2024 Australasia Meeting, Melbourne, Australia: December, 2024

Market Dynamics of Risk-On and Risk-Off Incentives and their Effect on Asset Prices

Idan Hodor

Mutual fund asset managers’ incentives contracts are dynamic: initially, there is a drive to outperform the index. However, as performance improves, the focus shifts from outperforming to maintaining performance.

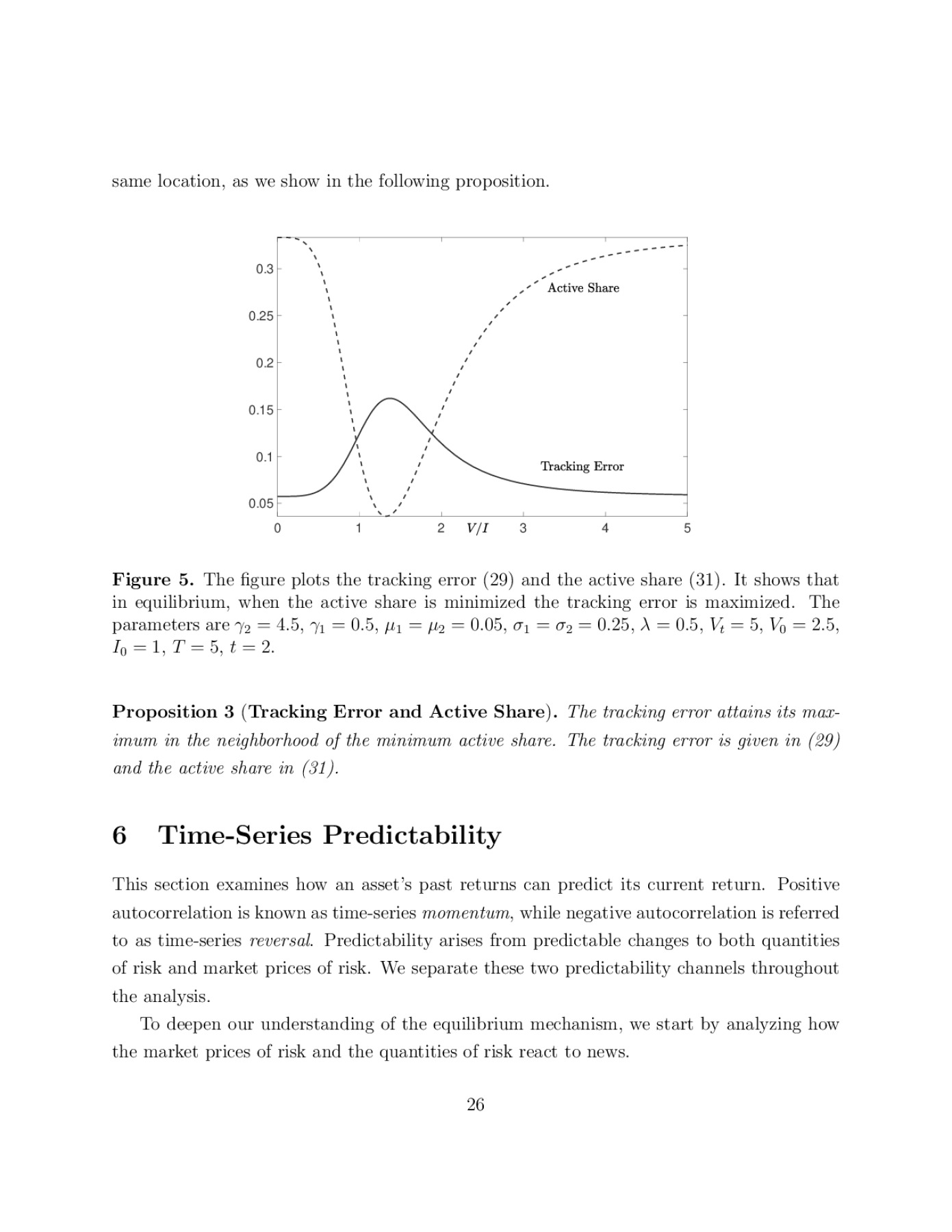

In equilibrium, expressed in closed form, the active share exhibits a U-shape, and the tracking error an inverted U-shape with the active share at its minimum and tracking error at its maximum when performance equals the benchmark.

