2024 North American Summer Meeting: June, 2024

Heterogeneous Banks, Liquidity Risk and the Distribution of Banks' Liquidity

Concetta Gigante

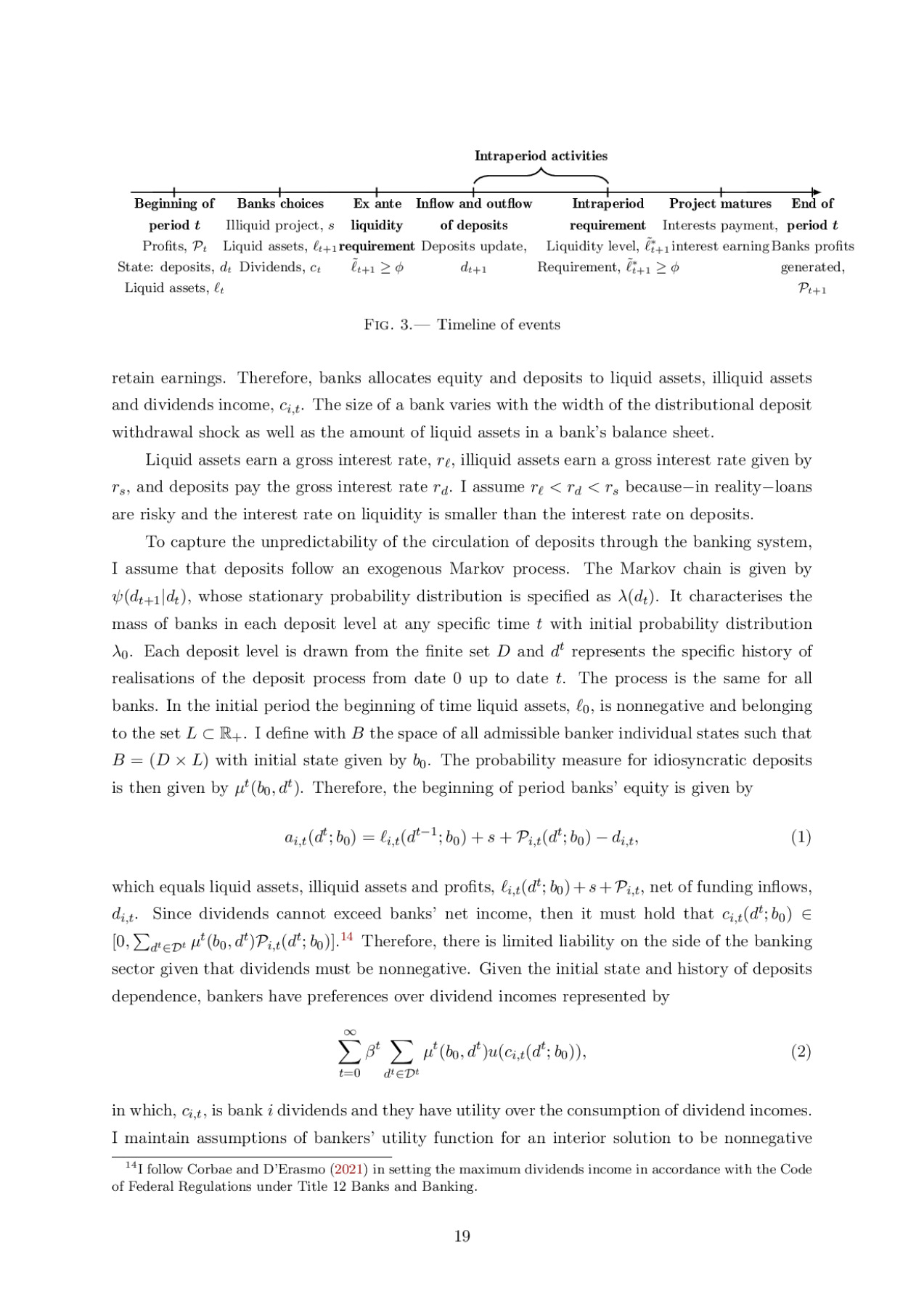

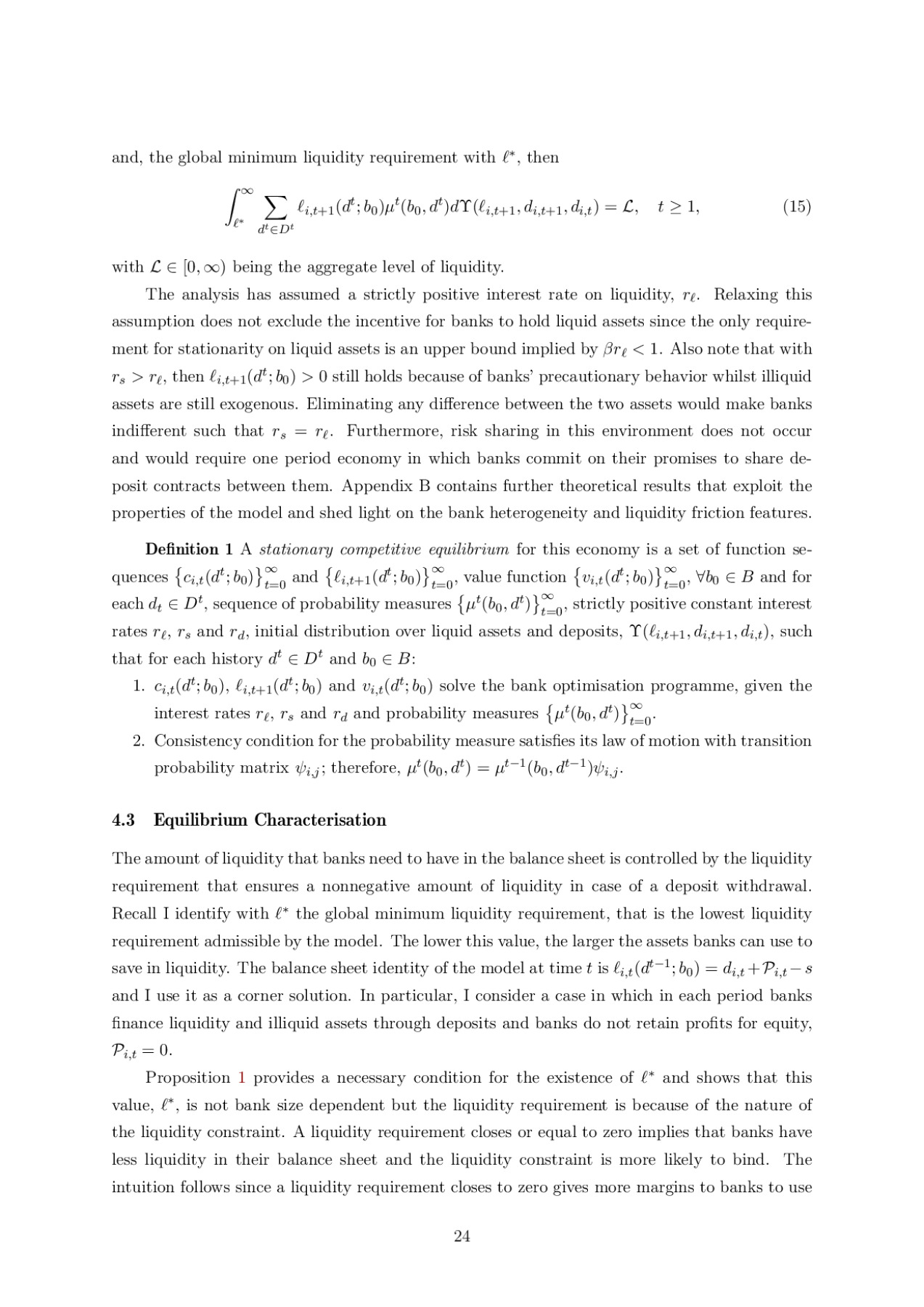

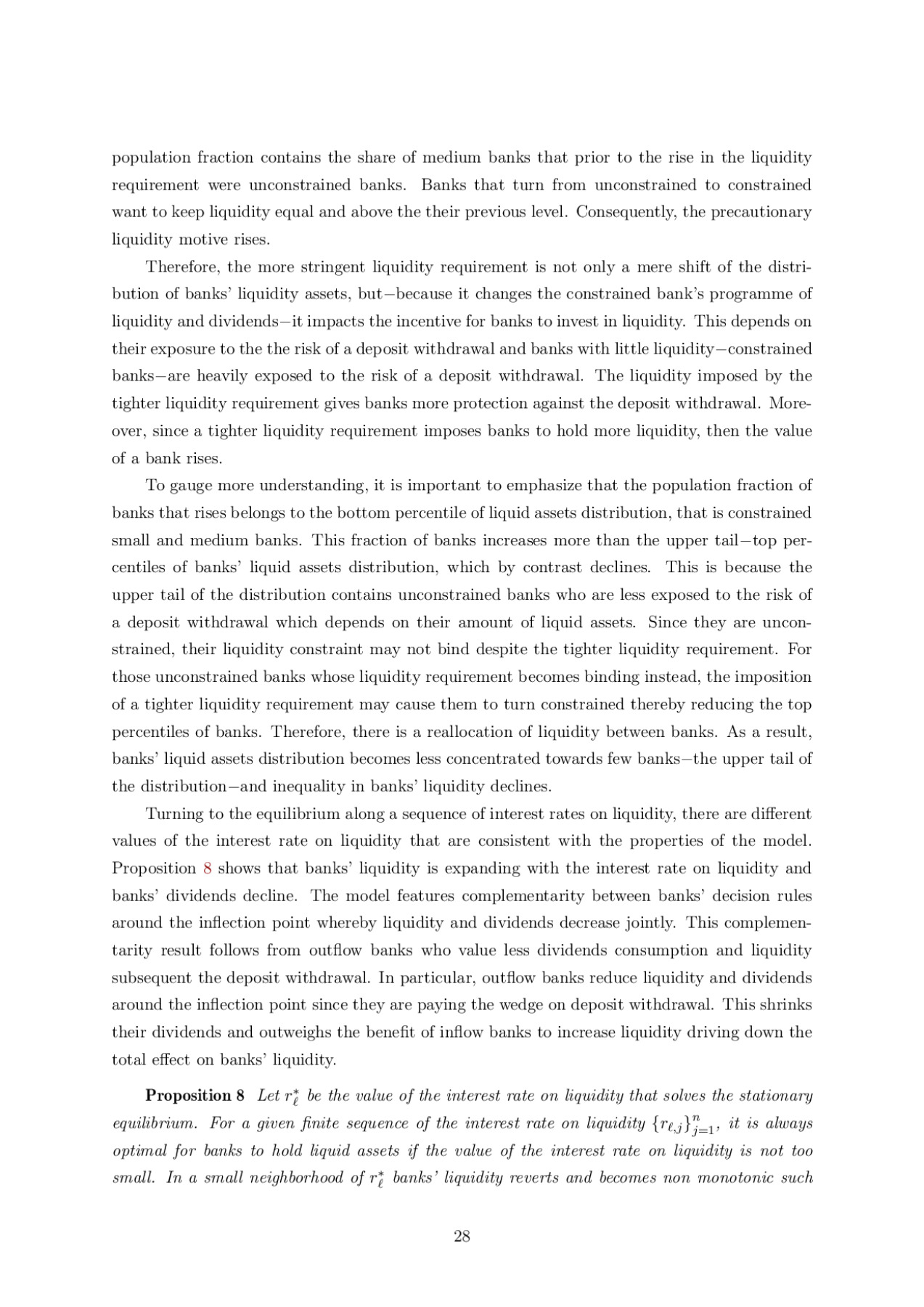

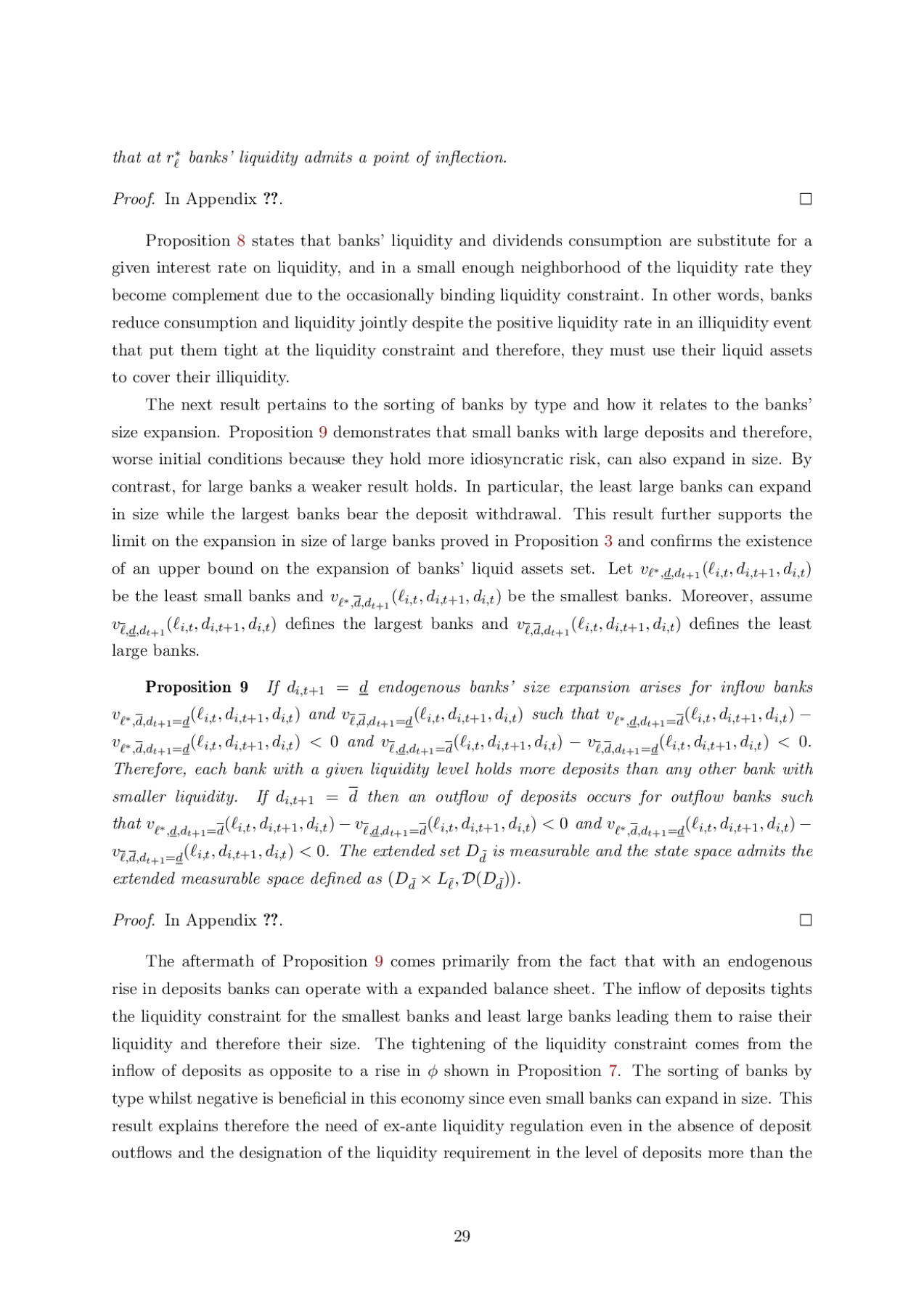

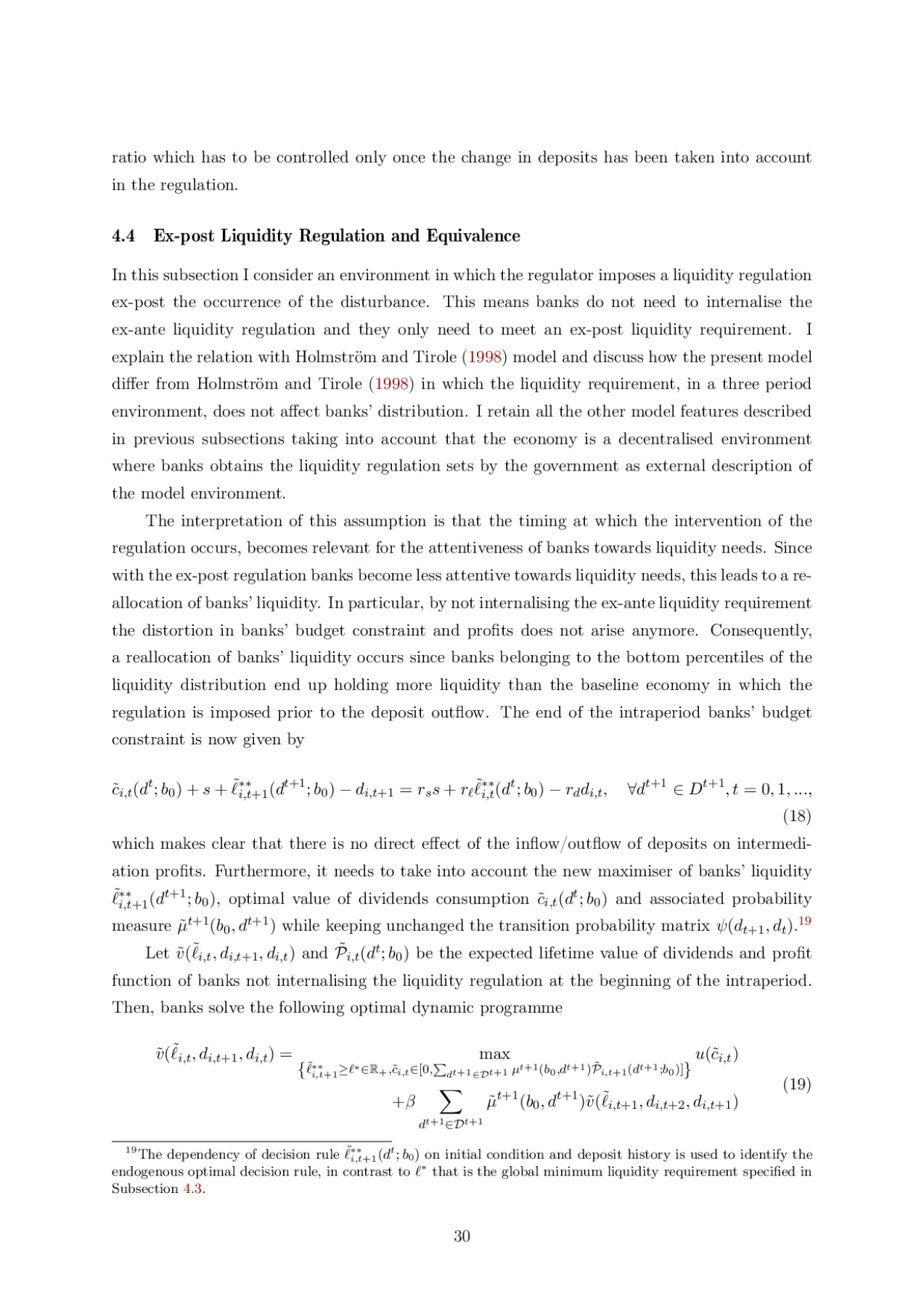

