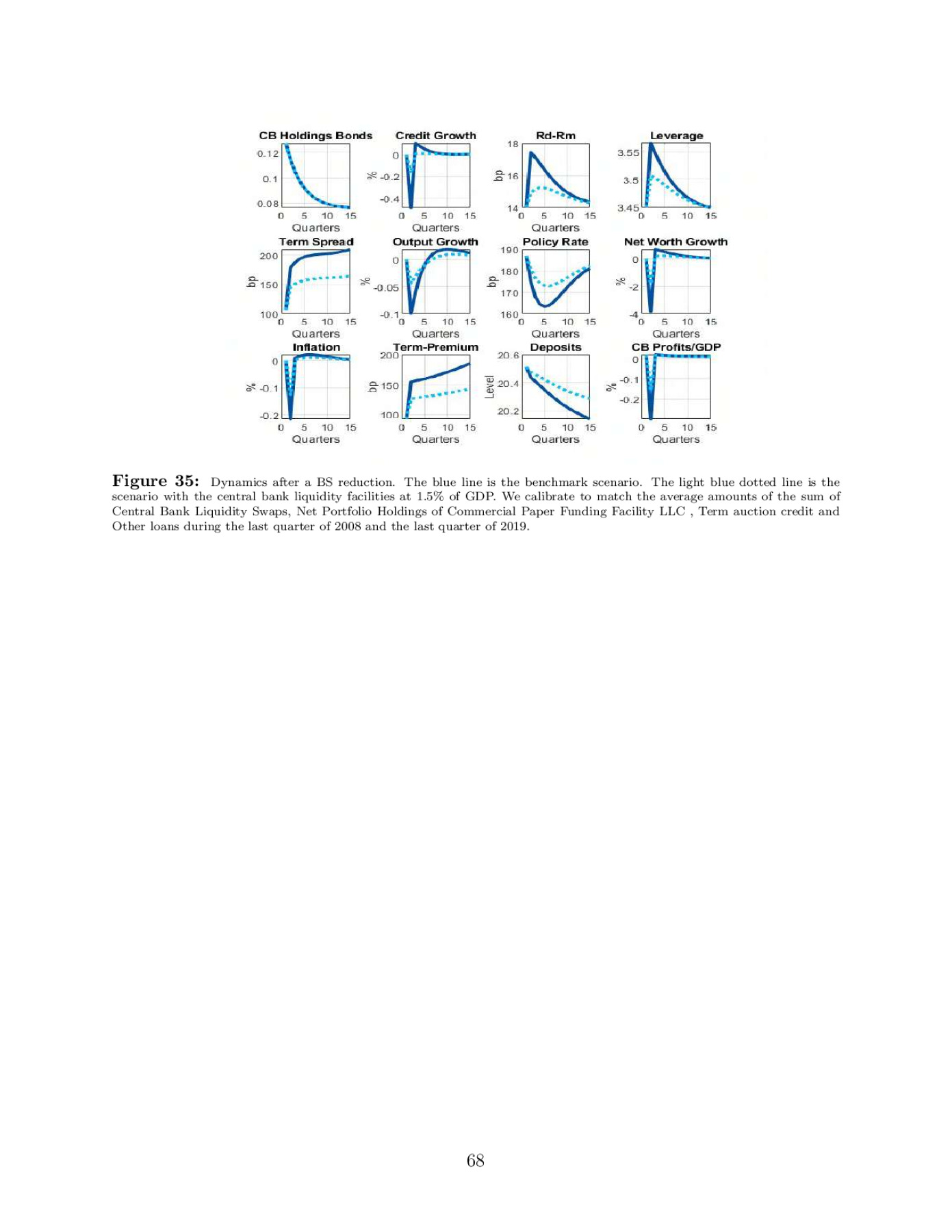

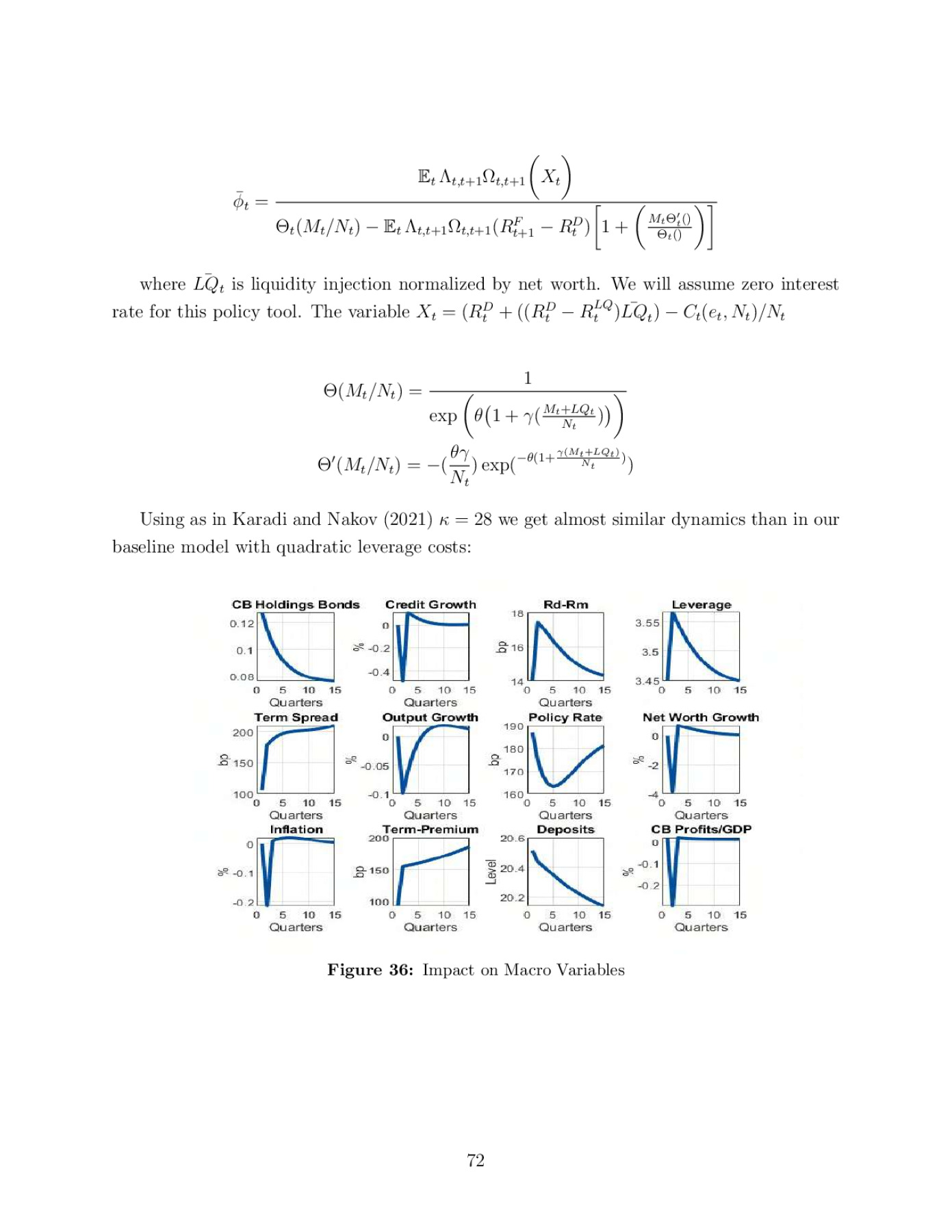

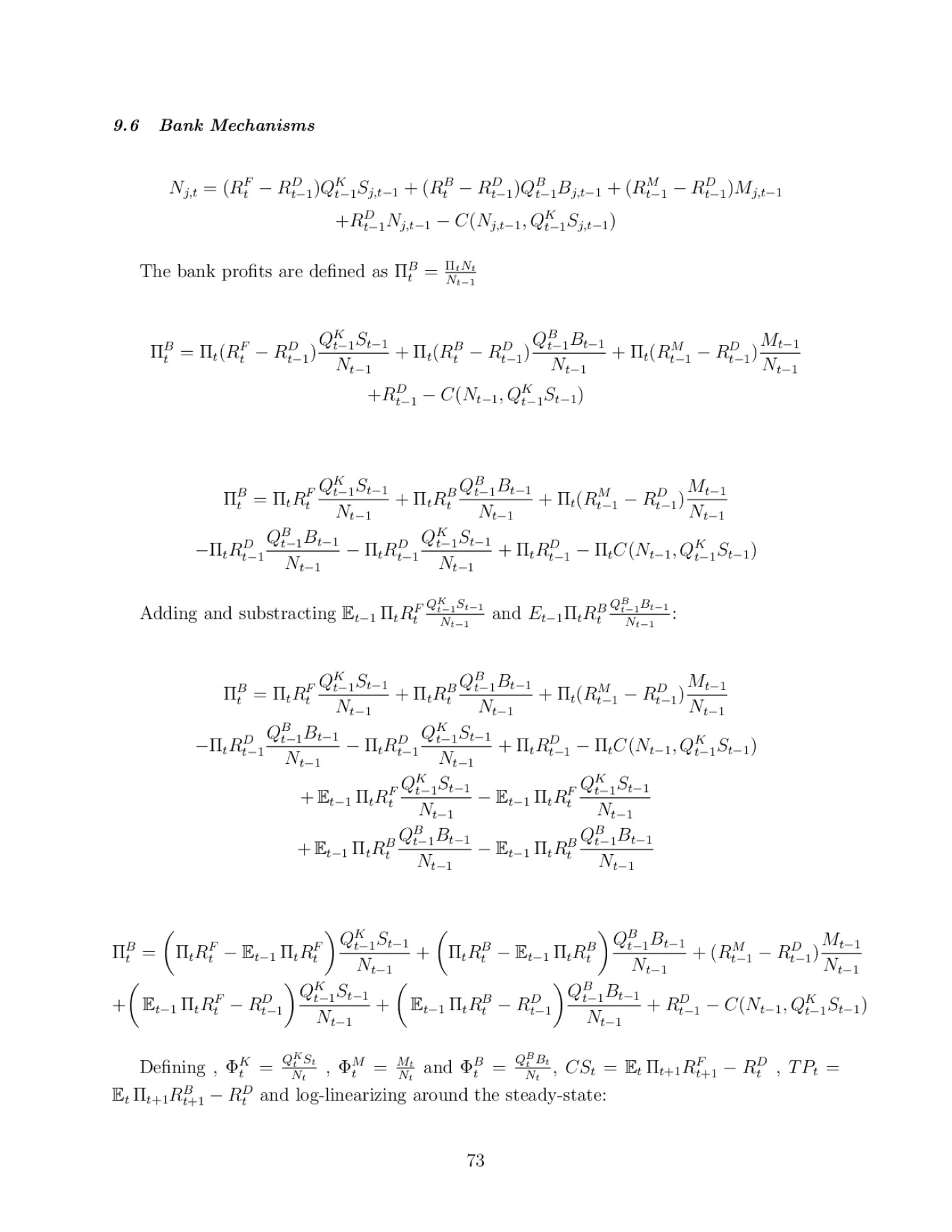

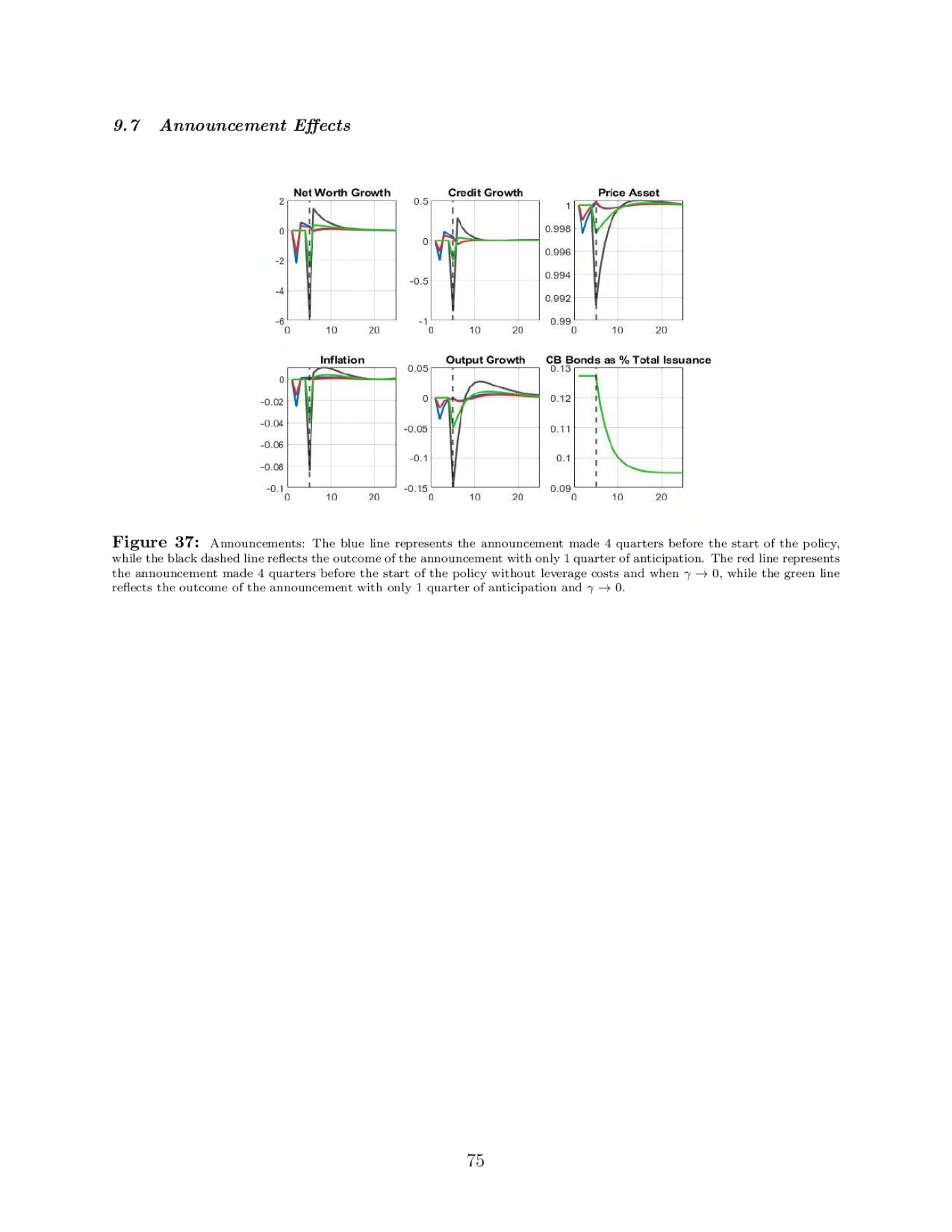

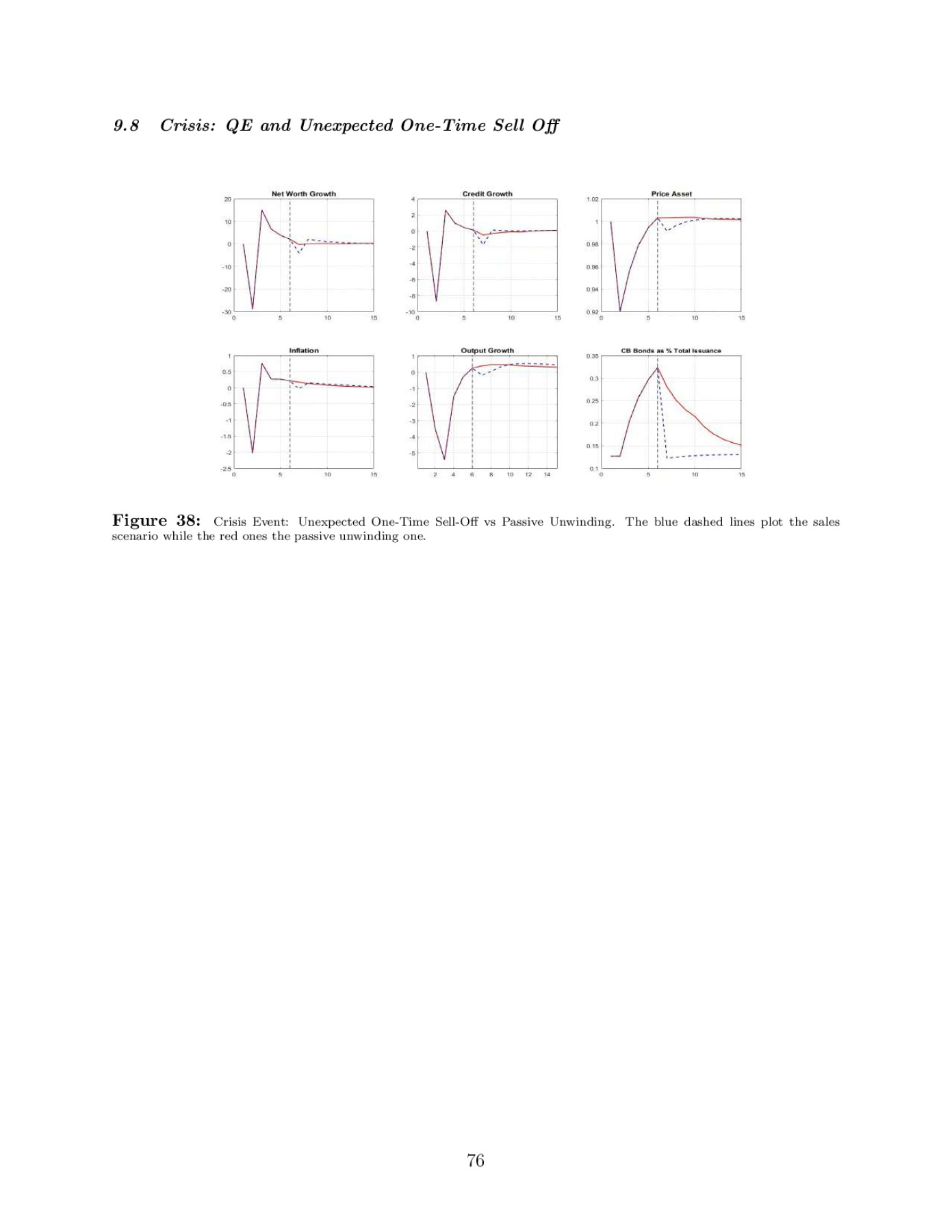

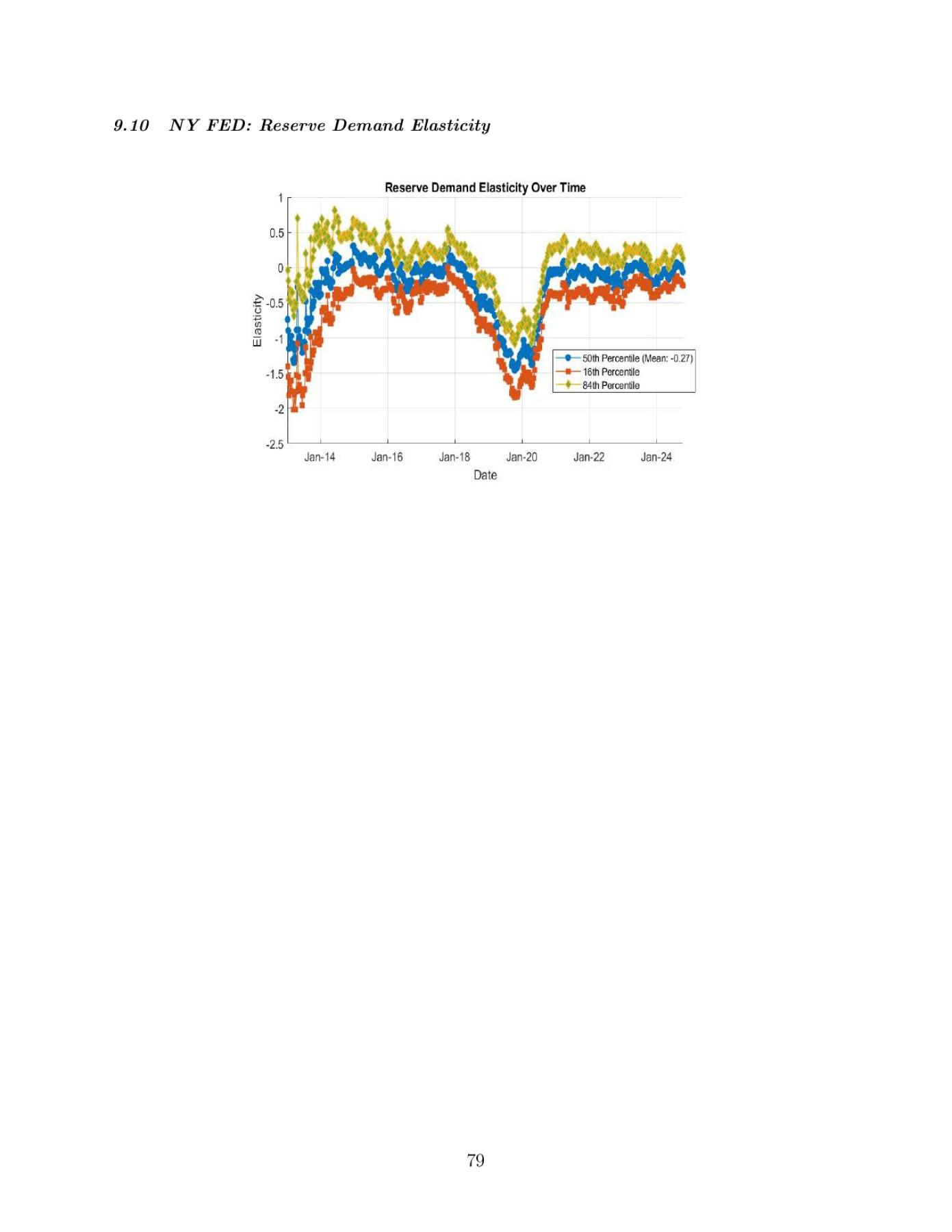