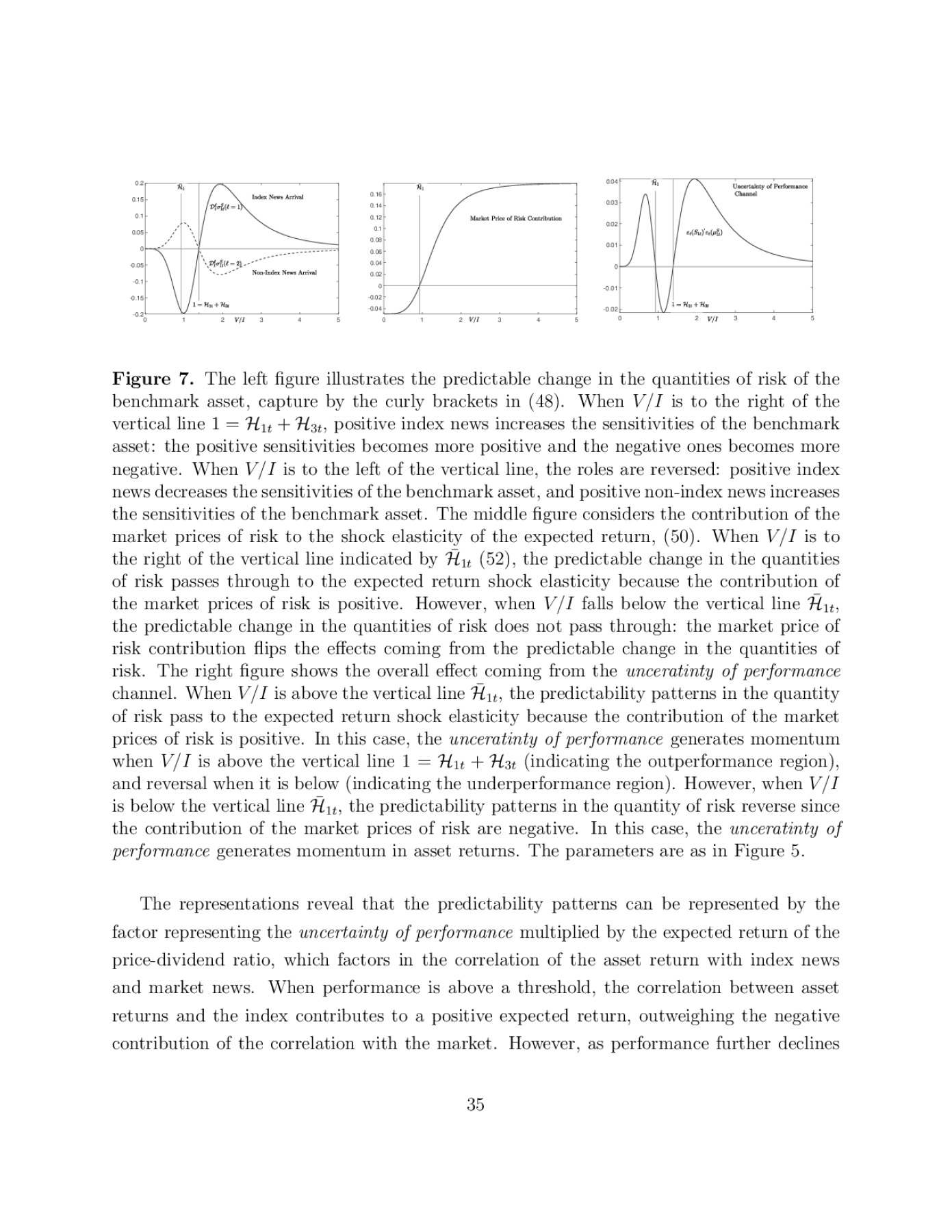

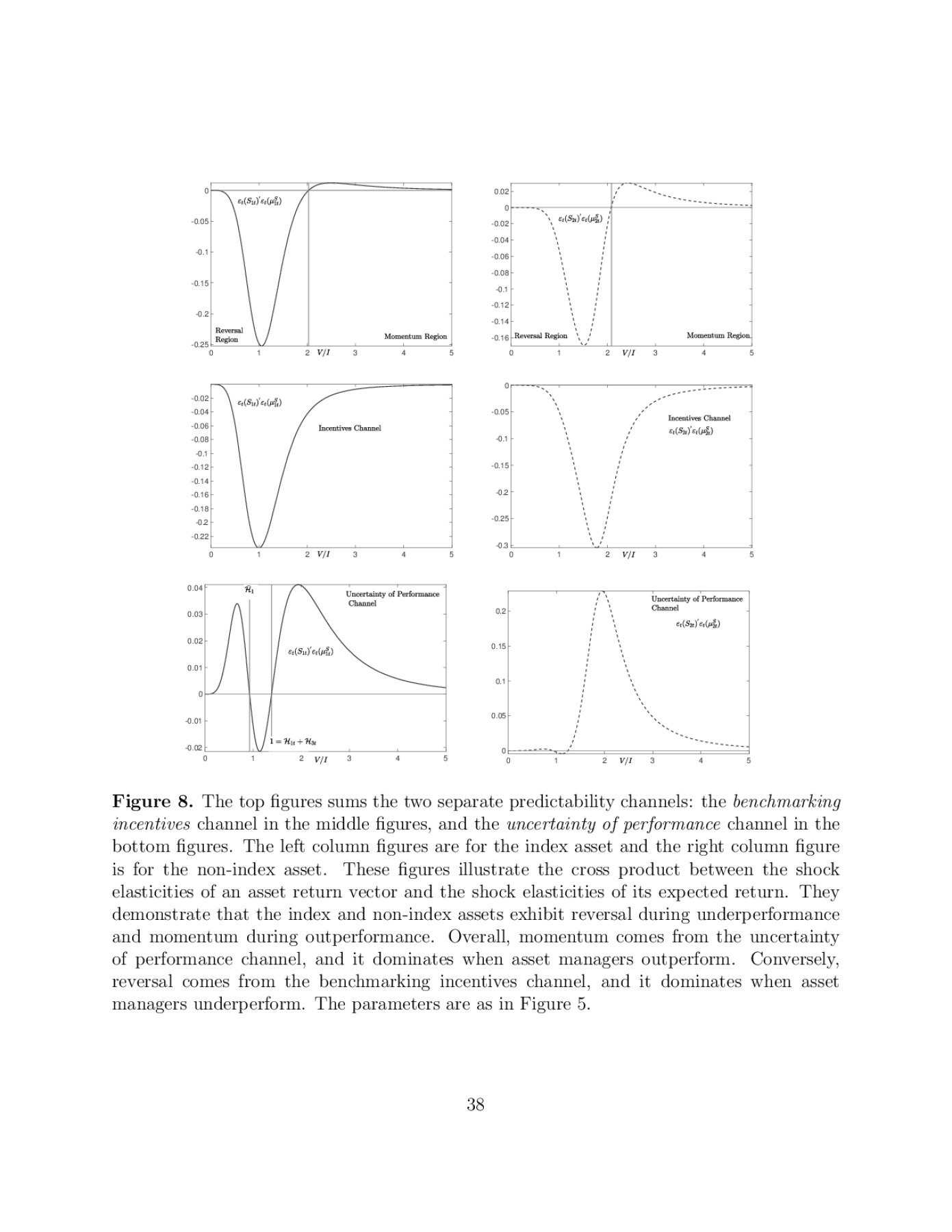

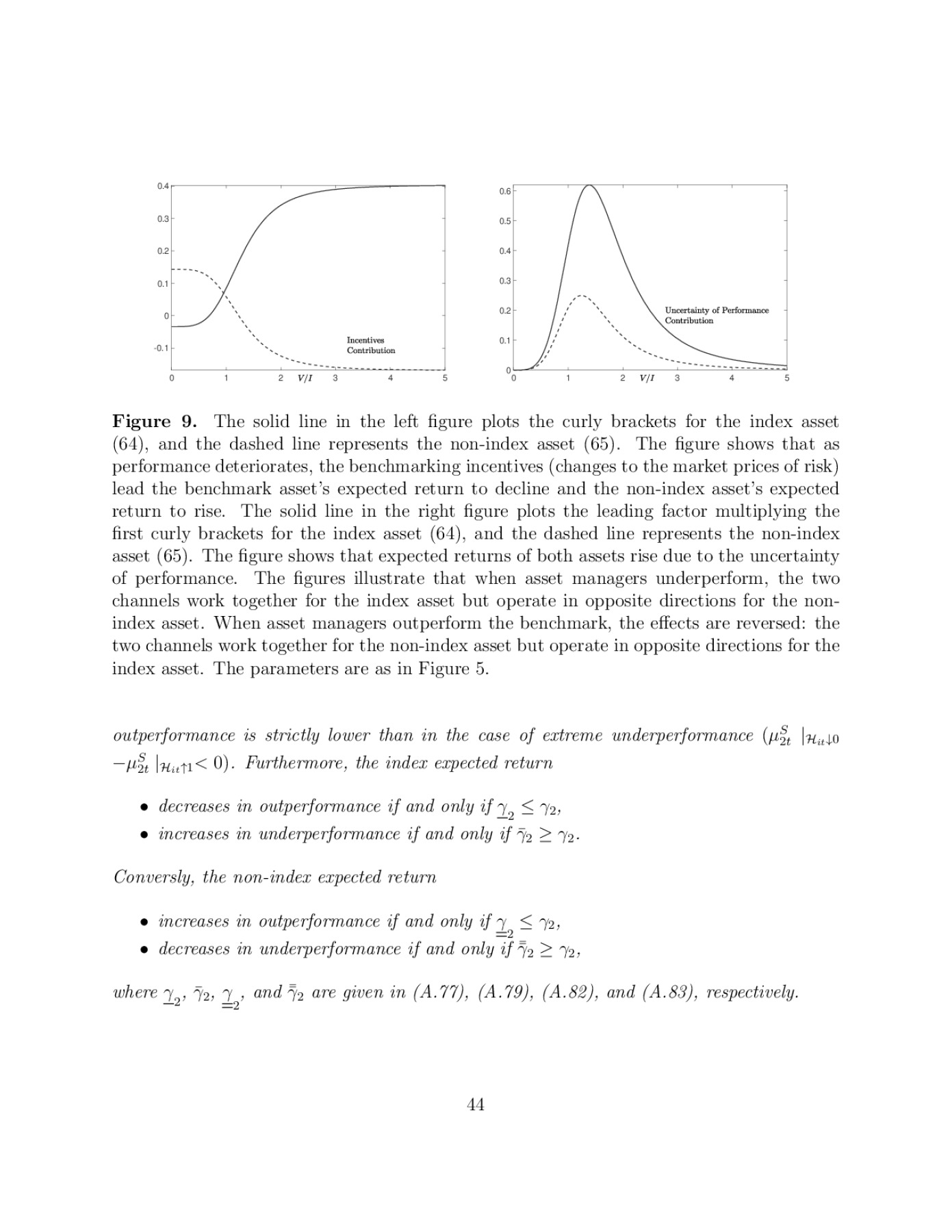

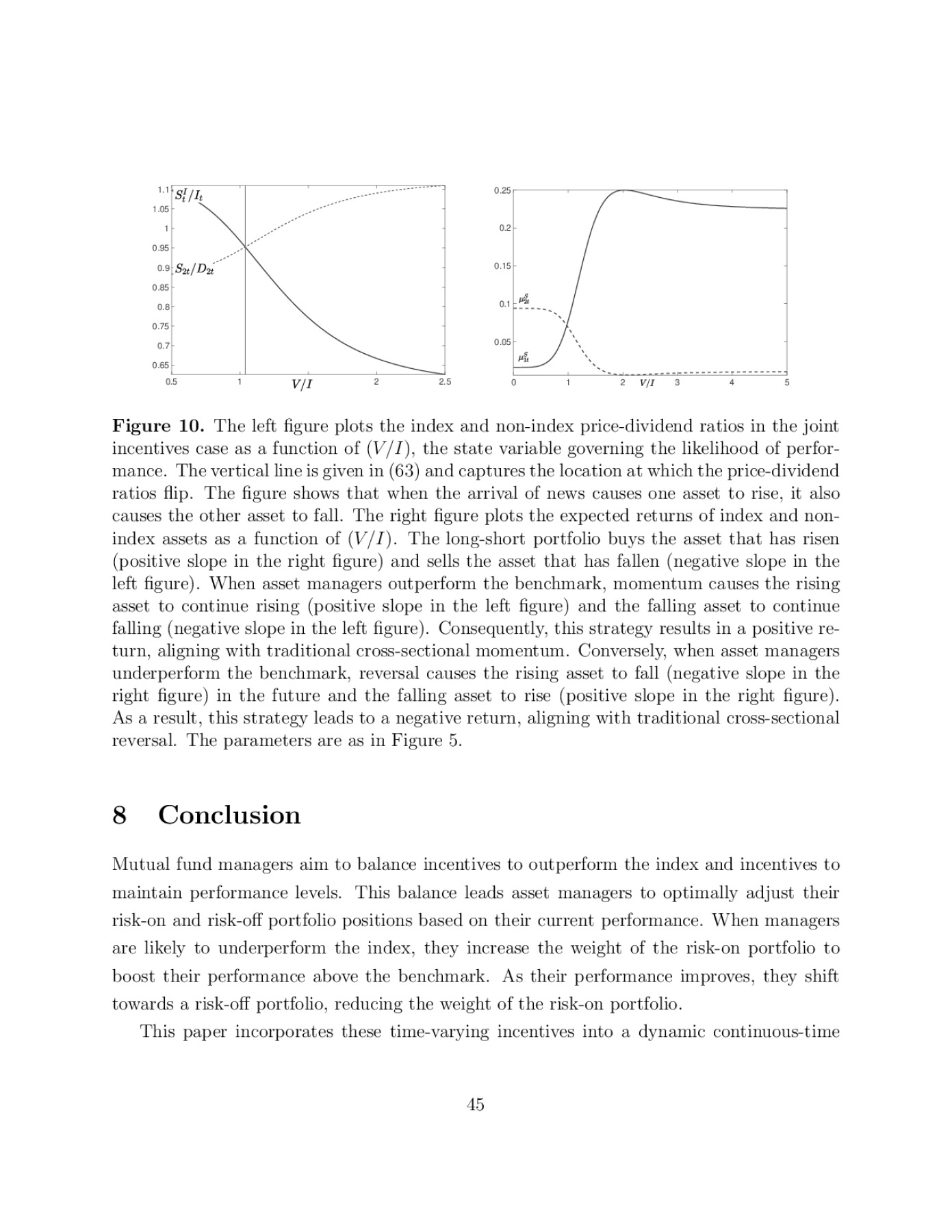

Equilibrium response to frictions introduces two predictability channels due to changes in incentives and performance uncertainty. These two channels lead to momentum in outperformance and reversal in underperformance, both in the time-series and cross-section.

In equilibrium, expressed in closed form, the active share exhibits a U-shape, and the tracking error an inverted U-shape with the active share at its minimum and tracking error at its maximum when performance equals the benchmark.

Equilibrium response to frictions introduces two predictability channels due to changes in incentives and performance uncertainty. These two channels lead to momentum in outperformance and reversal in underperformance, both in the time-series and cross-section.

Preview