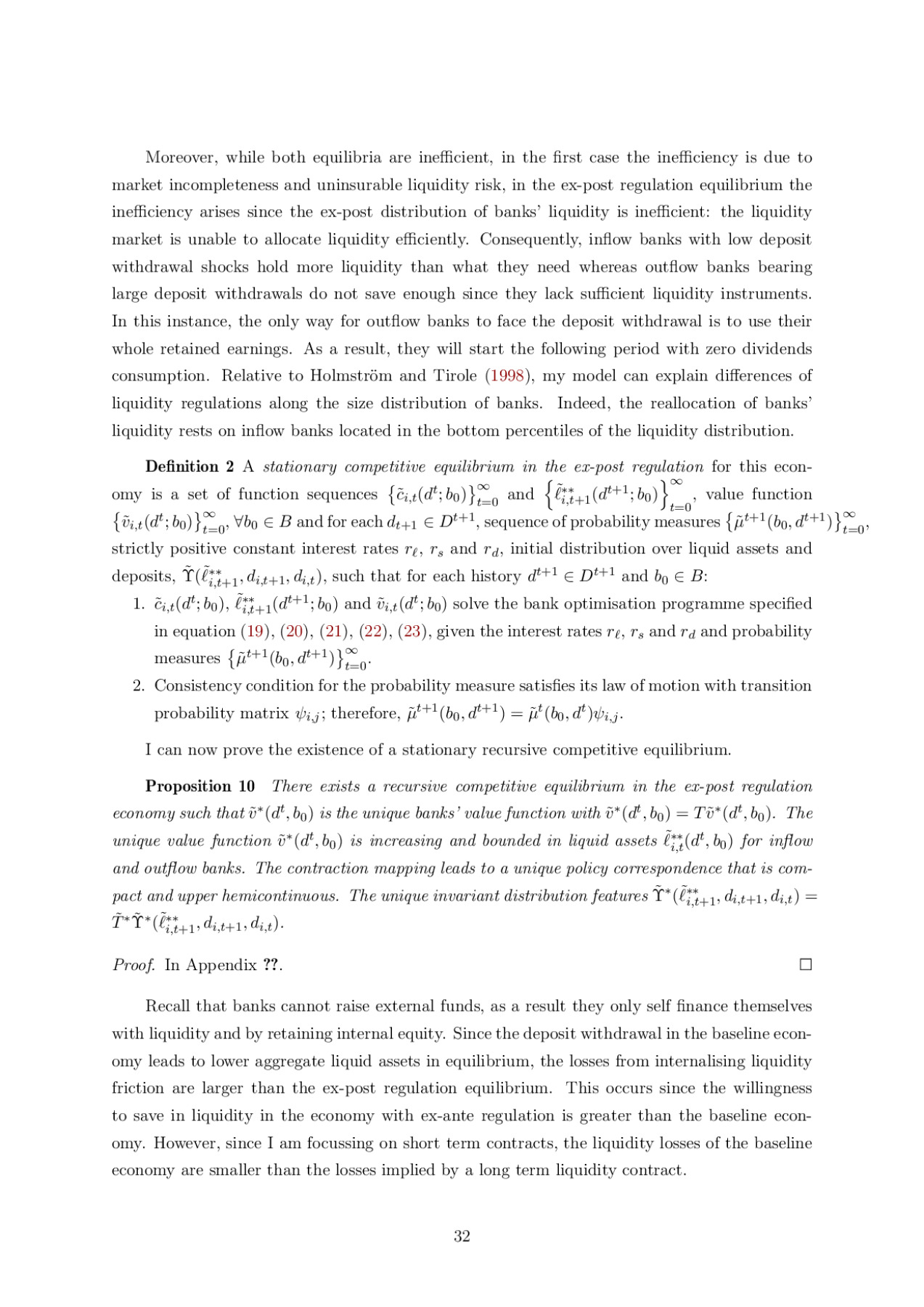

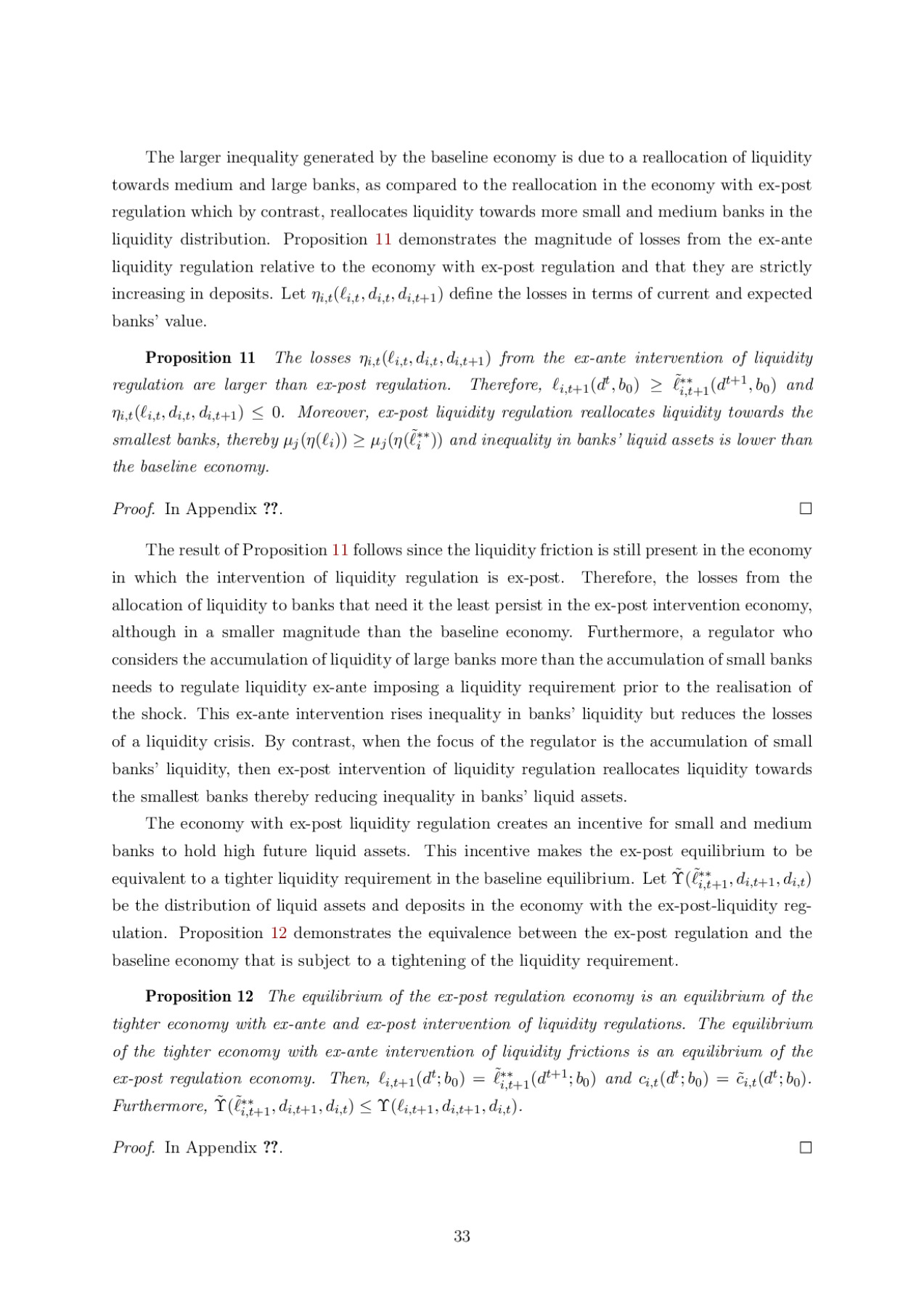

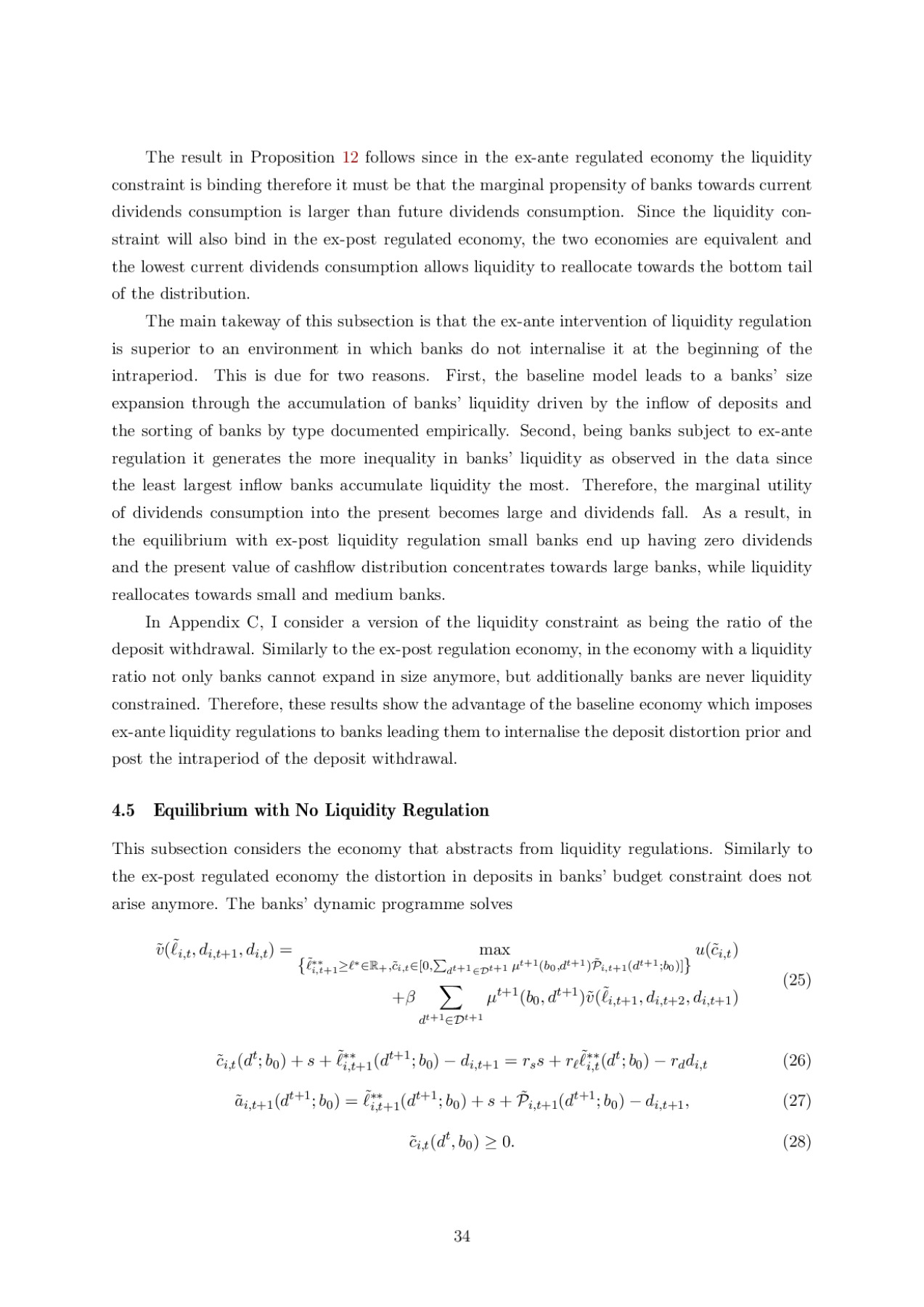

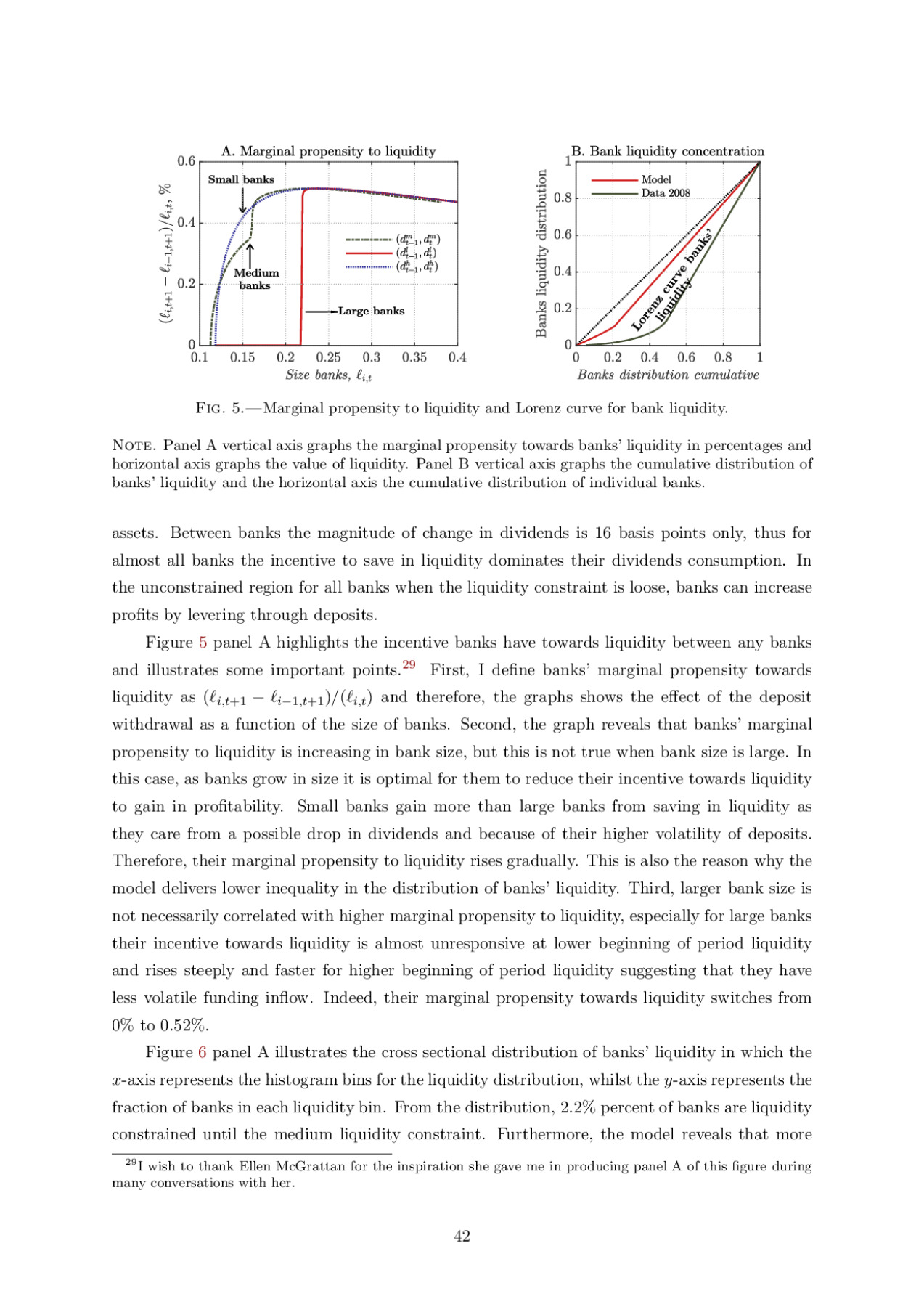

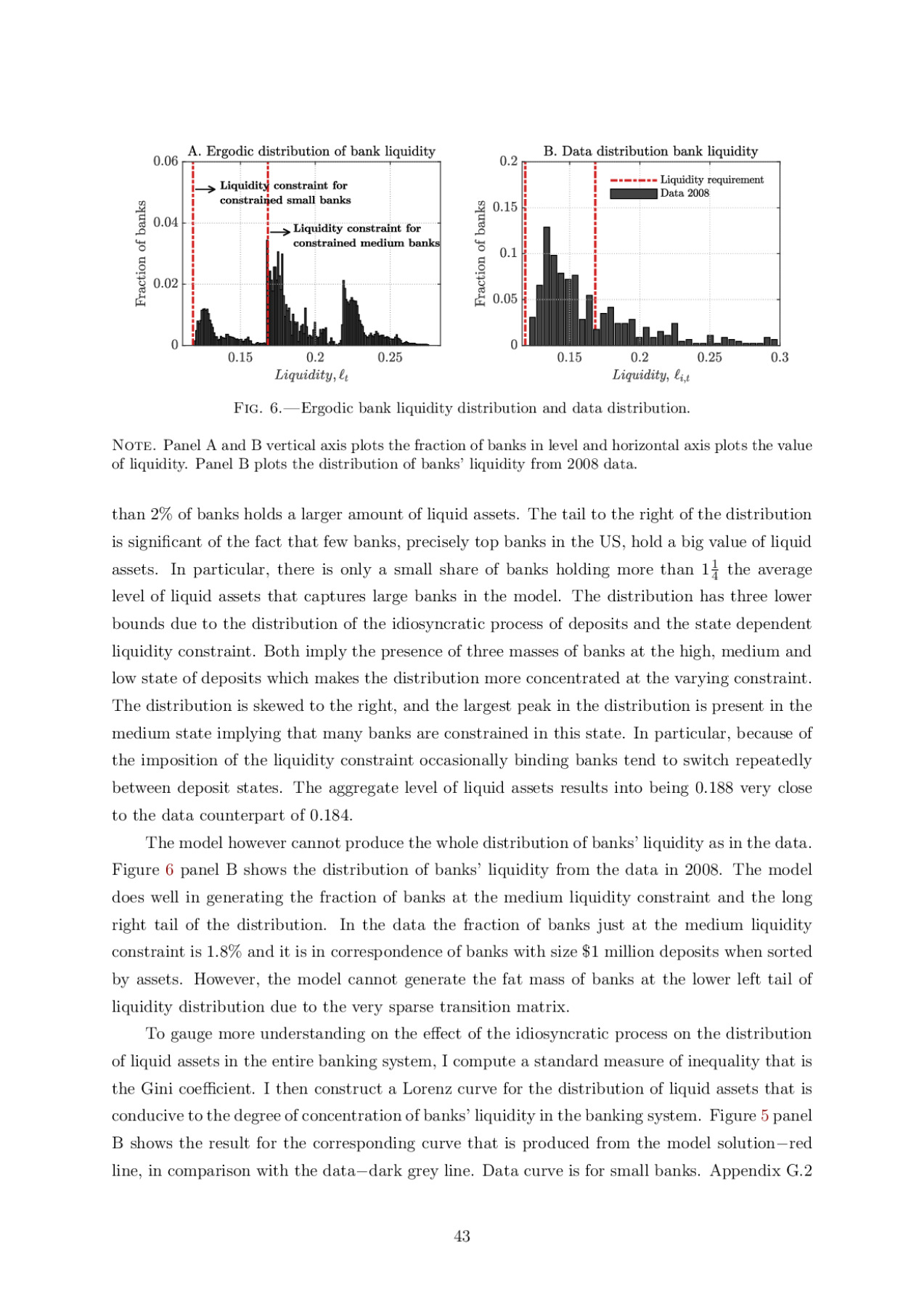

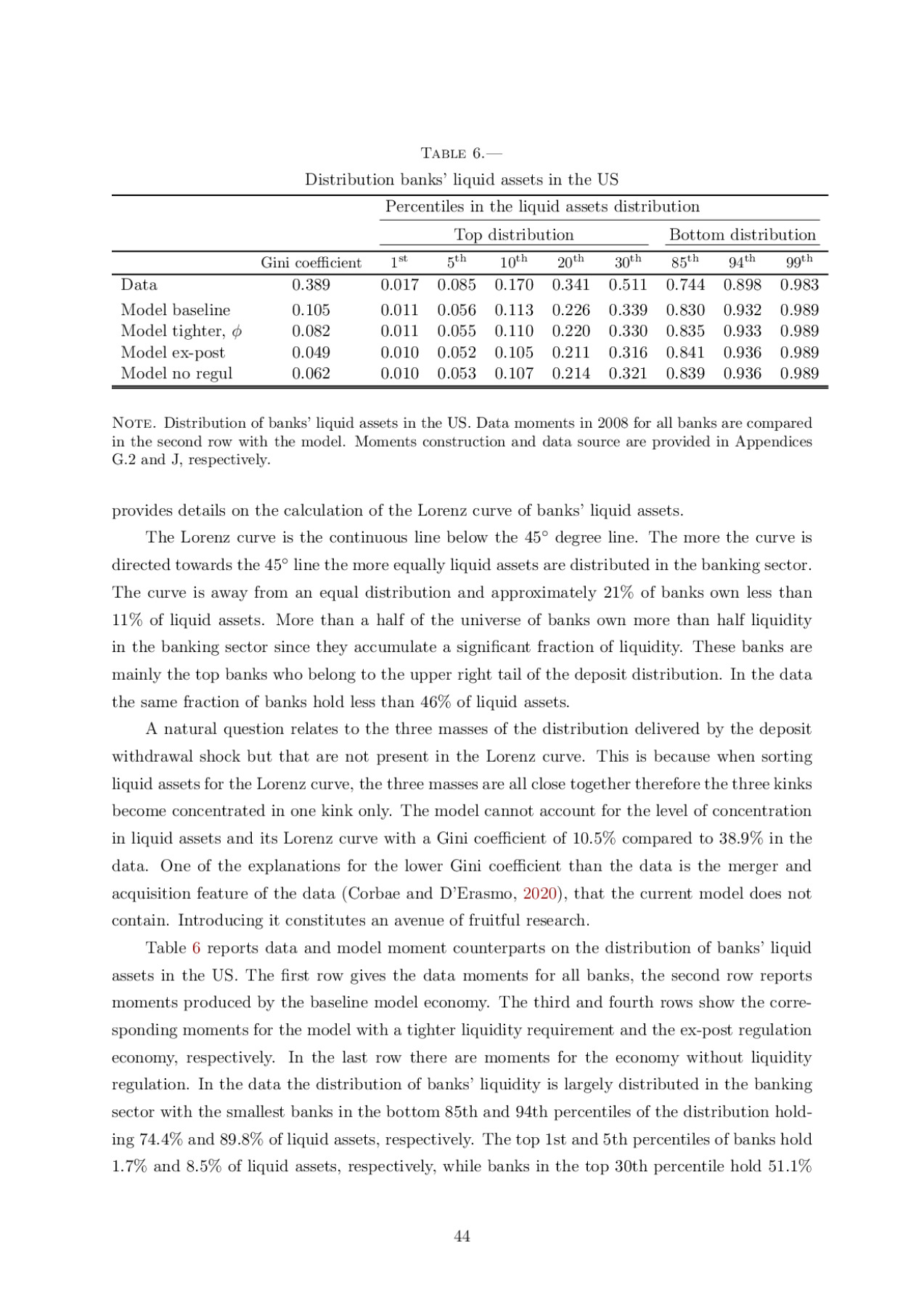

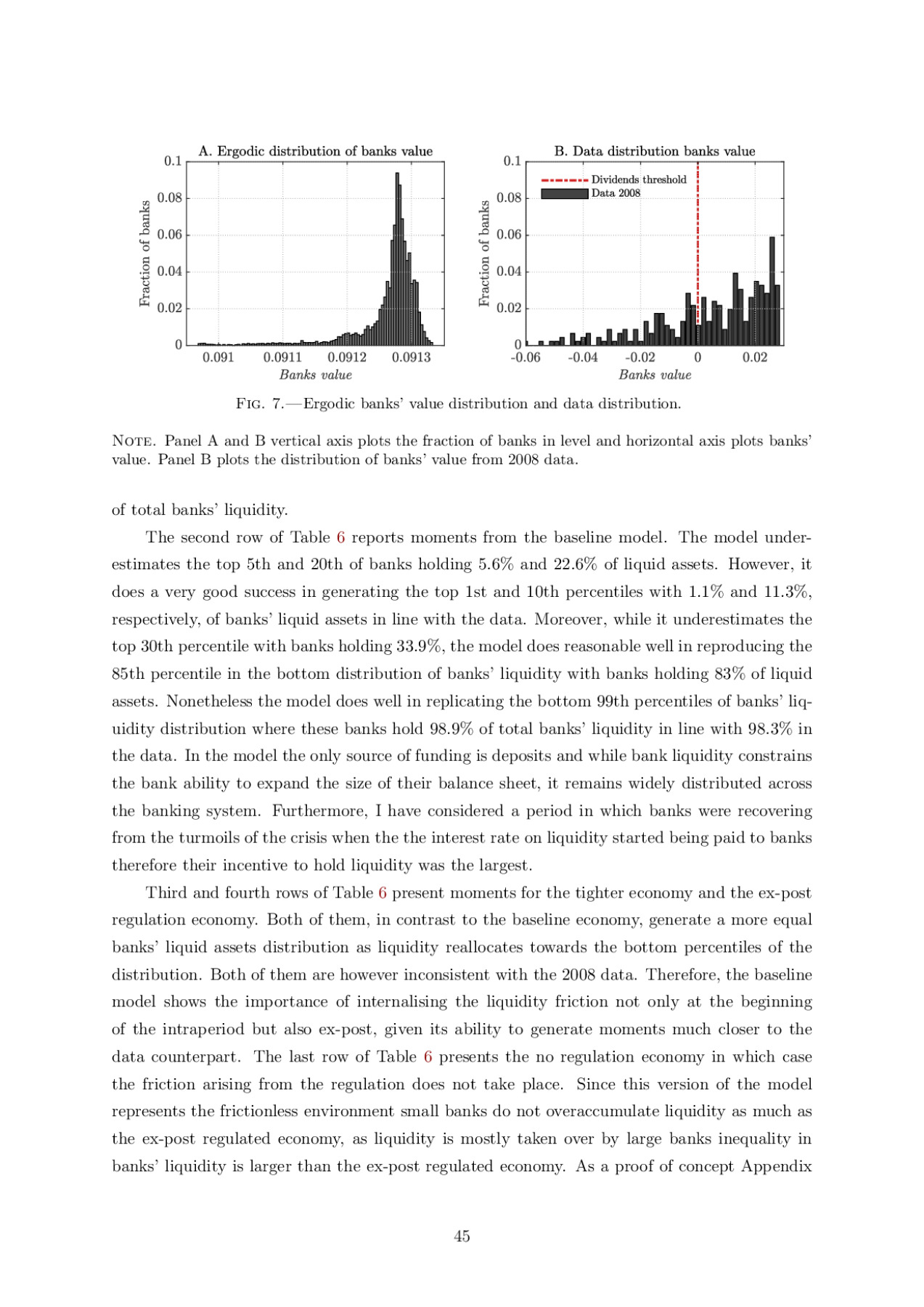

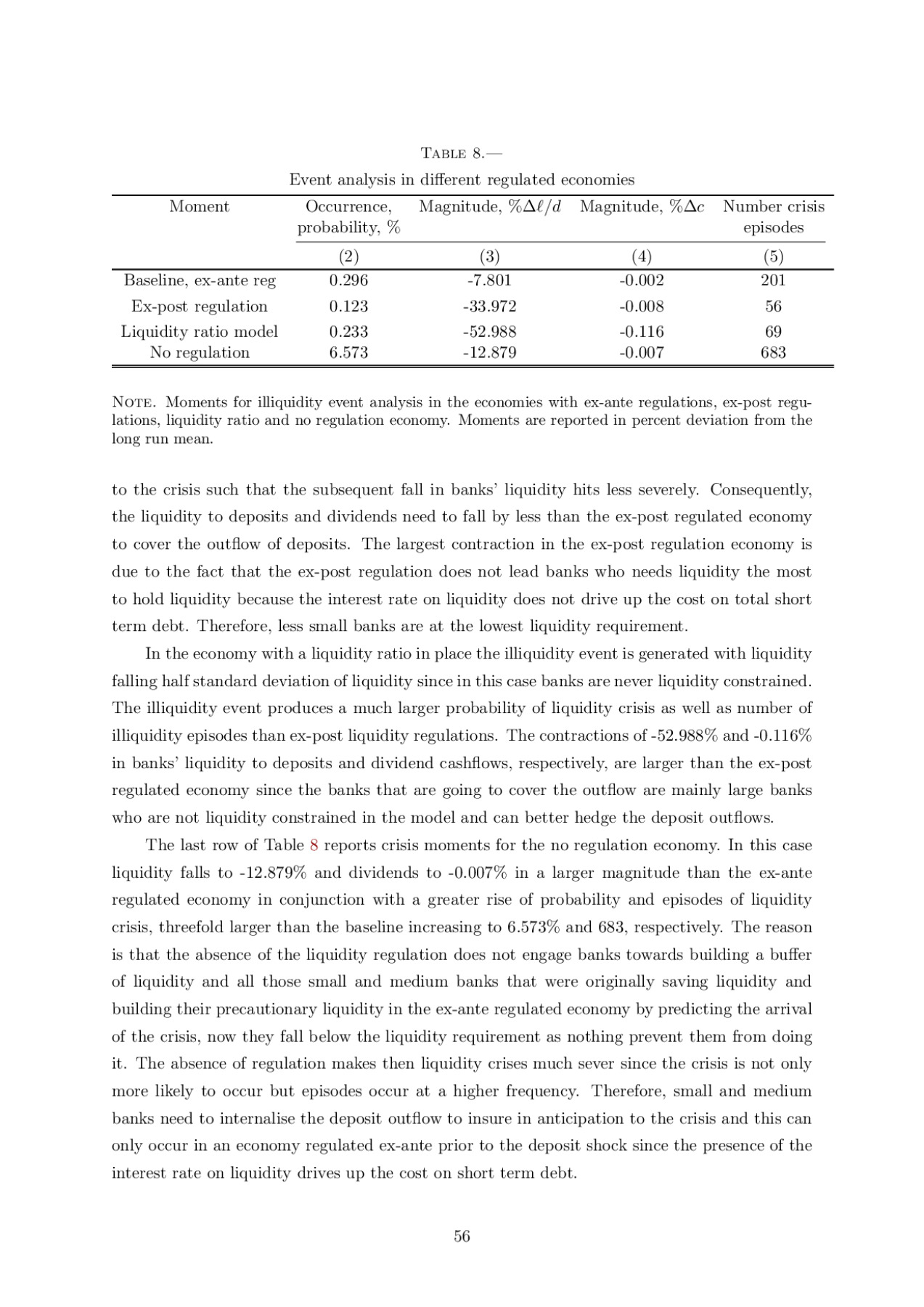

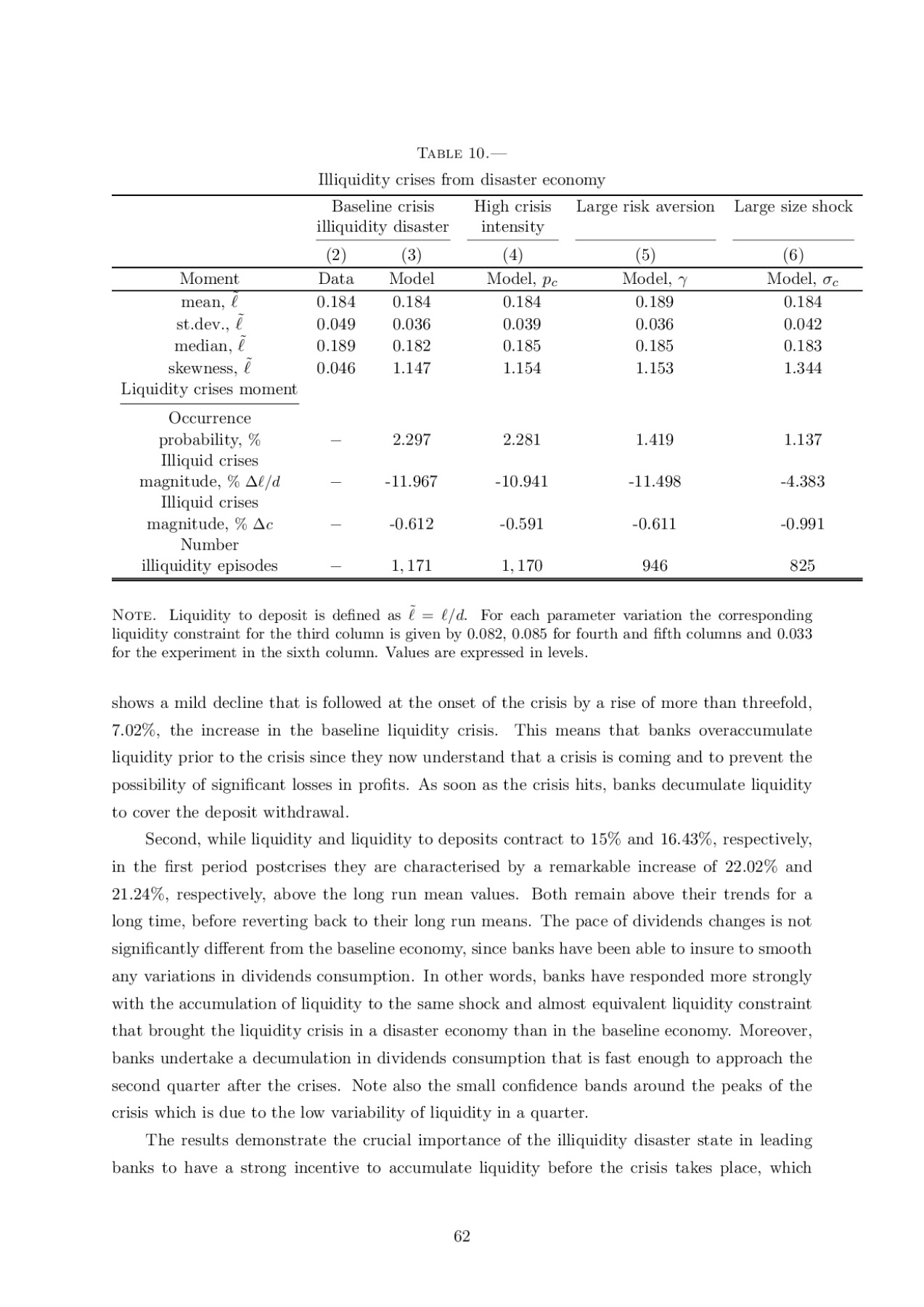