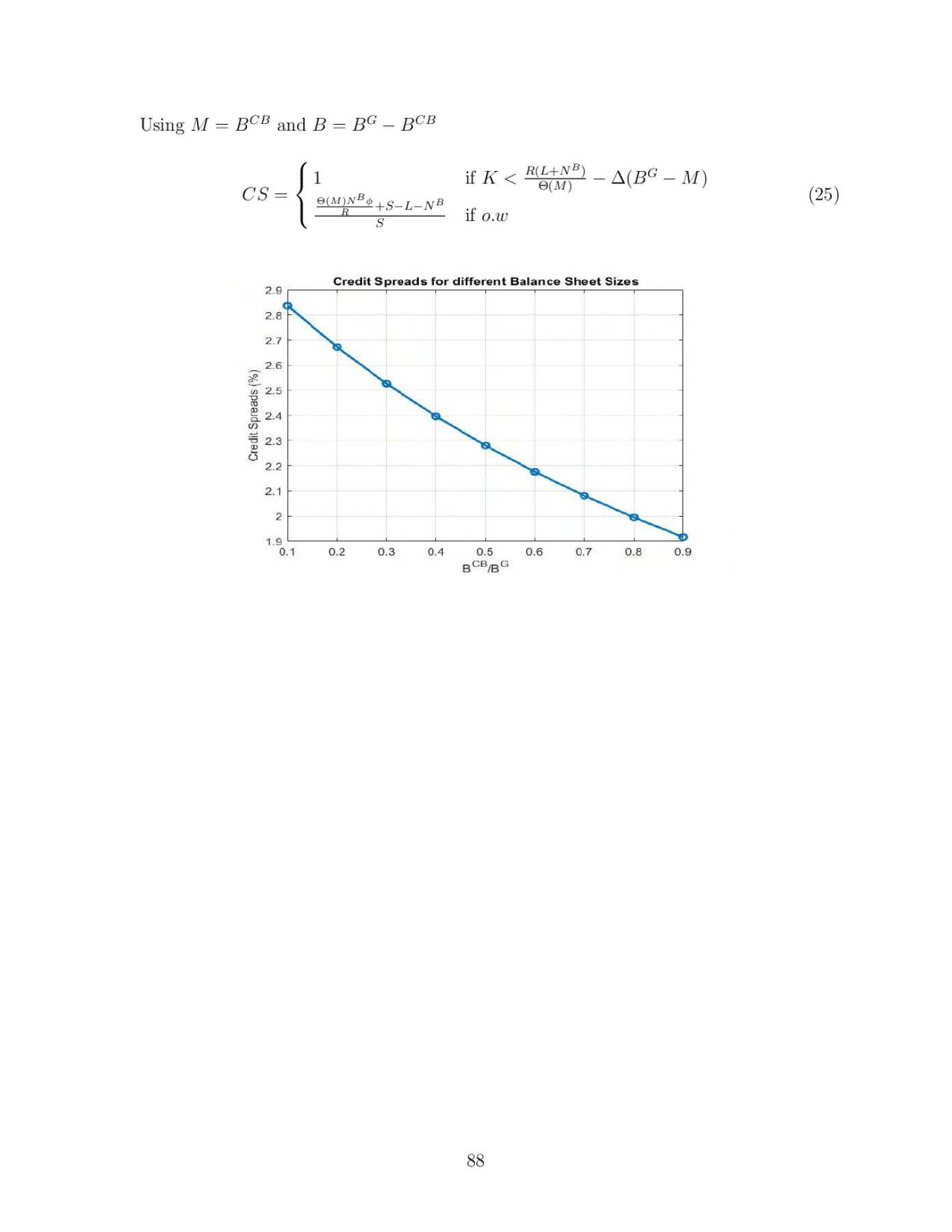

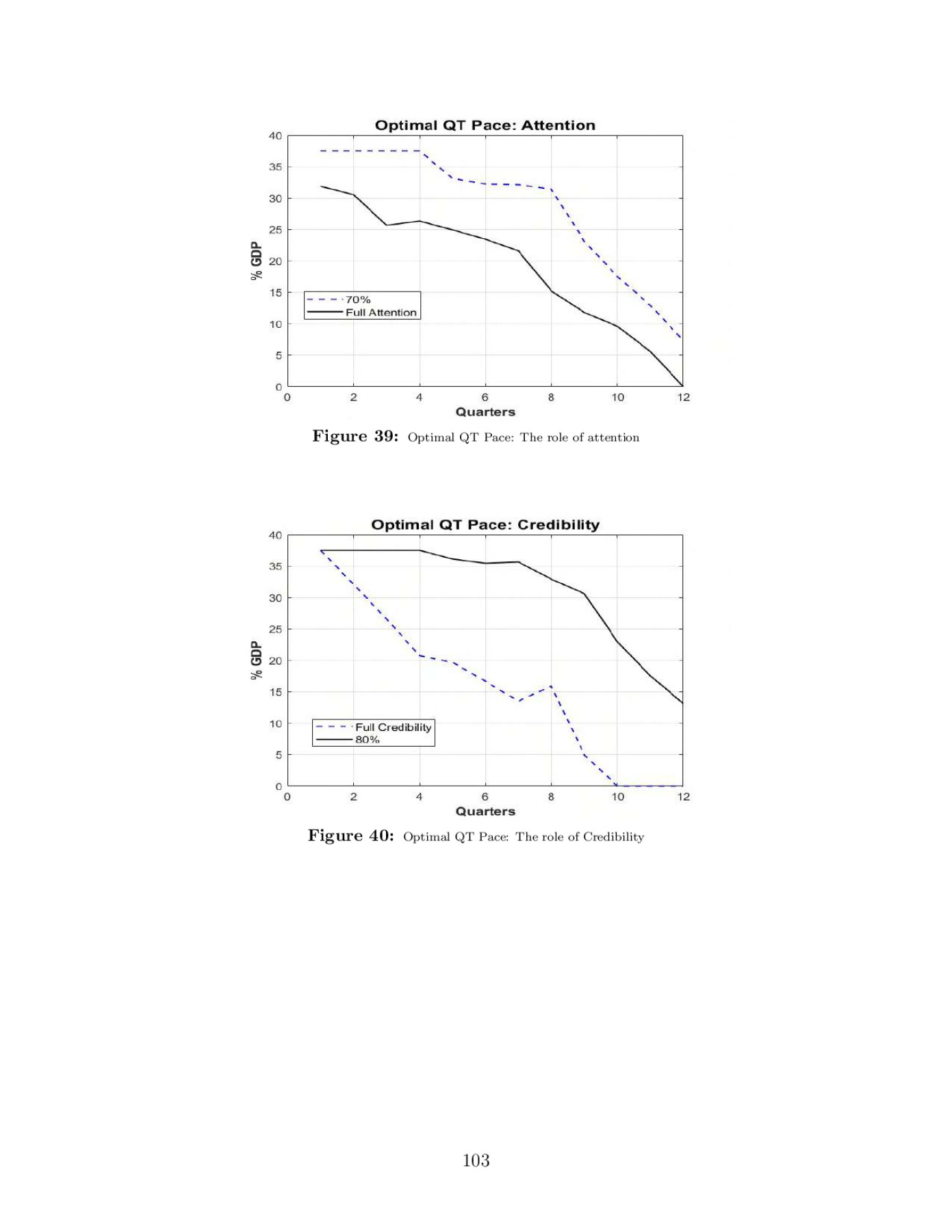

Do the pace, timing and announcement of balance sheet unwinding matter? This paper investigates the implications of various Quantitative Tightening strategies, examining