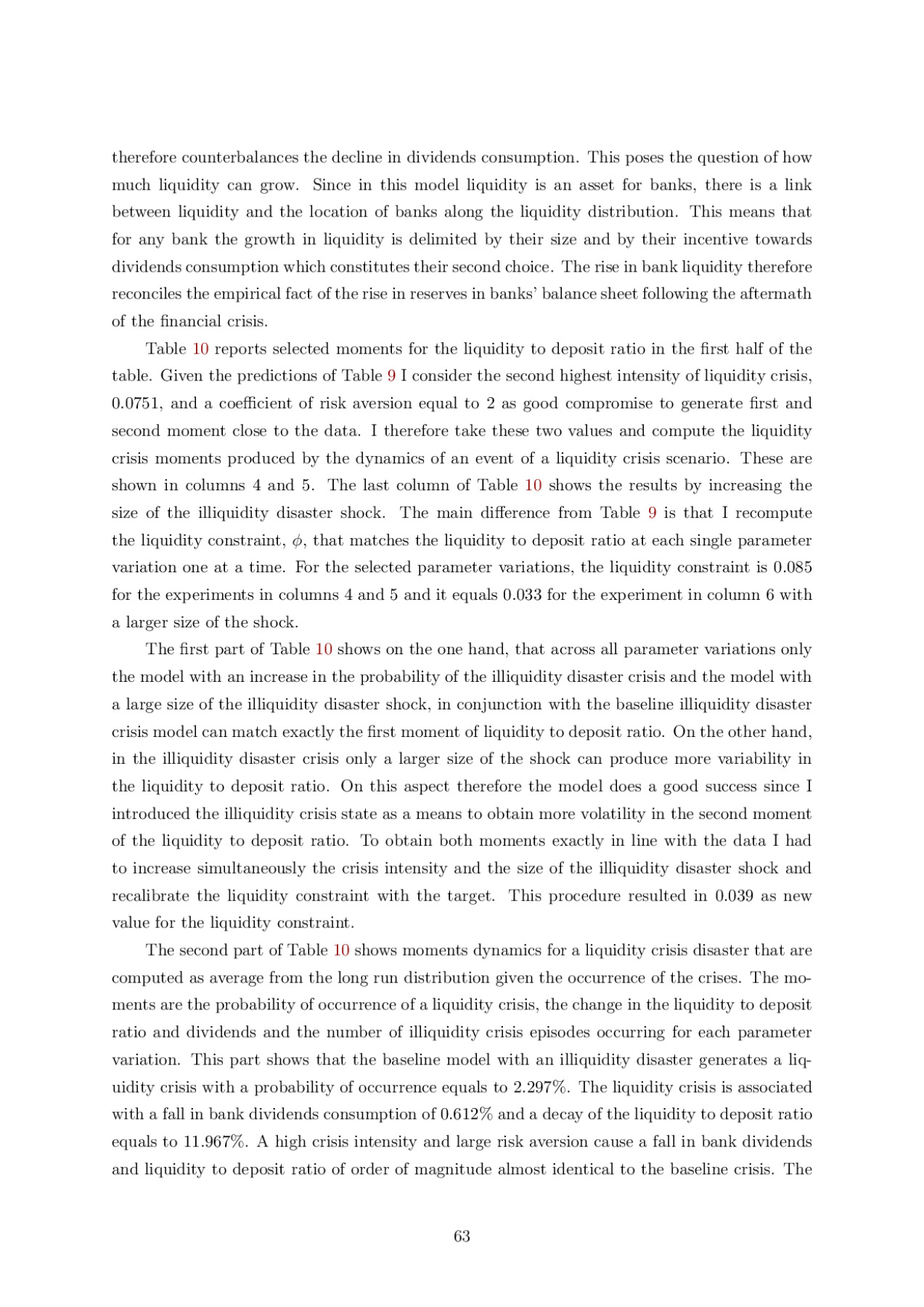

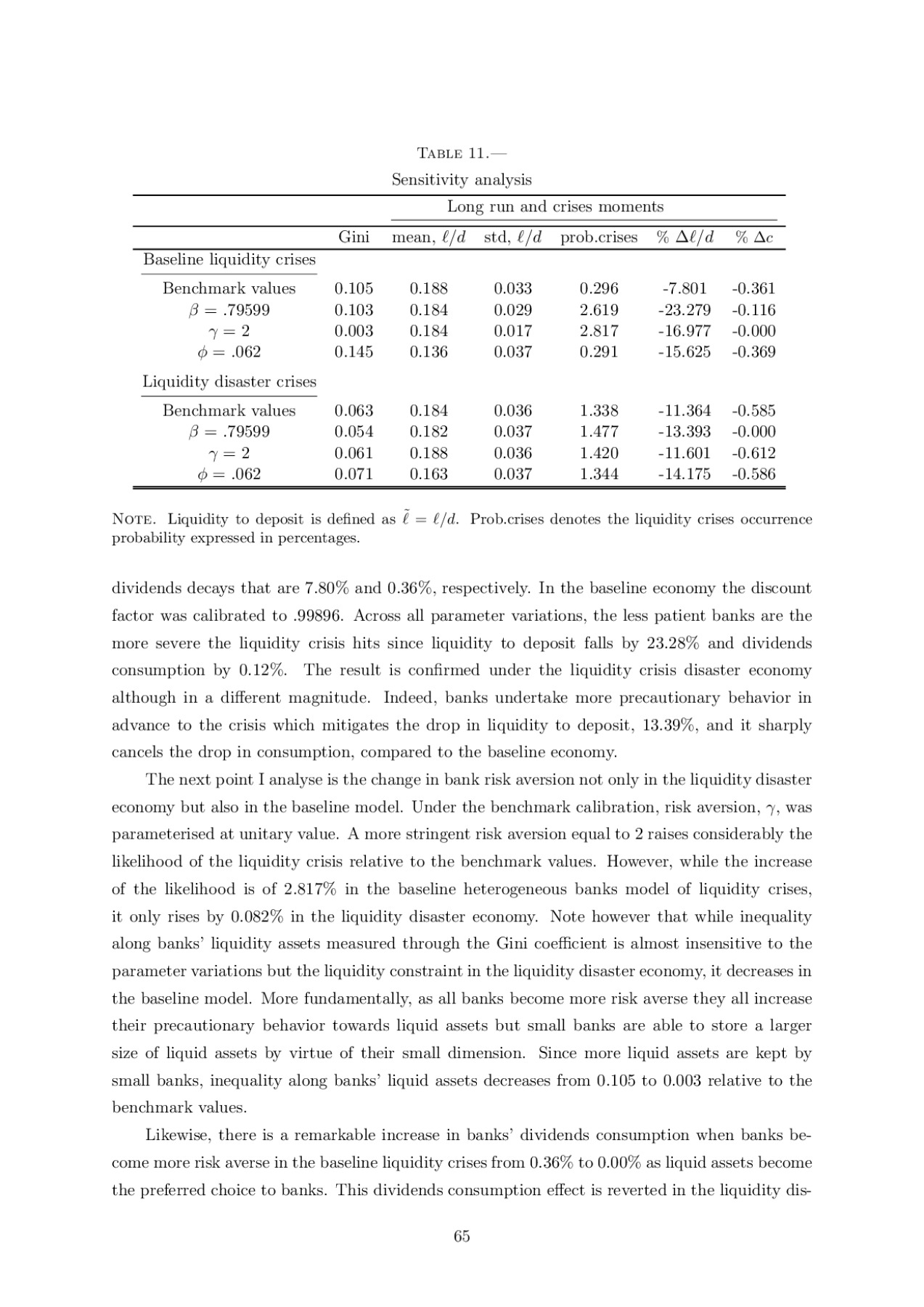

This paper studies banks' size expansion, sorting of banks by type and how banks make decisions by internalising ex-ante and ex-post liquidity regulations. I first propose a theoretical model of heterogeneous banks in an incomplete market economy in which I design liquidity regulations that account for uninsurable deposit withdrawal shocks. The characterisation results show that ex-ante liquidity regulations allocate liquidity to large banks and lead to banks' size expansion through liquidity that originates from the inflow of deposits. The necessary conditions for the expansion in banks' size are the withdrawal effect on deposits that has to be internalised by banks and the measurability of the expanded set. I then show how the sorting of banks by type arises. Since the distribution of banks is part of the equilibrium, I find that 2.2 percent of banks are constrained at the medium liquidity constraint. I study the effect of liquidity regulations on liquidity crises. Ex-ante liquidity regulations mitigate the severity of liquidity crises by reducing the contraction in banks' liquidity to deposits by 24.03 percent less relative to ex-post liquidity regulations. The theoretical economy supports ex-ante liquidity regulations for banks to withstand a sudden outflow of deposits and counteract liquidity crises.