both implementation and announcement effects. We focus on the consequences for financial stability and real variables, particularly the impact of reintroducing government bonds to the market, the role of reserves demand and balance sheet costs of financial intermediaries during the unwinding process. We also explore the dynamics associated with announcement effects. We present empirical evidence on the effects of QT on financial variables and develop a quantitative model with a banking sector to understand the dynamics of different QT strategies. We explore optimality and compare cases of commitment and discretion, as well as credibility and limited commitment. Our findings indicate that announcing QT with sufficient anticipation yields better macro-financial outcomes. While sales initially have a relatively shortterm stimulative effect due to agents precautionary motives, negative implementation effects eventually arise. Announcing passive unwinding followed by conducting sales leads to lower welfare and higher output volatility. Optimal QE is aggressive and optimal QT is gradual. QT should be more gradual when the maturity of debt is higher and reserves demand is higher. Under the optimal dual policy with commitment, the output gap closes and fully stabilizes 12 quarters earlier than observed in the data.

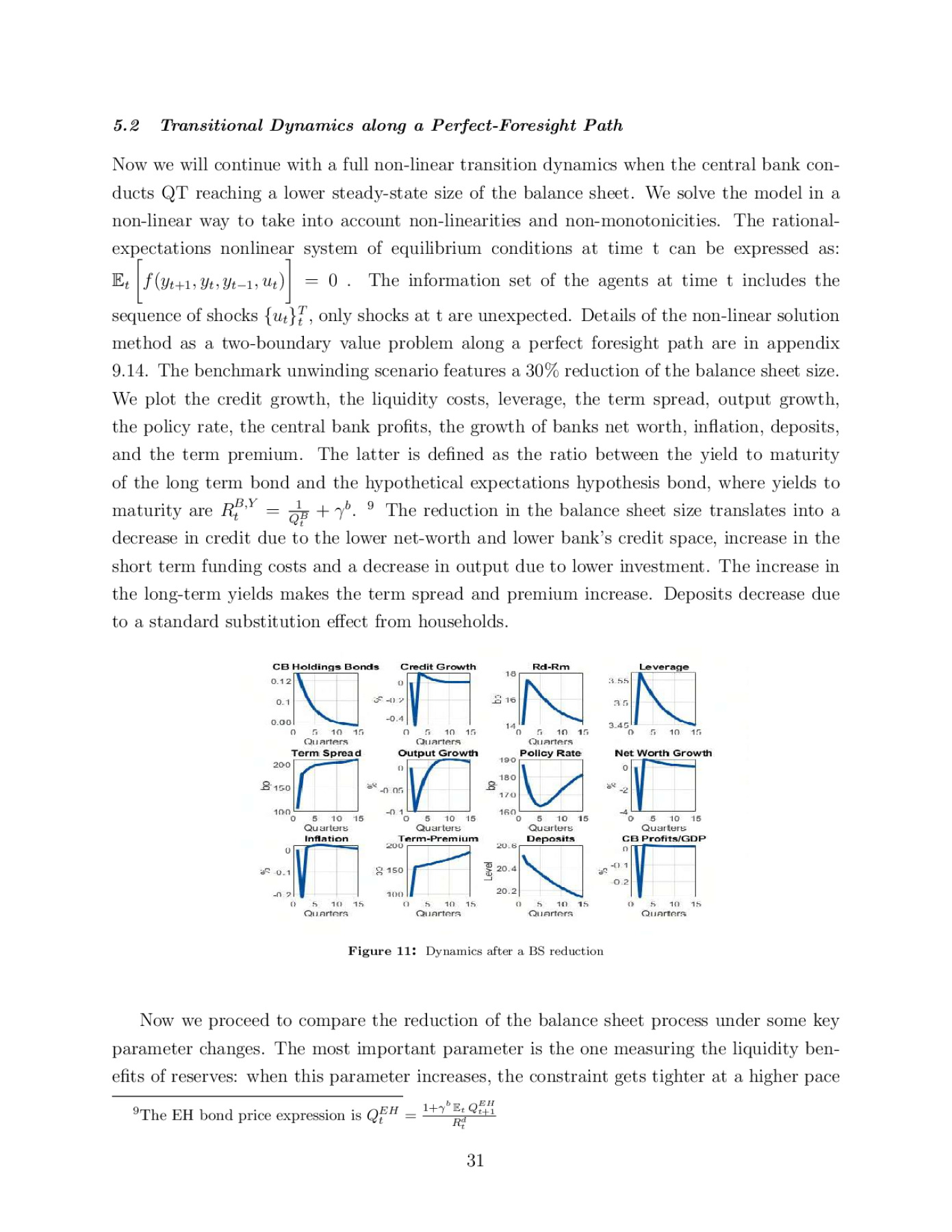

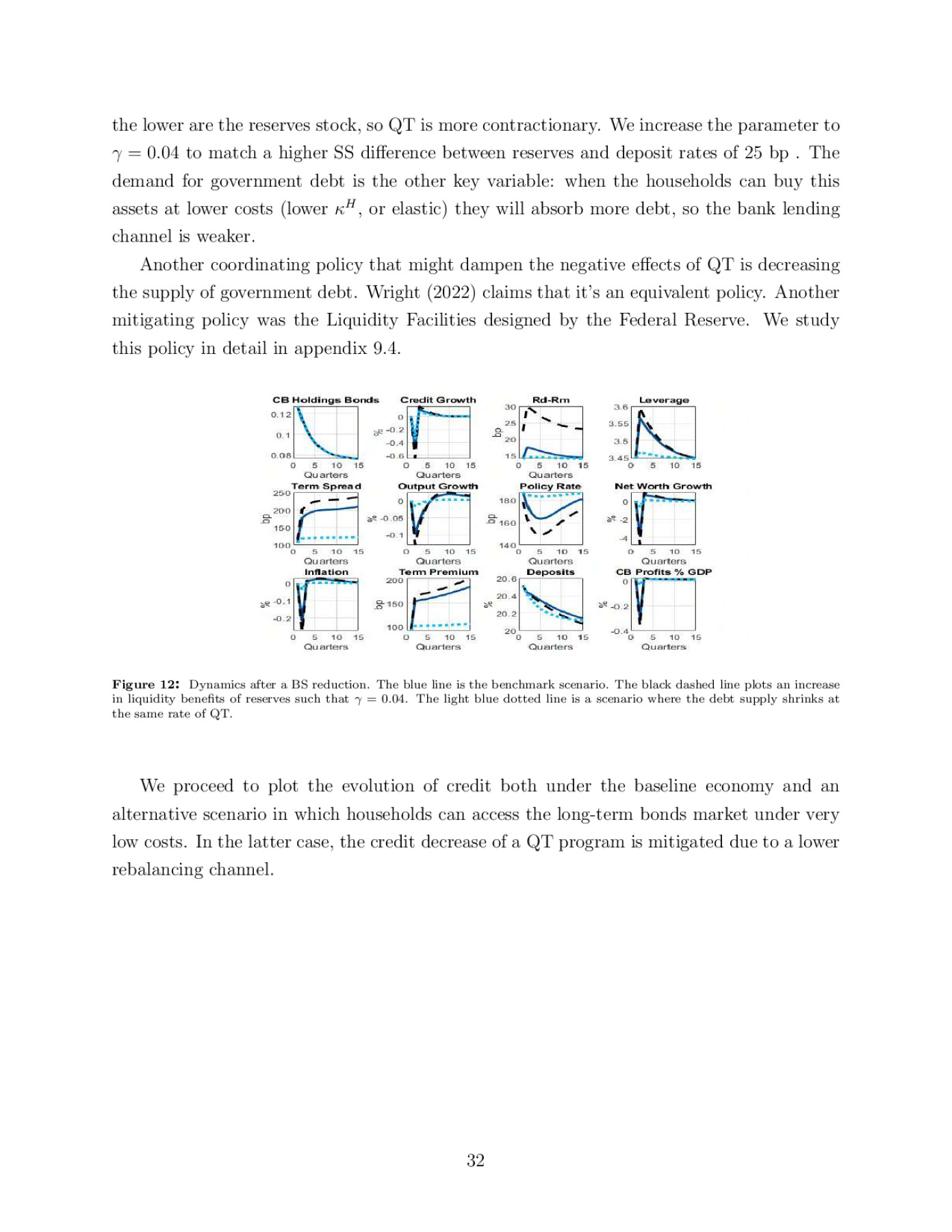

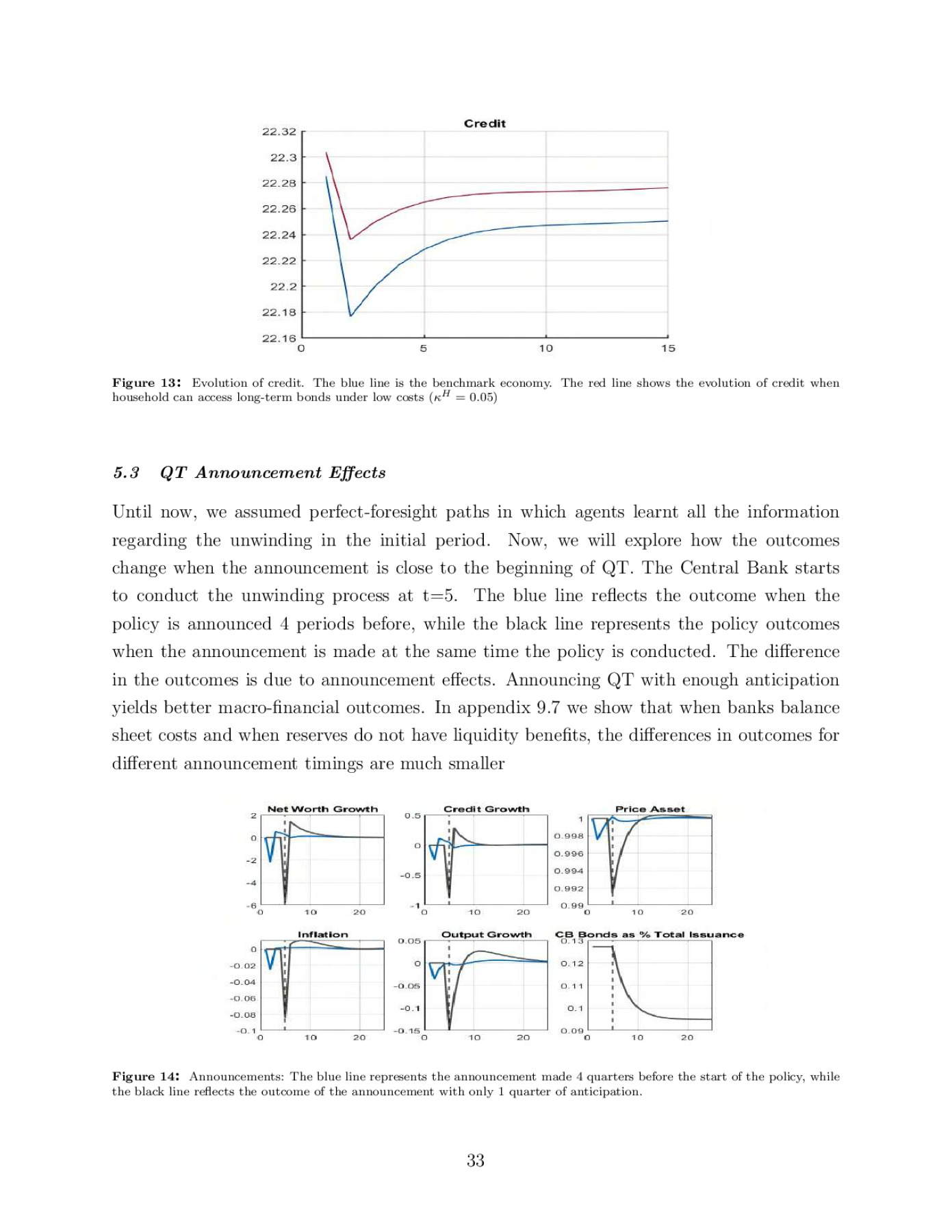

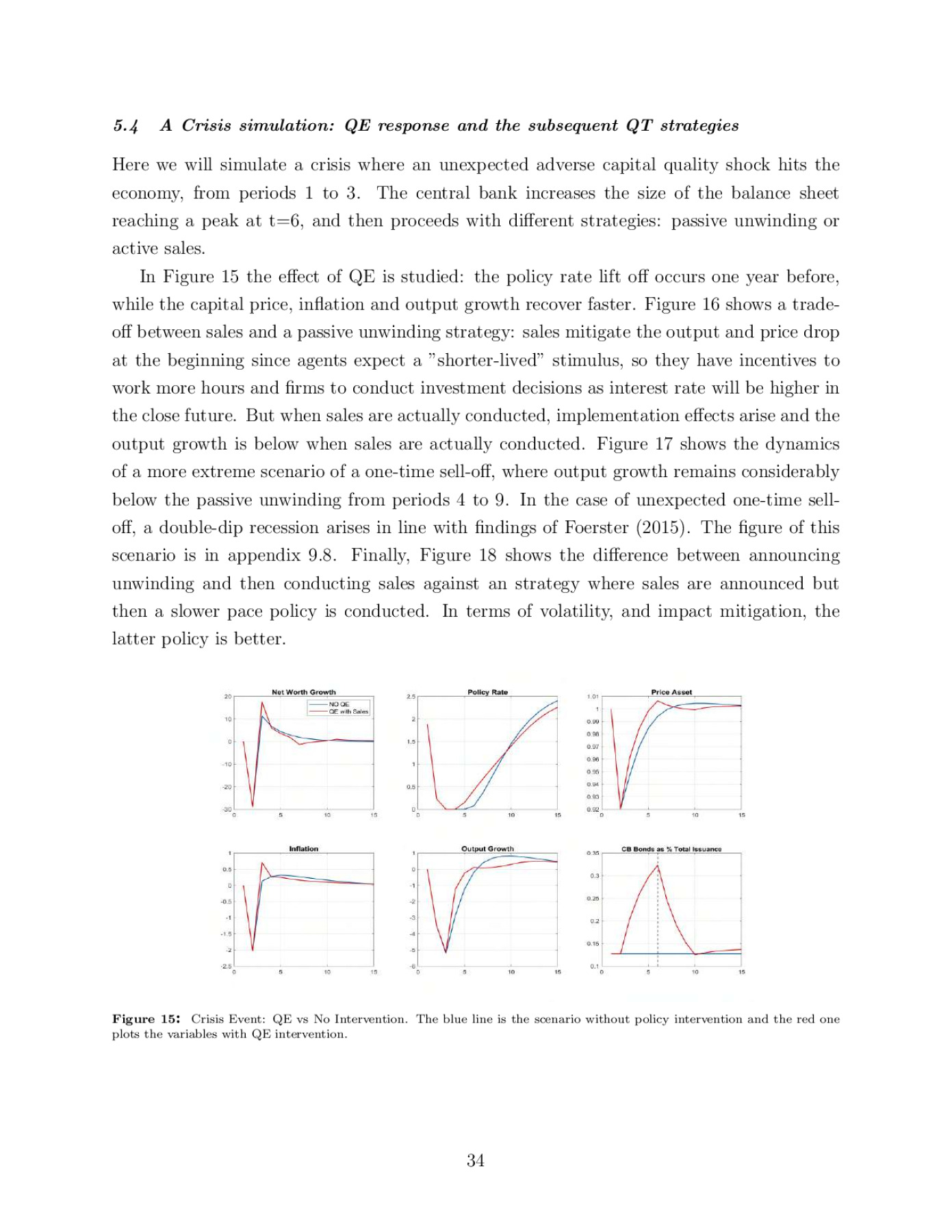

Preview