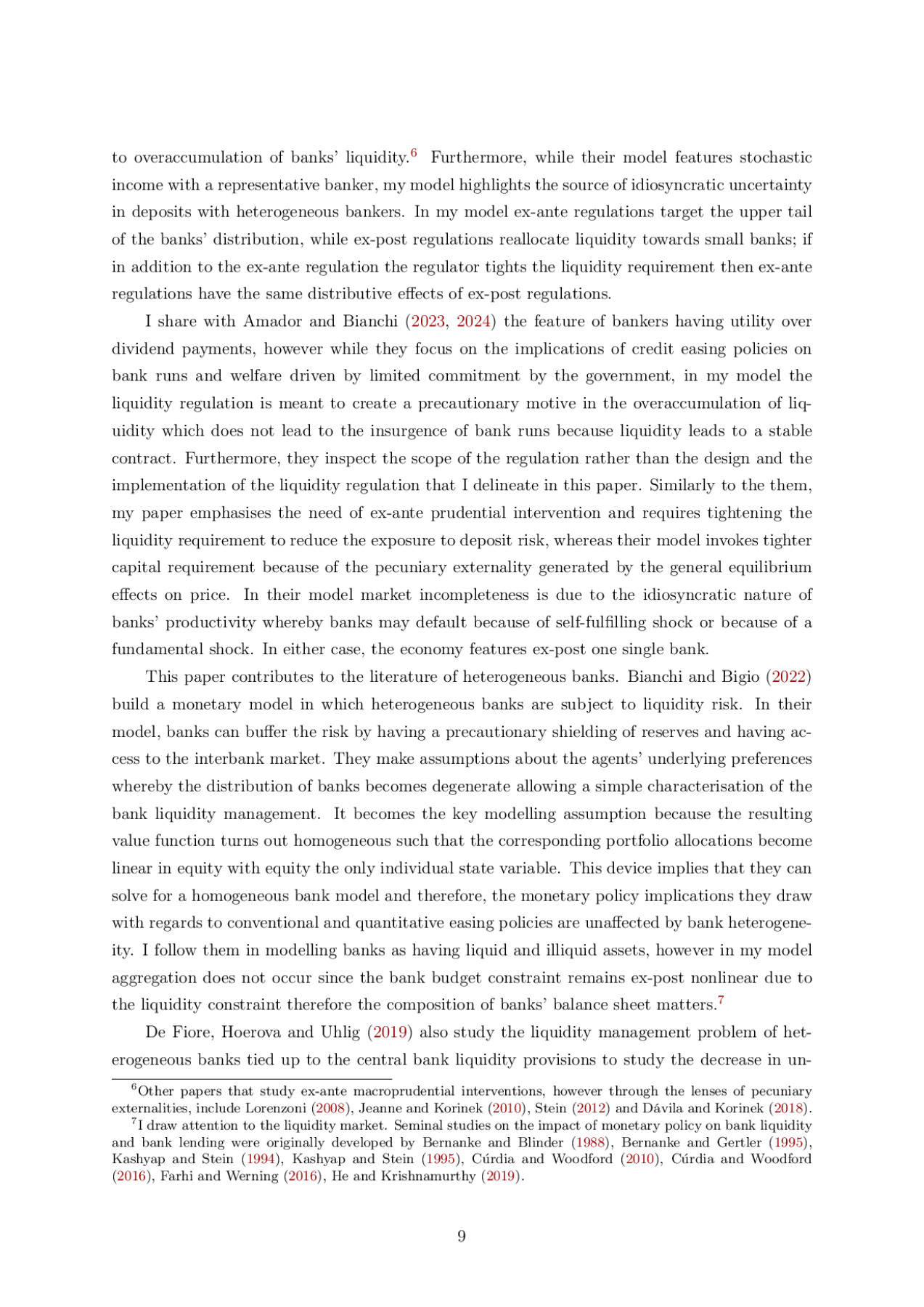

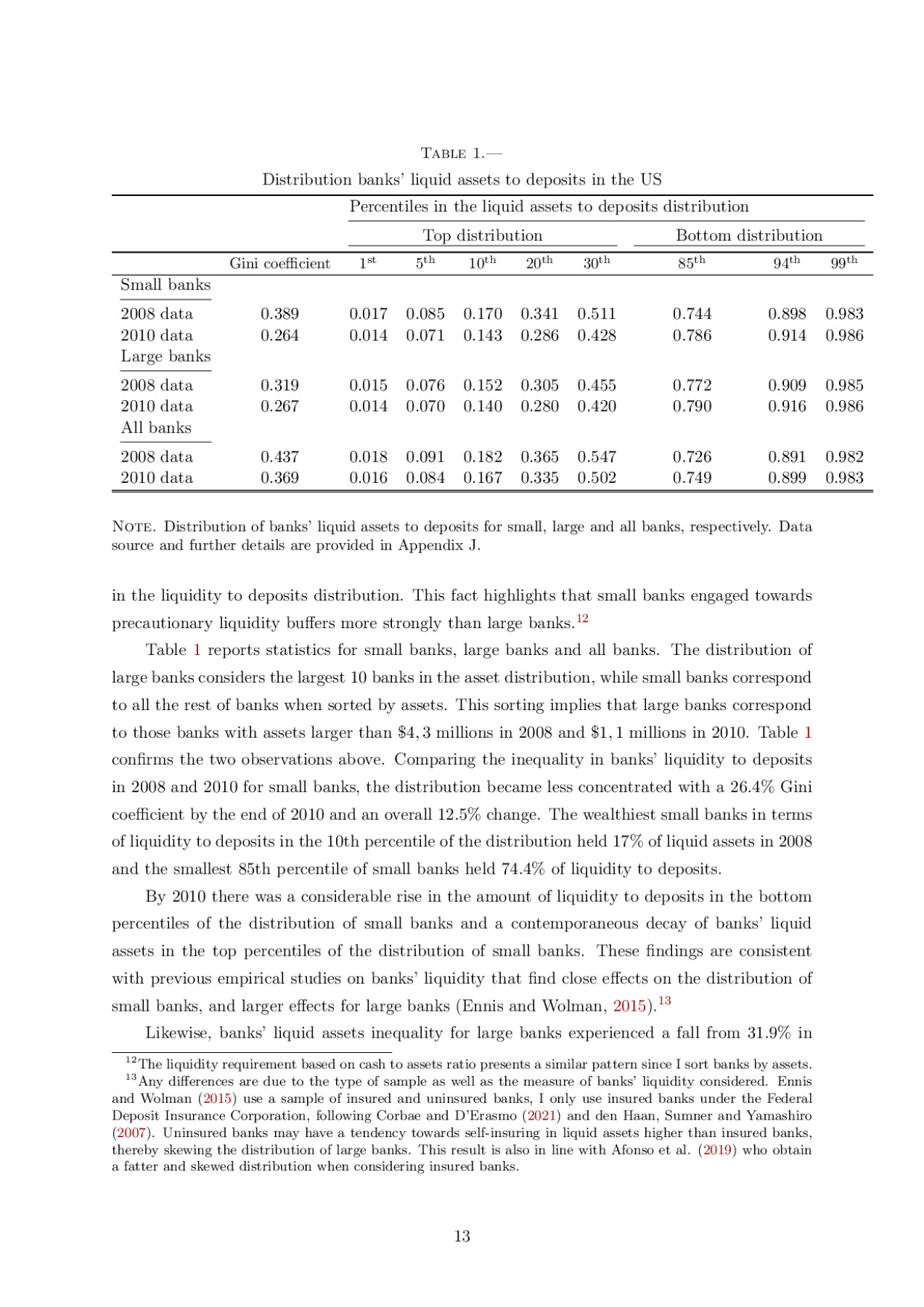

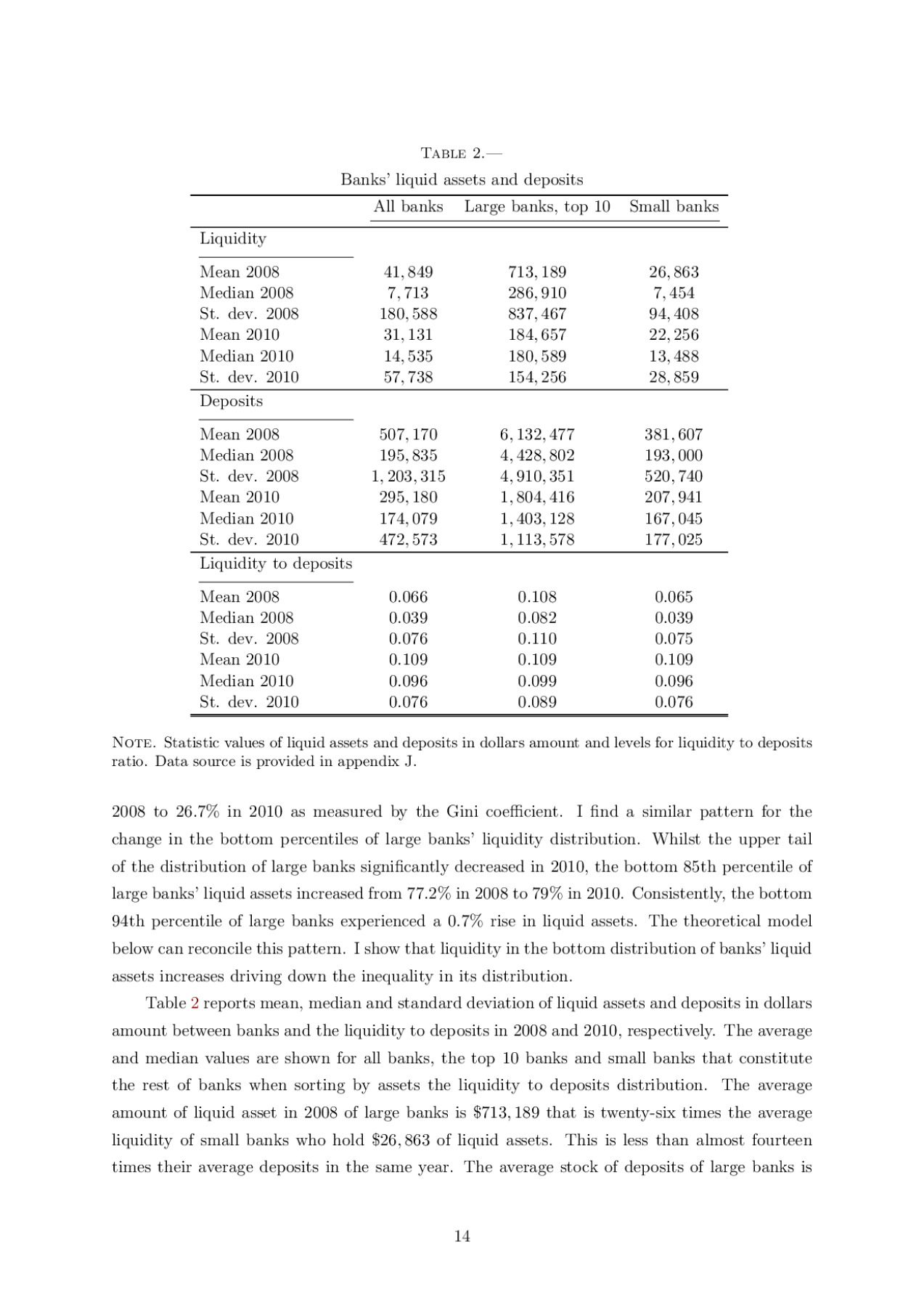

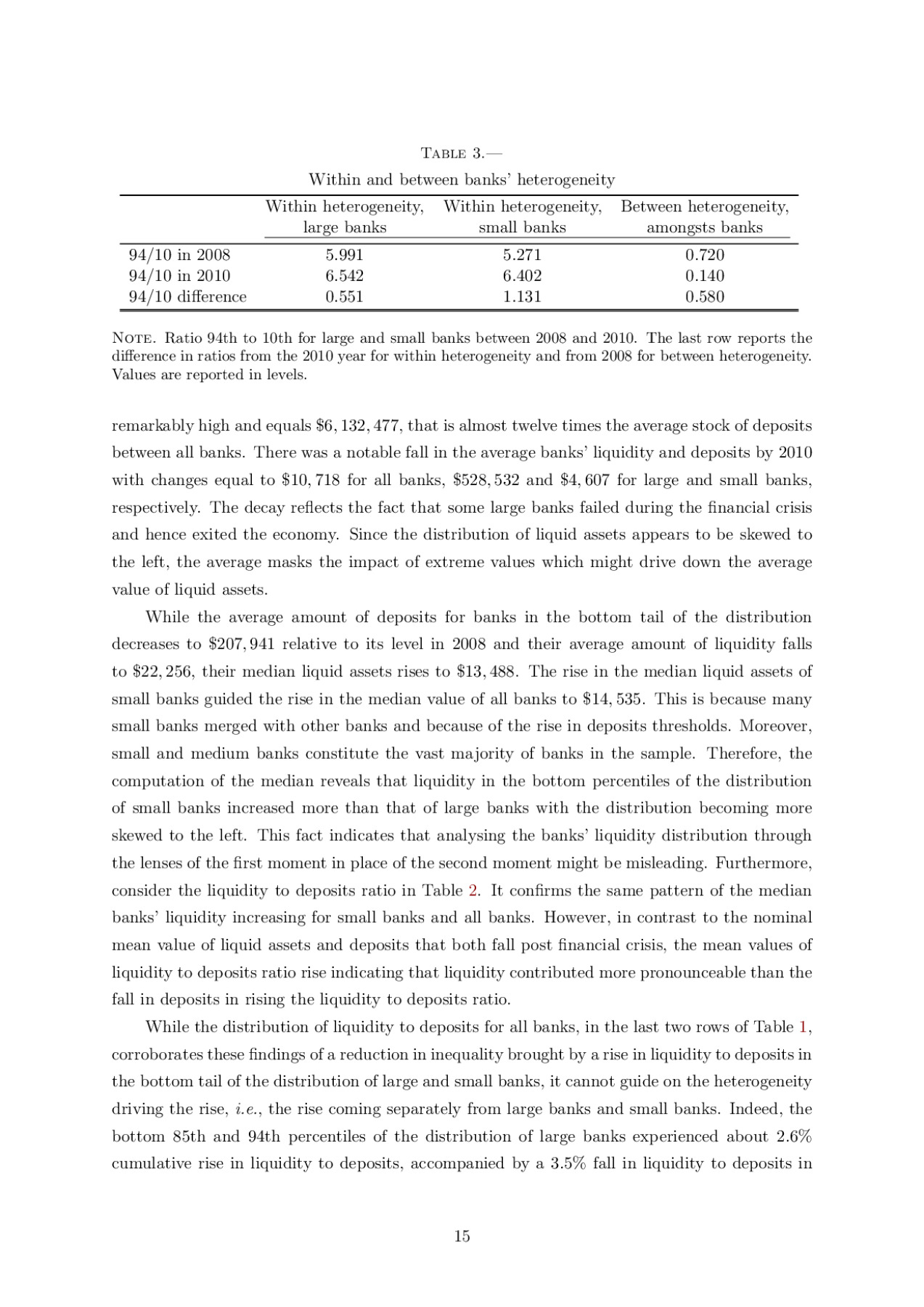

Preview